Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3.1. A new client, Mr Charles (aged 40 ) estimates that his taxable income for the year ended 28 February 2023 will be R 785000

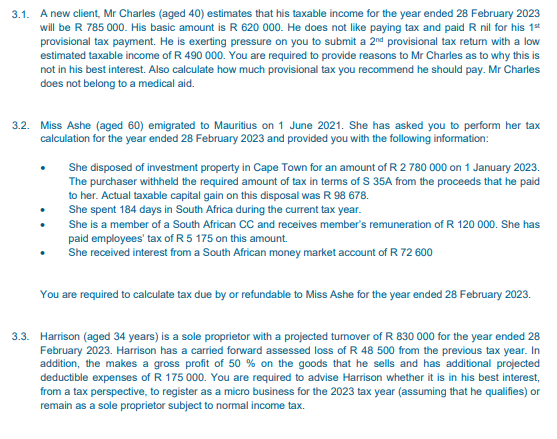

3.1. A new client, Mr Charles (aged 40 ) estimates that his taxable income for the year ended 28 February 2023 will be R 785000 . His basic amount is R620000. He does not like paying tax and paid R nil for his 1st provisional tax payment. He is exerting pressure on you to submit a 2nd provisional tax return with a low estimated taxable income of R 490000 . You are required to provide reasons to Mr Charles as to why this is not in his best interest. Also calculate how much provisional tax you recommend he should pay. Mr Charles does not belong to a medical aid. 3.2. Miss Ashe (aged 60) emigrated to Mauritius on 1 June 2021. She has asked you to perform her tax calculation for the year ended 28 February 2023 and provided you with the following information: - She disposed of investment property in Cape Town for an amount of R 2780000 on 1 January 2023. The purchaser withheld the required amount of tax in terms of S 35A from the proceeds that he paid to her. Actual taxable capital gain on this disposal was R 98678 . - She spent 184 days in South Africa during the current tax year. - She is a member of a South African CC and receives member's remuneration of R 120000 . She has paid employees' tax of R 5175 on this amount. - She received interest from a South African money market account of R 72600 You are required to calculate tax due by or refundable to Miss Ashe for the year ended 28 February 2023. 3.3. Harrison (aged 34 years) is a sole proprietor with a projected turnover of R 830000 for the year ended 28 February 2023. Harrison has a carried forward assessed loss of R 48500 from the previous tax year. In addition, the makes a gross profit of 50% on the goods that he sells and has additional projected deductible expenses of R 175000 . You are required to advise Harrison whether it is in his best interest, from a tax perspective, to register as a micro business for the 2023 tax year (assuming that he qualifies) or remain as a sole proprietor subject to normal income tax

3.1. A new client, Mr Charles (aged 40 ) estimates that his taxable income for the year ended 28 February 2023 will be R 785000 . His basic amount is R620000. He does not like paying tax and paid R nil for his 1st provisional tax payment. He is exerting pressure on you to submit a 2nd provisional tax return with a low estimated taxable income of R 490000 . You are required to provide reasons to Mr Charles as to why this is not in his best interest. Also calculate how much provisional tax you recommend he should pay. Mr Charles does not belong to a medical aid. 3.2. Miss Ashe (aged 60) emigrated to Mauritius on 1 June 2021. She has asked you to perform her tax calculation for the year ended 28 February 2023 and provided you with the following information: - She disposed of investment property in Cape Town for an amount of R 2780000 on 1 January 2023. The purchaser withheld the required amount of tax in terms of S 35A from the proceeds that he paid to her. Actual taxable capital gain on this disposal was R 98678 . - She spent 184 days in South Africa during the current tax year. - She is a member of a South African CC and receives member's remuneration of R 120000 . She has paid employees' tax of R 5175 on this amount. - She received interest from a South African money market account of R 72600 You are required to calculate tax due by or refundable to Miss Ashe for the year ended 28 February 2023. 3.3. Harrison (aged 34 years) is a sole proprietor with a projected turnover of R 830000 for the year ended 28 February 2023. Harrison has a carried forward assessed loss of R 48500 from the previous tax year. In addition, the makes a gross profit of 50% on the goods that he sells and has additional projected deductible expenses of R 175000 . You are required to advise Harrison whether it is in his best interest, from a tax perspective, to register as a micro business for the 2023 tax year (assuming that he qualifies) or remain as a sole proprietor subject to normal income tax Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started