31

31

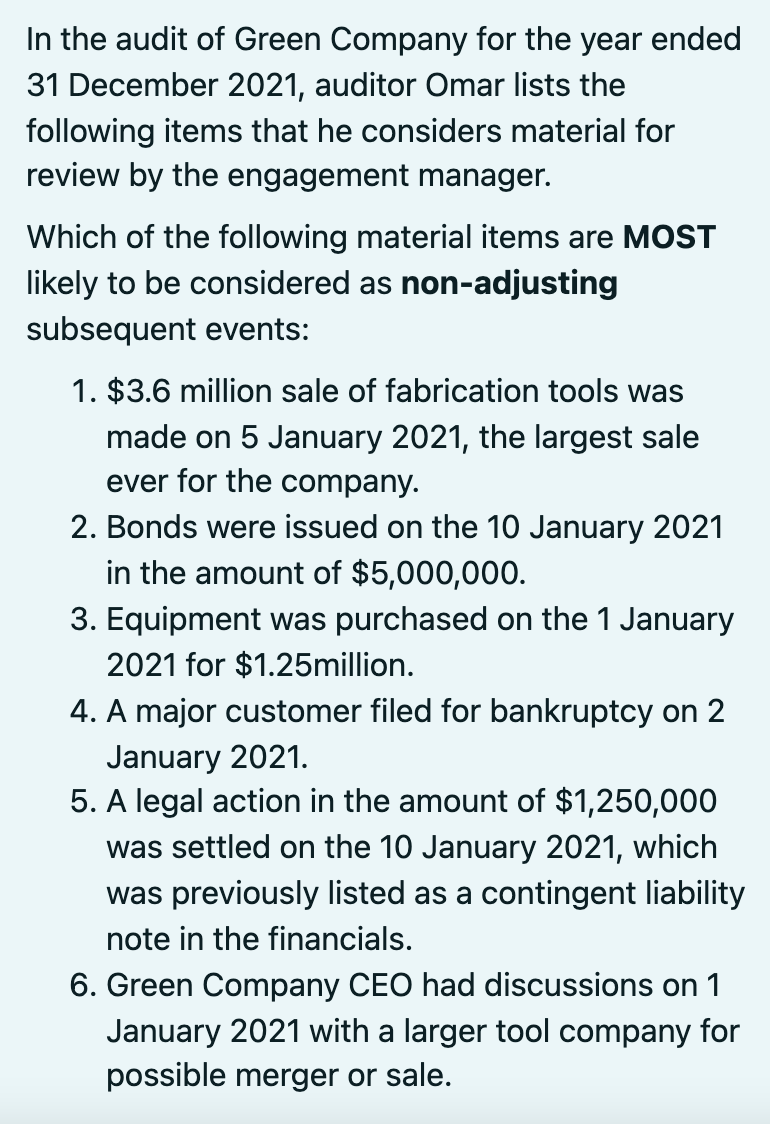

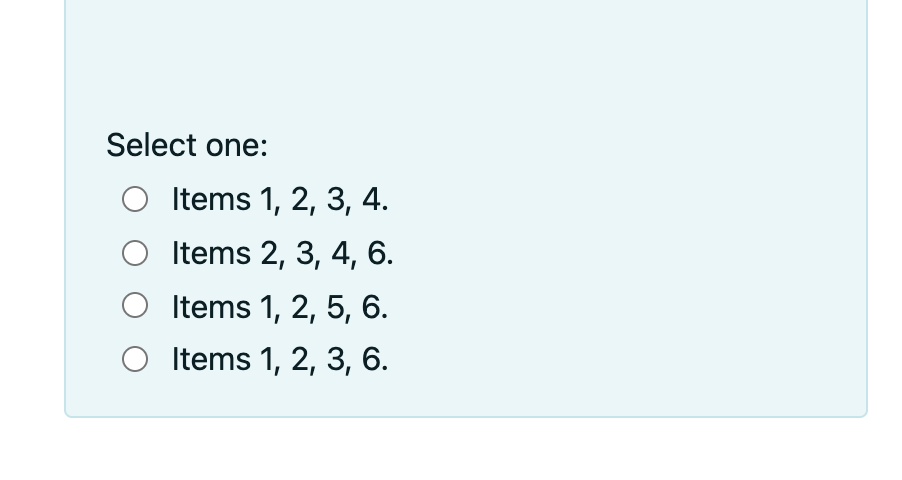

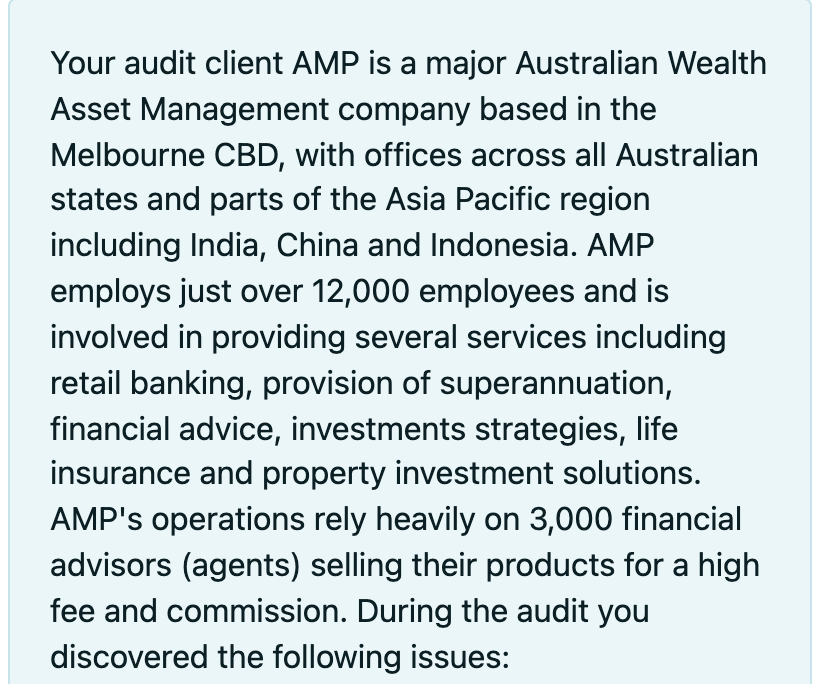

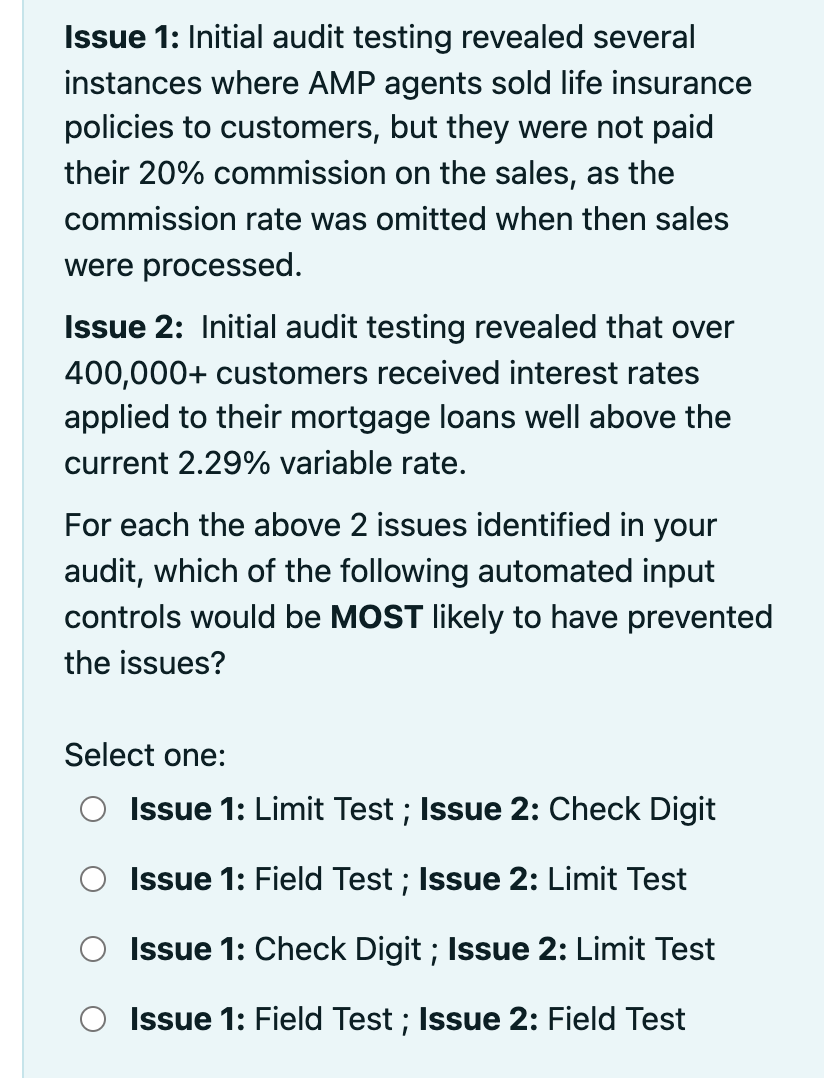

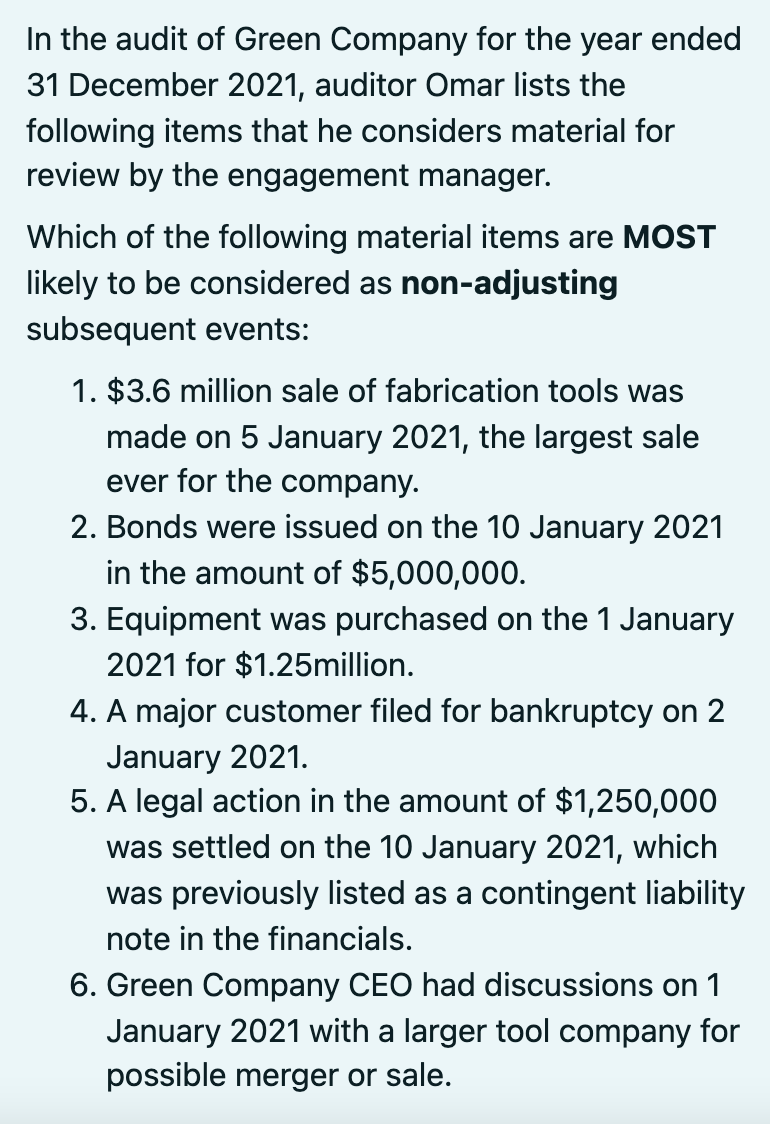

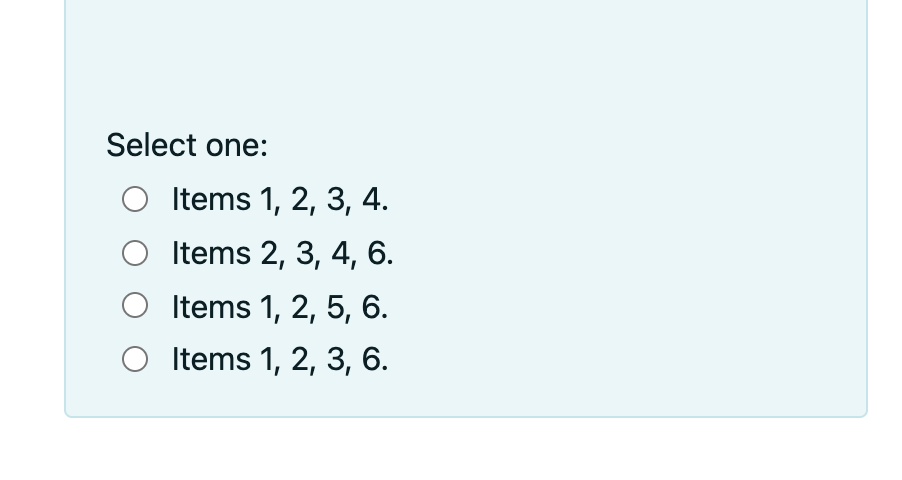

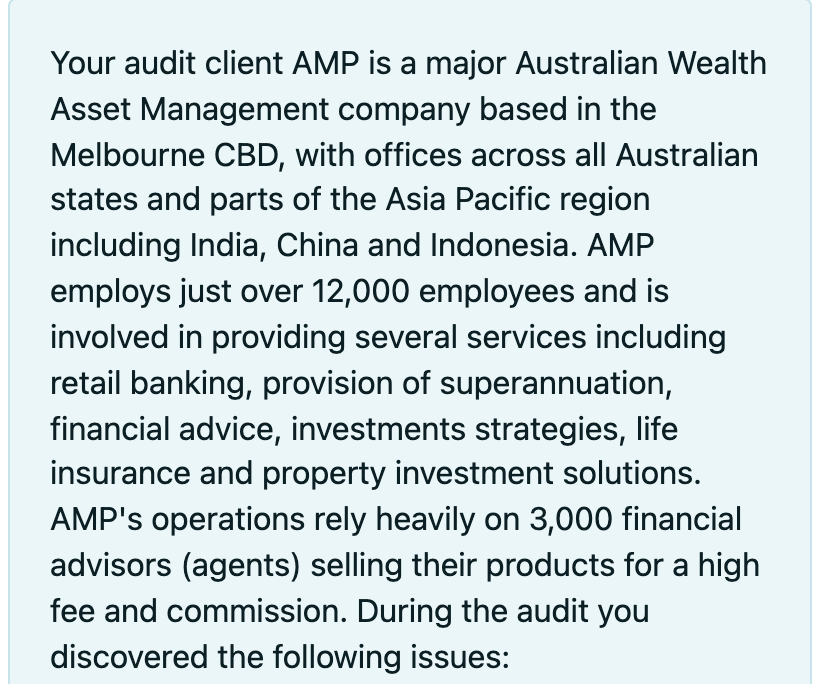

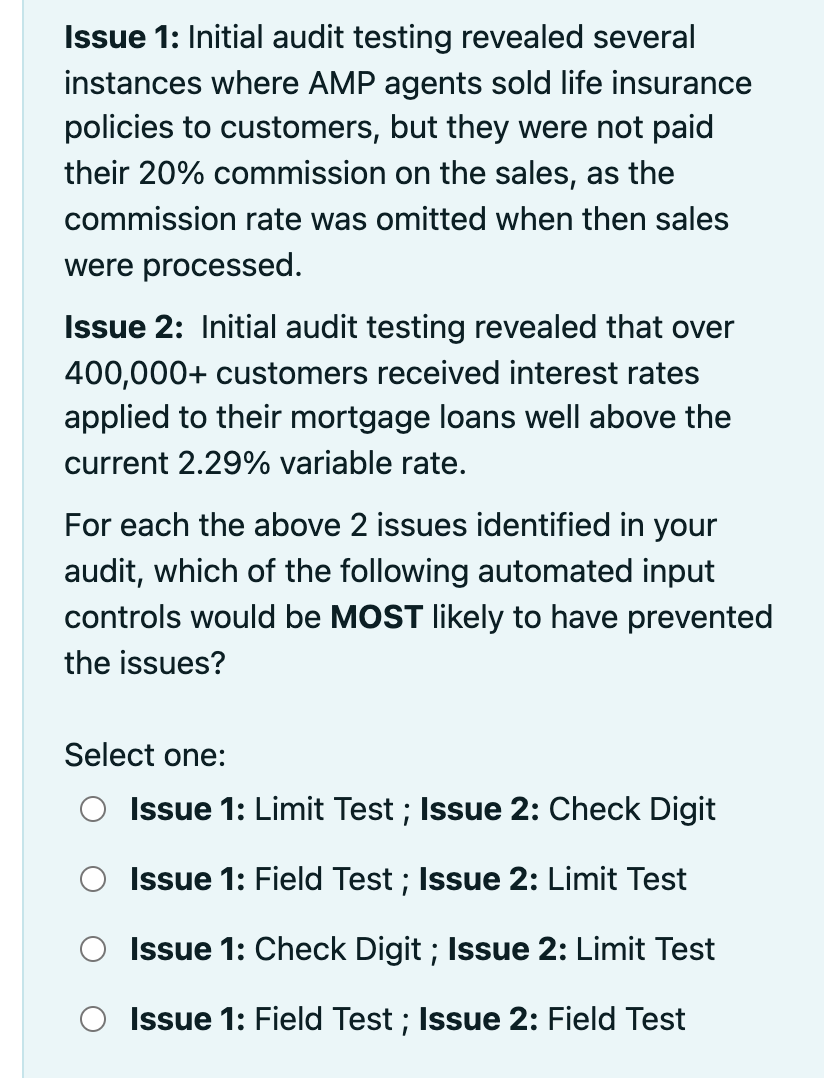

In the audit of Green Company for the year ended 31 December 2021, auditor Omar lists the following items that he considers material for review by the engagement manager. Which of the following material items are MOST likely to be considered as non-adjusting subsequent events: 1. $3.6 million sale of fabrication tools was made on 5 January 2021, the largest sale ever for the company. 2. Bonds were issued on the 10 January 2021 in the amount of $5,000,000. 3. Equipment was purchased on the 1 January 2021 for $1.25million. 4. A major customer filed for bankruptcy on 2 January 2021. 5. A legal action in the amount of $1,250,000 was settled on the 10 January 2021, which was previously listed as a contingent liability note in the financials. 6. Green Company CEO had discussions on 1 January 2021 with a larger tool company for possible merger or sale. Select one: Items 1, 2, 3, 4. Items 2, 3, 4, 6. Items 1, 2, 5, 6. 0 Items 1, 2, 3, 6. Your audit client AMP is a major Australian Wealth Asset Management company based in the Melbourne CBD, with offices across all Australian states and parts of the Asia Pacific region including India, China and Indonesia. AMP employs just over 12,000 employees and is involved in providing several services including retail banking, provision of superannuation, financial advice, investments strategies, life insurance and property investment solutions. AMP's operations rely heavily on 3,000 financial advisors (agents) selling their products for a high fee and commission. During the audit you discovered the following issues: Issue 1: Initial audit testing revealed several instances where AMP agents sold life insurance policies to customers, but they were not paid their 20% commission on the sales, as the commission rate was omitted when then sales were processed. Issue 2: Initial audit testing revealed that over 400,000+ customers received interest rates applied to their mortgage loans well above the current 2.29% variable rate. For each the above 2 issues identified in your audit, which of the following automated input controls would be MOST likely to have prevented the issues? Select one: 0 Issue 1: Limit Test ; Issue 2: Check Digit 0 Issue 1: Field Test ; Issue 2: Limit Test Issue 1: Check Digit; Issue 2: Limit Test 0 Issue 1: Field Test ; Issue 2: Field Test

31

31