Answered step by step

Verified Expert Solution

Question

1 Approved Answer

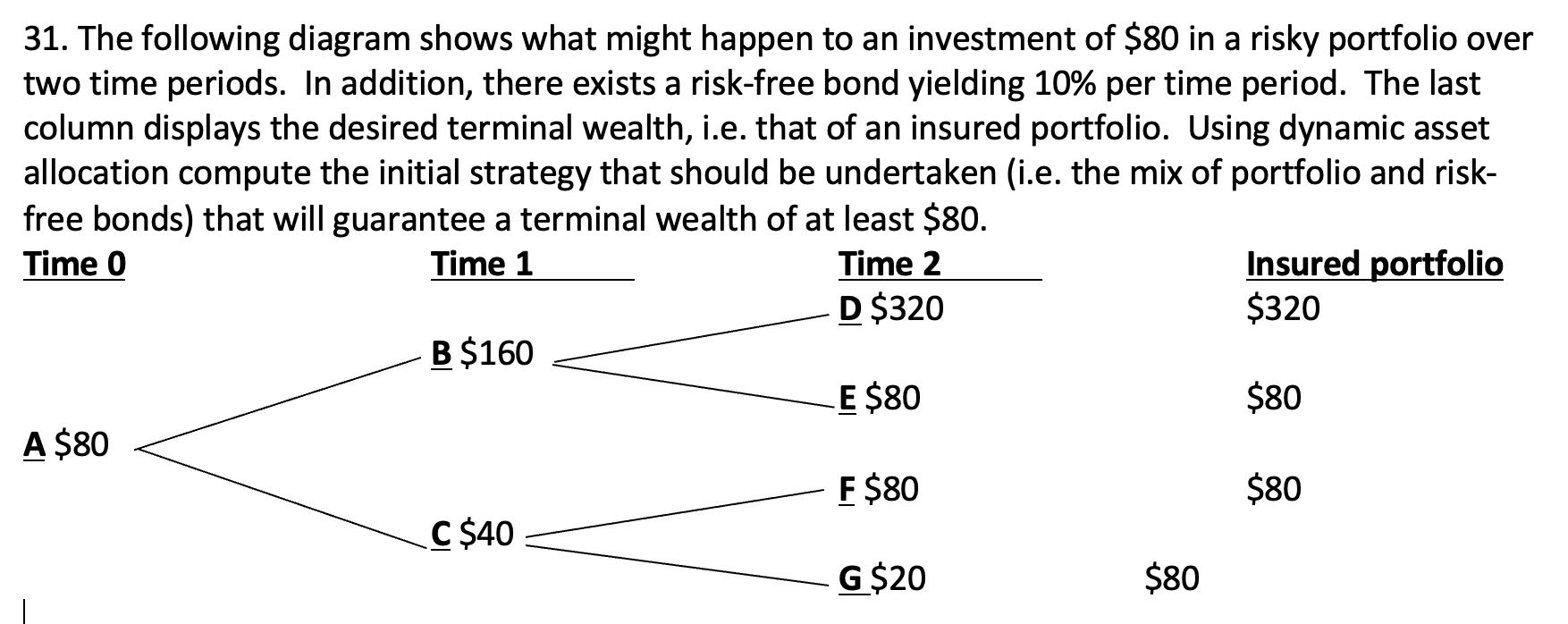

31. The following diagram shows what might happen to an investment of $80 in a risky portfolio over two time periods. In addition, there

31. The following diagram shows what might happen to an investment of $80 in a risky portfolio over two time periods. In addition, there exists a risk-free bond yielding 10% per time period. The last column displays the desired terminal wealth, i.e. that of an insured portfolio. Using dynamic asset allocation compute the initial strategy that should be undertaken (i.e. the mix of portfolio and risk- free bonds) that will guarantee a terminal wealth of at least $80. Time 0 Time 1 Time 2 D $320 A $80 B $160 C $40 E $80 F $80 G $20 $80 Insured portfolio $320 $80 $80

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To guarantee a terminal wealth of at least 80 we need to determine the initial strategy that balances the investment in the risky portfolio and the ri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started