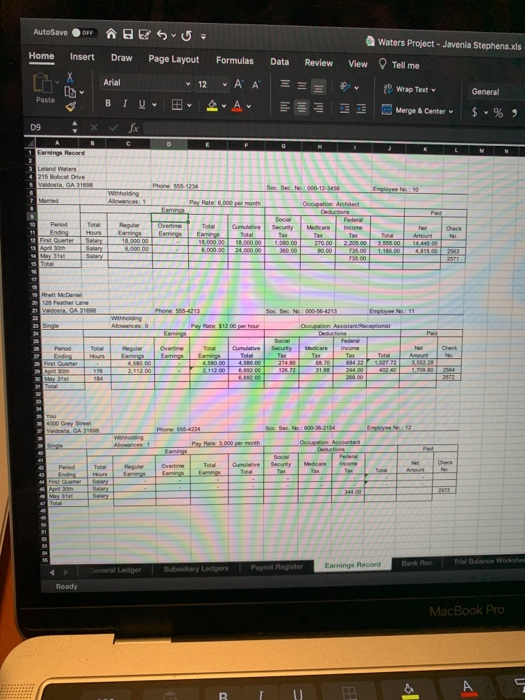

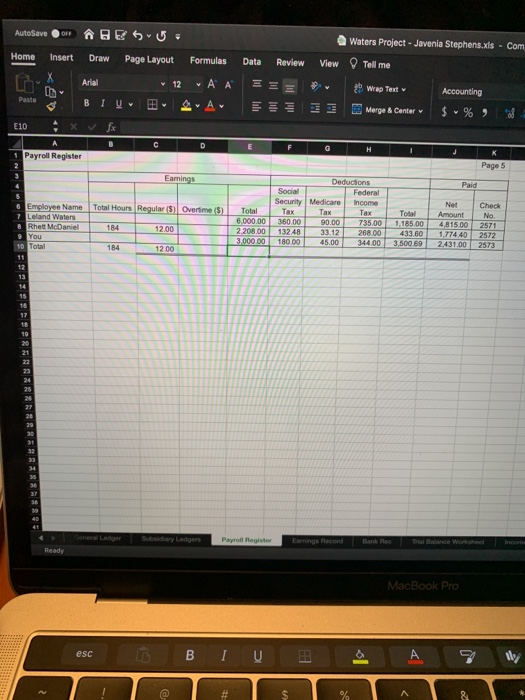

30th - Provided services for cash for $4,000. Step 2: Payroll Employees are paid once a month on the last day of the month. Leland is paid a salary of $6,000 a month, Rhett is paid $12.00 an hour, and you are paid a salary of $3,000 a month. Rhett worked a total of 184 hours in May all of which were regular hours. No overtime was worked this month. Earnings are subject to 6% social security tax and 1.5% Medicare tax. The federal income tax withheld from each employee's payroll check for the month is as follows: Leland - $735.00; Rhett - $268.00; you - $344.00. Also, don't forget about the employer match and unemployment taxes. The federal unemployment rate is 0.8% and the state unemployment rate is 5.4%. (Remember, federal unemployment is only calculated on the first $7,000 of earnings and, for this practice set, state unemployment is also only calculated on the first $7,000 of earnings). Record the payroll accrual, the payroll taxes accrual, and the payment of the payroll on the 31st Checks no. 2571-2573 are used for payroll (see Payroll Register). AutoSave OF BESU- Waters Project - Javenia Stephens.xls Home Insert Draw Page Layout Formulas Data Review View Tell me LD Arial 12 ab Wrap Text A A A General Paste B IU Merge & Center $ % 9 D9 X C D G Earnings Record 215 Bobcat Drive Vaidosta, GA 3101 Phone: 9-17 See See N 000-12-16 Married Withholding Allowances Pay Rate 5.000 per month Decupation Architect Deduction Social Regular To Gumi Period Ending Est Quarter Total Houn Selas Salary Overtime Ering 1000000 S8.000 0.000 6.000 1,000.00 270.00 $0.00 Income Tax 3 20500 795.00 75.00 3.55800 1,185.00 Amount 14.445.00 4.815.00 23 M Tot Ret Me 125 Feather and W GA 31090 Phone 585-4213 SocSes No: 000364213 ange Aces: 0 Pay Rate 512.00 per hour Den P Period To Regular Security Income Check Emis Macare T Eaine 4000 Ames Cumulative Te 4.580.00 6.RO Pet och 576 2.112.00 126.72 You 4000 Grey olding Allowances Farge Deco Total Social Security Overtime Tot Durative Medicare April och Mar Earnings Record Band Red Tri Balance Works General Ledger Subsidiary Ledgers Payroll Register Ready MacBook Pro AutoSave OR BESU: Waters Project - Javenia Stephens.xls - Com Home Insert Draw Page Layout Formulas Data Review View Tell me D Arial 12 A A E th Wrap Text Paste B Accounting $ % ) v Merge & Center od E10 X D H Payroll Register Page 5 Earnings Paid Employee Name Total Hours Regular (5Overtime (5) Leland Waters & Rhett McDaniel 184 12.00 9 You 10 Total 184 12.00 11 Medicare . Deductions Social Federal Security Medicare Income Tax Tax 360.00 90.00 735.00 13248 33.12 268.00 180.00 45.00 344.00 Total 6,000.00 2.208,00 3,000.00 Total 1.185.00 433.60 3,500 69 Net Amount 4,815.00 1.774.40 2431.00 Check No. 2571 2572 2573 13 14 15 16 17 21 22 23 24 26 27 20 30 32 33 34 37 40 Say Ledgers Payroll Register Earnings Record Bank Poo Ready MacBook Pro esc 1 BIU 30th - Provided services for cash for $4,000. Step 2: Payroll Employees are paid once a month on the last day of the month. Leland is paid a salary of $6,000 a month, Rhett is paid $12.00 an hour, and you are paid a salary of $3,000 a month. Rhett worked a total of 184 hours in May all of which were regular hours. No overtime was worked this month. Earnings are subject to 6% social security tax and 1.5% Medicare tax. The federal income tax withheld from each employee's payroll check for the month is as follows: Leland - $735.00; Rhett - $268.00; you - $344.00. Also, don't forget about the employer match and unemployment taxes. The federal unemployment rate is 0.8% and the state unemployment rate is 5.4%. (Remember, federal unemployment is only calculated on the first $7,000 of earnings and, for this practice set, state unemployment is also only calculated on the first $7,000 of earnings). Record the payroll accrual, the payroll taxes accrual, and the payment of the payroll on the 31st Checks no. 2571-2573 are used for payroll (see Payroll Register). AutoSave OF BESU- Waters Project - Javenia Stephens.xls Home Insert Draw Page Layout Formulas Data Review View Tell me LD Arial 12 ab Wrap Text A A A General Paste B IU Merge & Center $ % 9 D9 X C D G Earnings Record 215 Bobcat Drive Vaidosta, GA 3101 Phone: 9-17 See See N 000-12-16 Married Withholding Allowances Pay Rate 5.000 per month Decupation Architect Deduction Social Regular To Gumi Period Ending Est Quarter Total Houn Selas Salary Overtime Ering 1000000 S8.000 0.000 6.000 1,000.00 270.00 $0.00 Income Tax 3 20500 795.00 75.00 3.55800 1,185.00 Amount 14.445.00 4.815.00 23 M Tot Ret Me 125 Feather and W GA 31090 Phone 585-4213 SocSes No: 000364213 ange Aces: 0 Pay Rate 512.00 per hour Den P Period To Regular Security Income Check Emis Macare T Eaine 4000 Ames Cumulative Te 4.580.00 6.RO Pet och 576 2.112.00 126.72 You 4000 Grey olding Allowances Farge Deco Total Social Security Overtime Tot Durative Medicare April och Mar Earnings Record Band Red Tri Balance Works General Ledger Subsidiary Ledgers Payroll Register Ready MacBook Pro AutoSave OR BESU: Waters Project - Javenia Stephens.xls - Com Home Insert Draw Page Layout Formulas Data Review View Tell me D Arial 12 A A E th Wrap Text Paste B Accounting $ % ) v Merge & Center od E10 X D H Payroll Register Page 5 Earnings Paid Employee Name Total Hours Regular (5Overtime (5) Leland Waters & Rhett McDaniel 184 12.00 9 You 10 Total 184 12.00 11 Medicare . Deductions Social Federal Security Medicare Income Tax Tax 360.00 90.00 735.00 13248 33.12 268.00 180.00 45.00 344.00 Total 6,000.00 2.208,00 3,000.00 Total 1.185.00 433.60 3,500 69 Net Amount 4,815.00 1.774.40 2431.00 Check No. 2571 2572 2573 13 14 15 16 17 21 22 23 24 26 27 20 30 32 33 34 37 40 Say Ledgers Payroll Register Earnings Record Bank Poo Ready MacBook Pro esc 1 BIU