Answered step by step

Verified Expert Solution

Question

1 Approved Answer

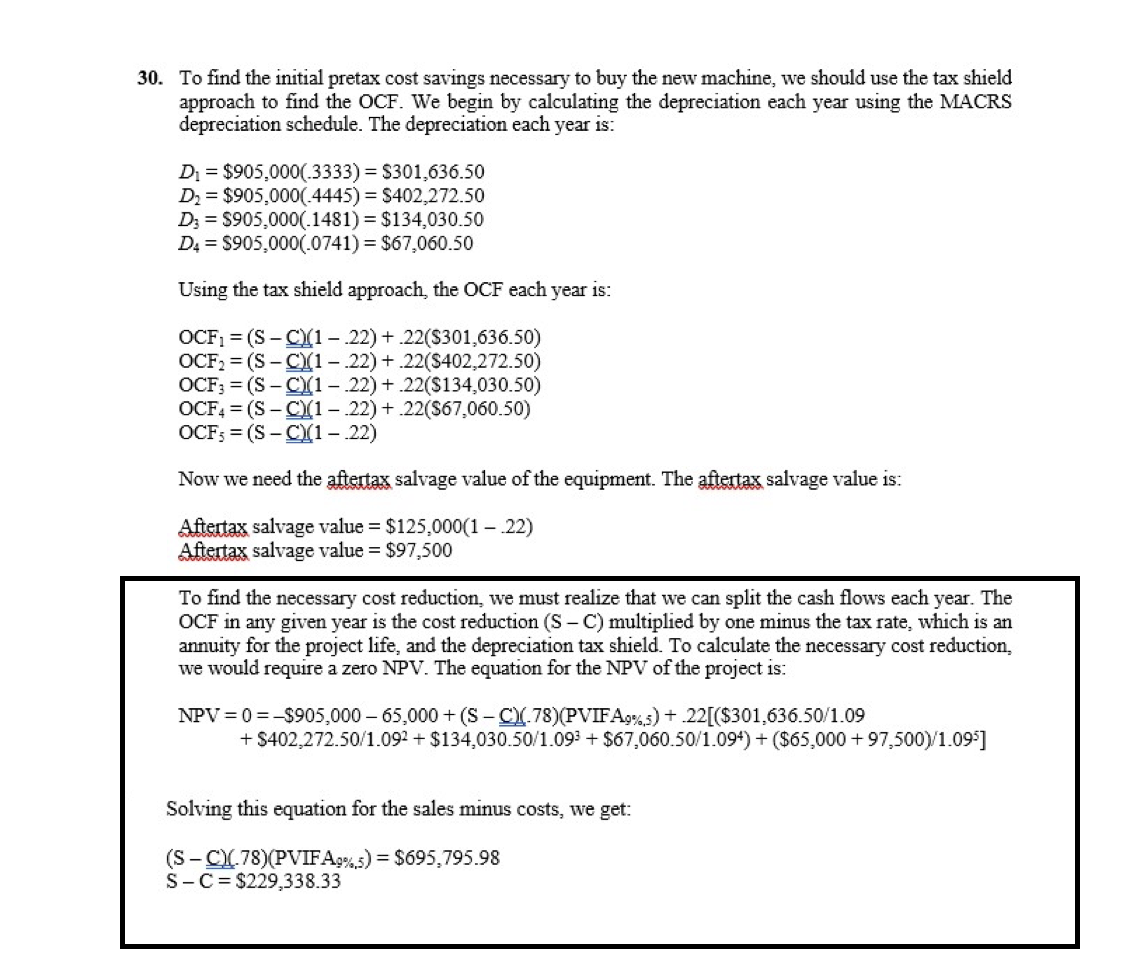

30. To find the initial pretax cost savings necessary to buy the new machine, we should use the tax shield approach to find the

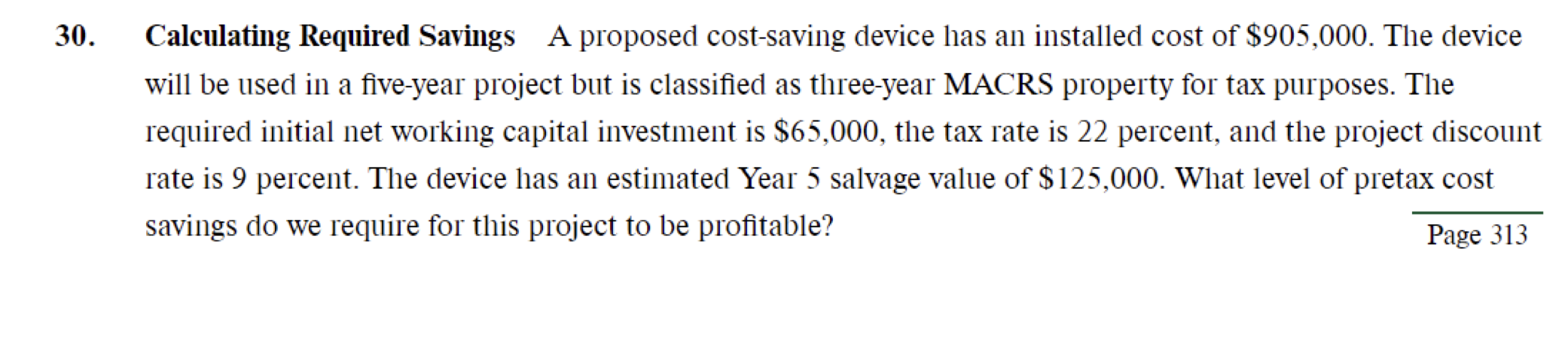

30. To find the initial pretax cost savings necessary to buy the new machine, we should use the tax shield approach to find the OCF. We begin by calculating the depreciation each year using the MACRS depreciation schedule. The depreciation each year is: D = $905,000(.3333)= $301,636.50 D = $905,000(.4445)=$402,272.50 D3 $905,000(.1481) = $134,030.50 D4=$905,000(.0741) = $67,060.50 Using the tax shield approach, the OCF each; year is: OCF =(S-C)(1.22) + .22($301,636.50) OCF2 (S-C)(1.22) + 22($402,272.50) OCF3 (S-C)(1.22)+.22($134,030.50) OCF4 (S-C)(1.22)+.22($67,060.50) OCF (S-C)(1-22) Now we need the aftertax salvage value of the equipment. The aftertax salvage value is: Aftertax salvage value = $125,000(1-22) Aftertax salvage value = $97,500 To find the necessary cost reduction, we must realize that we can split the cash flows each year. The OCF in any given year is the cost reduction (S-C) multiplied by one minus the tax rate, which is an annuity for the project life, and the depreciation tax shield. To calculate the necessary cost reduction. we would require a zero NPV. The equation for the NPV of the project is: NPV=0 -$905,000 - 65,000+ (S-C)(78)(PVIFA9%,5)+22[($301,636.50/1.09 + $402,272.50/1.092 + $134,030.50/1.093 + $67,060.50/1.094) + ($65,000 + 97,500)/1.095] Solving this equation for the sales minus costs, we get: (S-C)(78)(PVIFA9%,5) = $695,795.98 S-C $229,338.33 30. Calculating Required Savings A proposed cost-saving device has an installed cost of $905,000. The device will be used in a five-year project but is classified as three-year MACRS property for tax purposes. The required initial net working capital investment is $65,000, the tax rate is 22 percent, and the project discount rate is 9 percent. The device has an estimated Year 5 salvage value of $125,000. What level of pretax cost savings do we require for this project to be profitable? Page 313

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started