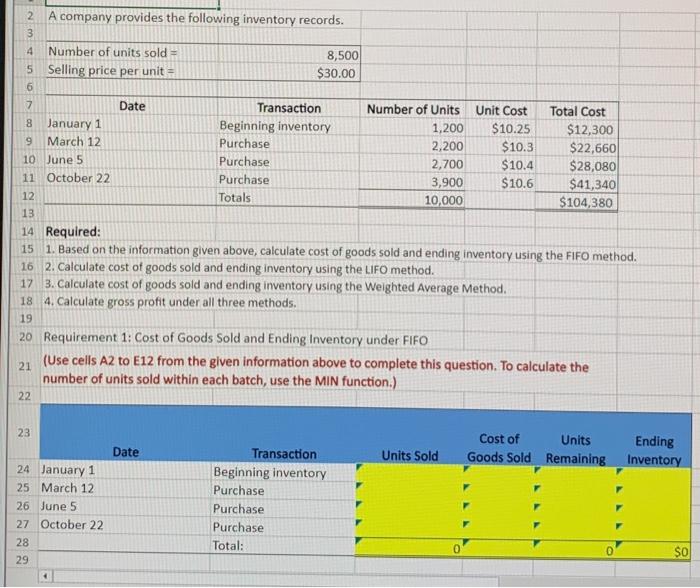

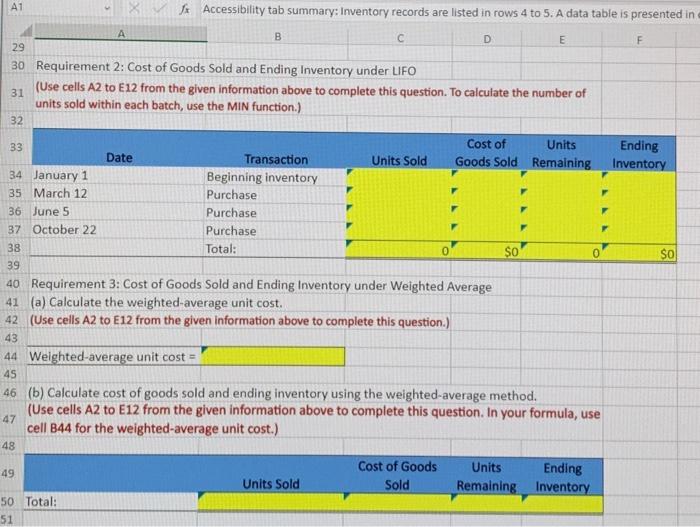

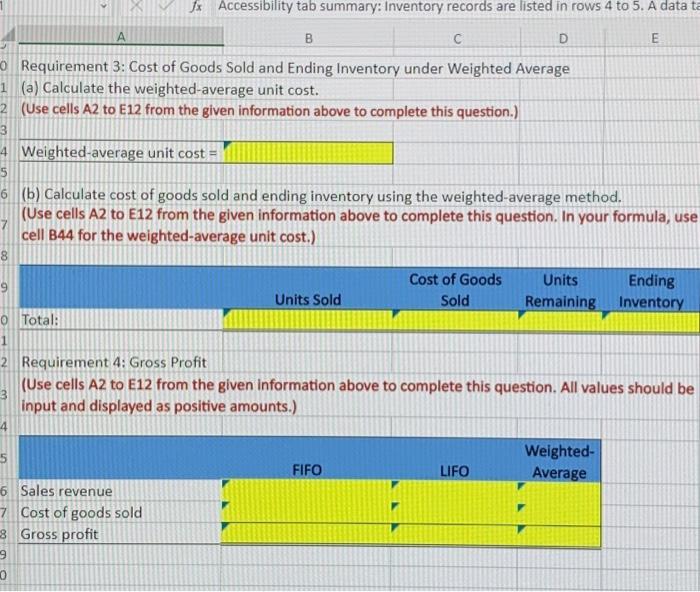

30 Requirement 2: Cost of Goods Sold and Ending Inventory under LIFO 31 (Use cells A2 to E12 from the given information above to complete this question. To calculate the number of units sold within each batch, use the MiN function.) 32 Requirement 3: Cost of Goods Sold and Ending Inventory under Weighted Average (a) Calculate the weighted-average unit cost. (Use cells A2 to E12 from the given information above to complete this question.) Weighted-average unit cost = (b) Calculate cost of goods sold and ending inventory using the weighted-average method. (Use cells A2 to E12 from the given information above to complete this question. In your formula, use cell B44 for the weighted-average unit cost.) (b) Calculate cost of goods sold and ending inventory using the weighted-average method. (Use cells A2 to E12 from the given information above to complete this question. In your formula, use cell B44 for the weighted-average unit cost.) Total: Requirement 4: Gross Profit (Use cells A2 to E12 from the given information above to complete this question. All values should be input and displayed as positive amounts.) 2. A company provides the following inventory records. 3 \begin{tabular}{|c|c|} \hline 4 Number of units sold = & 8,500 \\ \hline 5 Selling price per unit = & $30.00 \\ \hline \end{tabular} 6 \begin{tabular}{|l|l|l|r|r|r|} \hline 7 & Date & Transaction & Number of Units & Unit Cost & Total Cost \\ \hline 8 & January 1 & Beginning inventory & 1,200 & $10.25 & $12,300 \\ \hline 9 & March 12 & Purchase & 2,200 & $10.3 & $22,660 \\ \hline 10 & June 5 & Purchase & 2,700 & $10.4 & $28,080 \\ \hline 11 & October 22 & Purchase & 3,900 & $10.6 & $41,340 \\ \hline 12 & & Totals & 10,000 & $104,380 \\ \hline 13 & & & & & \end{tabular} 14 Required: 15 1. Based on the information given above, calculate cost of goods sold and ending inventory using the FIFO method. 16 2. Calculate cost of goods sold and ending inventory using the Lifo method. 17 3. Calculate cost of goods sold and ending inventory using the Weighted Average Method. 18 4. Calculate gross profit under all three methods. 20 Requirement 1: Cost of Goods Sold and Ending Inventory under FIFO 21 (Use cells A2 to E12 from the given information above to complete this question. To calculate the number of units sold within each batch, use the MIN function.) 22 23 \begin{tabular}{|c|c|c|c|c|c|c|} \hline 23 & Date & Transaction & Units Sold & \begin{tabular}{l} Cost of \\ Goods Sold \end{tabular} & \begin{tabular}{c} Units \\ Remaining \end{tabular} & \begin{tabular}{l} Ending \\ Inventory \end{tabular} \\ \hline 24 & January 1 & Beginning inventory & r & & & r \\ \hline 25 & March 12 & Purchase & r & r & r & r \\ \hline 26 & June 5 & Purchase & r & r & r & r \\ \hline 27 & October 22 & Purchase & r & r & r & r \\ \hline 28 & & Total: & r & 0 & 0 & so \\ \hline \end{tabular}