Answered step by step

Verified Expert Solution

Question

1 Approved Answer

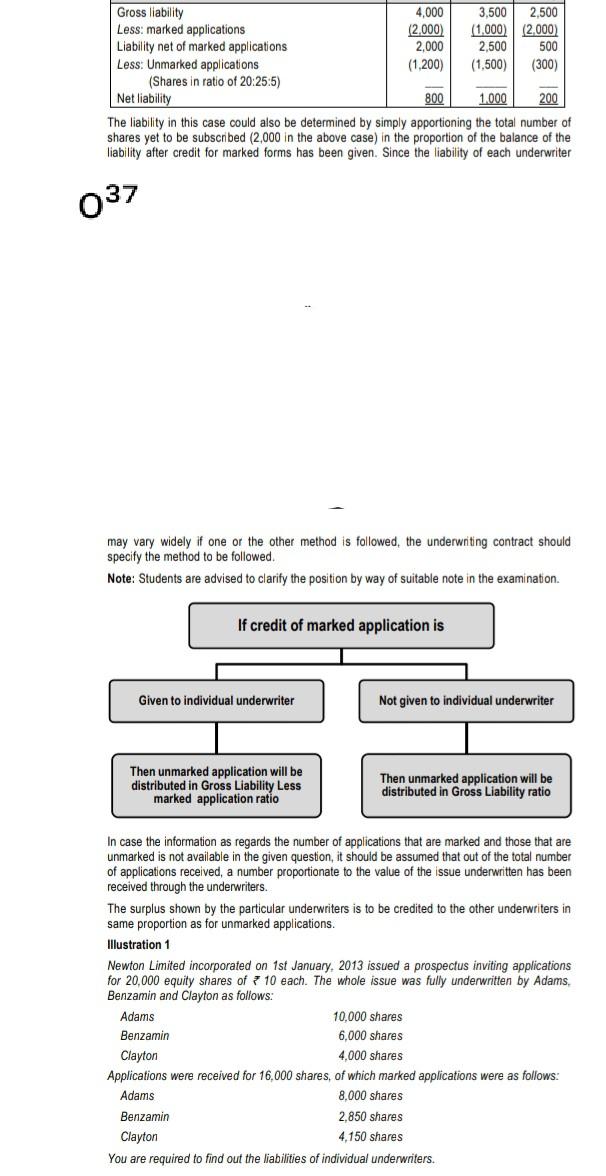

(300) Gross liability 4,000 3.500 2.500 Less: marked applications (2.000) (1.000) (2000) Liability net of marked applications 2,000 2,500 500 Less: Unmarked applications (1,200) (1,500)

(300) Gross liability 4,000 3.500 2.500 Less: marked applications (2.000) (1.000) (2000) Liability net of marked applications 2,000 2,500 500 Less: Unmarked applications (1,200) (1,500) (Shares in ratio of 20:25:5) Net liability 800 1.000 200 The liability in this case could also be determined by simply apportioning the total number of shares yet to be subscribed (2,000 in the above case) in the proportion of the balance of the liability after credit for marked forms has been given. Since the liability of each underwriter 037 may vary widely if one or the other method is followed, the underwriting contract should specify the method to be followed Note: Students are advised to clarify the position by way of suitable note in the examination. If credit of marked application is Given to individual underwriter Not given to individual underwriter Then unmarked application will be distributed in Gross Liability Less marked application ratio Then unmarked application will be distributed in Gross Liability ratio In case the information as regards the number of applications that are marked and those that are unmarked is not available in the given question, it should be assumed that out of the total number of applications received, a number proportionate to the value of the issue underwritten has been received through the underwriters. The surplus shown by the particular underwriters is to be credited to the other underwriters in same proportion as for unmarked applications. Illustration 1 Newton Limited incorporated on 1st January 2013 issued a prospectus inviting applications for 20.000 equity shares of 7 10 each. The whole issue was fully underwritten by Adams, Benzamin and Clayton as follows: Adams 10,000 shares Benzamin 6,000 shares Clayton 4,000 shares Applications were received for 16,000 shares, of which marked applications were as follows: Adams 8,000 shares Benzamin 2,850 shares Clayton 4,150 shares You are required to find out the liabilities of individual underwriters

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started