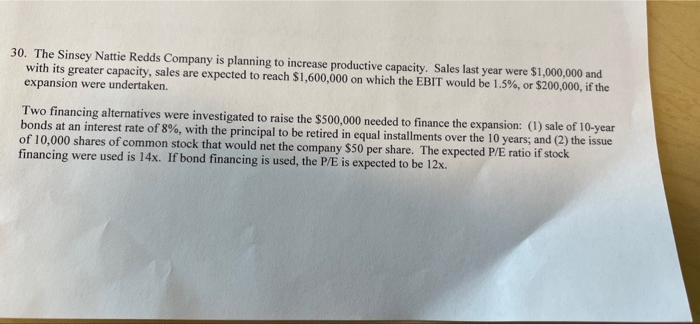

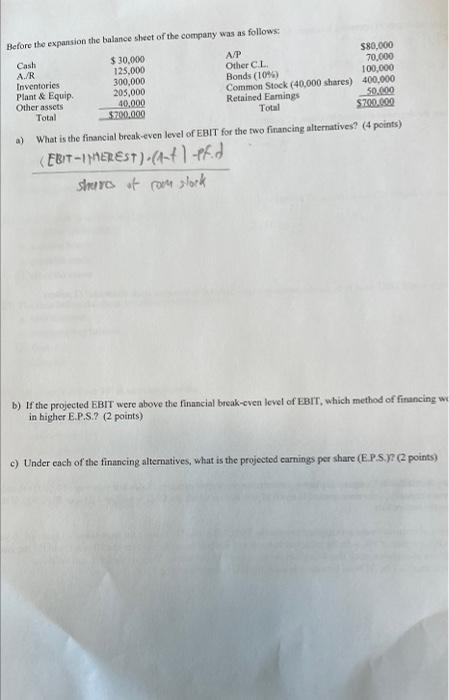

30. The Sinsey Nattie Redds Company is planning to increase productive capacity. Sales last year were $1,000,000 and with its greater capacity, sales are expected to reach $1,600,000 on which the EBIT would be 1.5%, or $200,000, if the expansion were undertaken. Two financing alternatives were investigated to raise the $500,000 needed to finance the expansion: (1) sale of 10-year bonds at an interest rate of 8%, with the principal to be retired in equal installments over the 10 years; and (2) the issue of 10,000 shares of common stock that would net the company $50 per share. The expected P/E ratio if stock financing were used is 14x. If bond financing is used, the P/E is expected to be 12x. Before the expansion the balance sheet of the company was as follows: Cash $ 30,000 AXP $80,000 AIR 125.000 Other CL 70,000 Inventories 300,000 Bonds (10%) 100,000 Plant & Equip 205,000 Common Stock (40,000 shares) 400,000 Other assets 40.000 Retained Eamings 50.000 Total $700.000 Total $700.000 a) What is the financial break-even level of EBIT for the two financing alternatives? (4 points) (EBIT -THEREST).(Atl-pEd shero of roon slook b) If the projected EBIT were above the financial break-even level of EBIT, which method of financing we in higher E.P.S.? (2 points) c) Under each of the financing alternatives, what is the projected carnings per share (E.P.S.? (2 points) 30. The Sinsey Nattie Redds Company is planning to increase productive capacity. Sales last year were $1,000,000 and with its greater capacity, sales are expected to reach $1,600,000 on which the EBIT would be 1.5%, or $200,000, if the expansion were undertaken. Two financing alternatives were investigated to raise the $500,000 needed to finance the expansion: (1) sale of 10-year bonds at an interest rate of 8%, with the principal to be retired in equal installments over the 10 years; and (2) the issue of 10,000 shares of common stock that would net the company $50 per share. The expected P/E ratio if stock financing were used is 14x. If bond financing is used, the P/E is expected to be 12x. Before the expansion the balance sheet of the company was as follows: Cash $ 30,000 AXP $80,000 AIR 125.000 Other CL 70,000 Inventories 300,000 Bonds (10%) 100,000 Plant & Equip 205,000 Common Stock (40,000 shares) 400,000 Other assets 40.000 Retained Eamings 50.000 Total $700.000 Total $700.000 a) What is the financial break-even level of EBIT for the two financing alternatives? (4 points) (EBIT -THEREST).(Atl-pEd shero of roon slook b) If the projected EBIT were above the financial break-even level of EBIT, which method of financing we in higher E.P.S.? (2 points) c) Under each of the financing alternatives, what is the projected carnings per share (E.P.S.? (2 points)