Question

31. Assume that you are interested in acquiring a retail power center leased to Office Depot and Best Buy for $83M. If you anticipate

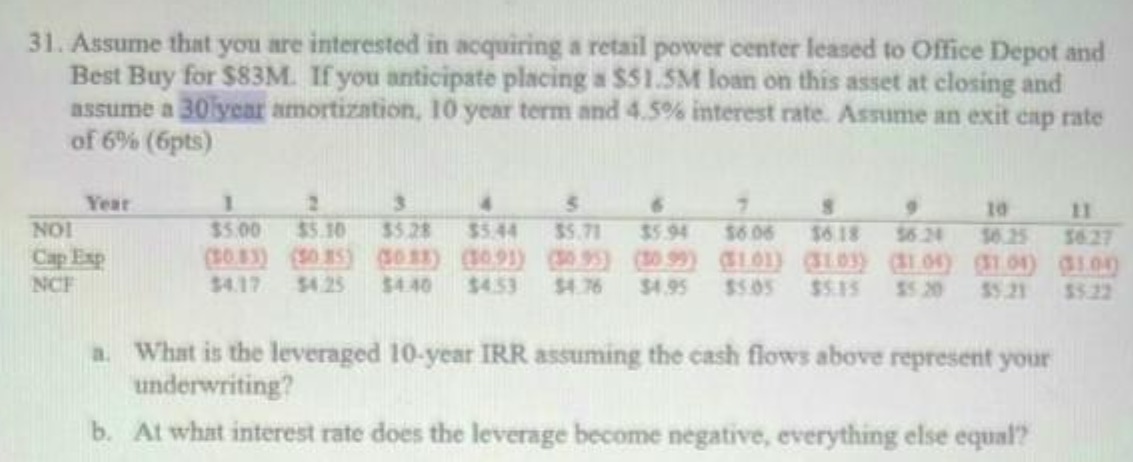

31. Assume that you are interested in acquiring a retail power center leased to Office Depot and Best Buy for $83M. If you anticipate placing a $51.5M loan on this asset at closing and assume a 30 year amortization, 10 year term and 4.5% interest rate. Assume an exit cap rate of 6% (6pts) Year NOI Cap Exp NCE 1 3 10 $5.00 $5.10 55.28 $5.44 $5.71 $5.94 $6.06 $6.18 16.25 (50.83) (305) (3033) (30.91) (3095) (3099) ($1.01) (31.03) ($1.04) (31.04) 54.25 $4.40 $4.53 $4.76 $4.95 $5.05 $5.35 $5.21 a. What is the leveraged 10-year IRR assuming the cash flows above represent your underwriting? b. At what interest rate does the leverage become negative, everything else equal? 11 3627 ($1.00)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Year NOI Loan Payment NCF 1 500 3356 8356 2 510 3356 8456 3 3528 3356 38636 4 3544 3356 38796 5 3571 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Robert Libby, Patricia Libby, Daniel Short, George Kanaan, M

5th Canadian edition

9781259105692, 978-1259103285

Students also viewed these Business Writing questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App