Question

31 May 20X5 Agenda Item 1 New capital projects Initial approvals The cash flow projections for the Kuwait solar project had been prepared in accordance

31 May 20X5 Agenda Item 1

New capital projects Initial approvals

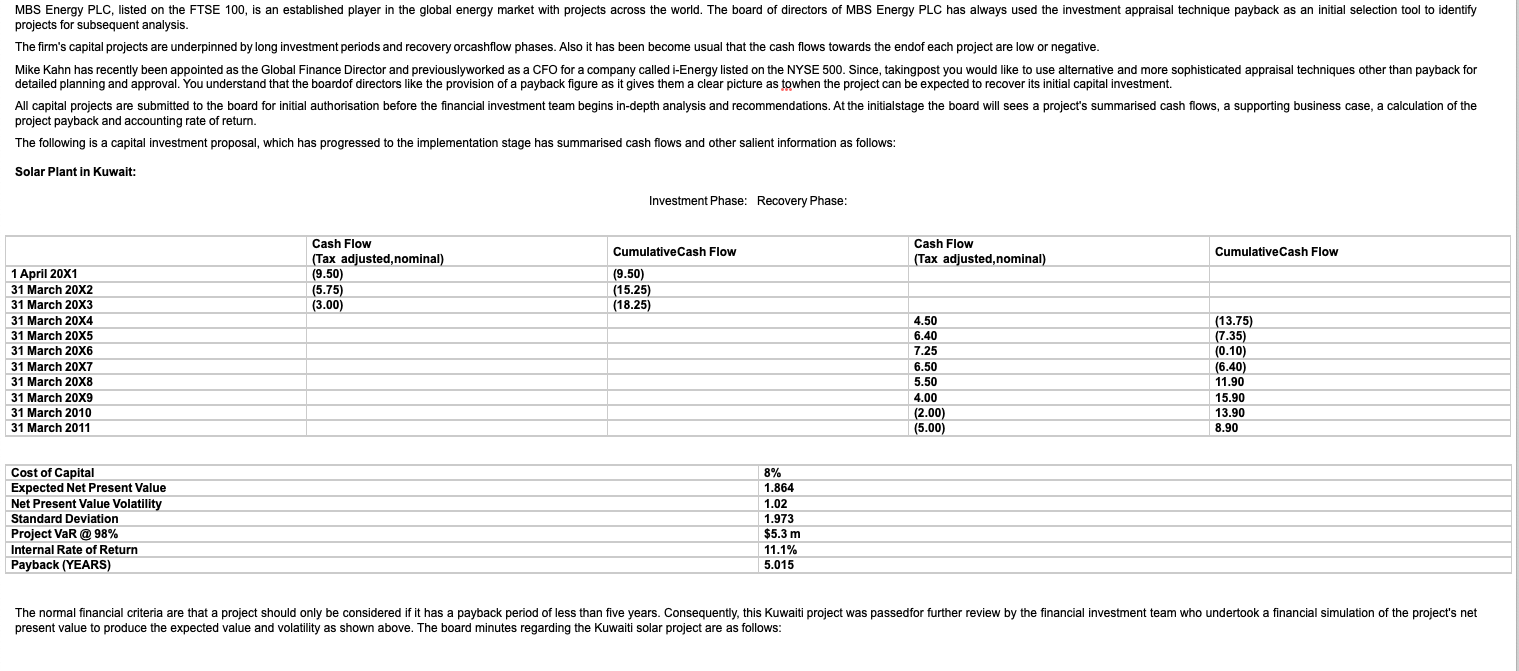

The cash flow projections for the Kuwait solar project had been prepared in accordance with established company rules and it was identified that there was uncertainty with respect to capital build and future viability. However, given the projects strategic significance the Global Finance Director had sanctioned the project for board discussion and the proximity to the payback estimate to the company's barrier for long term capital investment of five years.

Mr. Robinson (non-executive director) argued that the board would require further information including the impact of risk upon the project's outcome before giving final approval. Ms. Khan (operations director) agreed but asked why the board needed to consider capital proposals twice. The board was unanimous that what was needed was more detailed and clear information about each proposal and the risks to which they were exposed. Mr. Johnson (chair) asked the CFO to supply a review of the company's capital approval protocols to include enhanced assessment of the company's financial exposure. The revised guidelines must include procedures for both the initial and final authorisation stages. Approved (Action: CFO to report).

Utilising the appraisal methods, outline the case for the acceptance of the project to build a solar plant in Kuwait with an assessment of the company's likely value at risk. (Ignore the impact on the financial statements)

projects for subsequent analysis. project payback and accounting rate of return. Solar Plant in Kuwait: Investment Phase: Recovery Phase: present value to produce the expected value and volatility as shown above. The board minutes regarding the Kuwaiti solar project are as follows: projects for subsequent analysis. project payback and accounting rate of return. Solar Plant in Kuwait: Investment Phase: Recovery Phase: present value to produce the expected value and volatility as shown above. The board minutes regarding the Kuwaiti solar project are as follows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started