Question

31 The Profit and Loss Account and Related Concept several years. Cleaning service, on the other hand, was much simpler to plan for; it involved

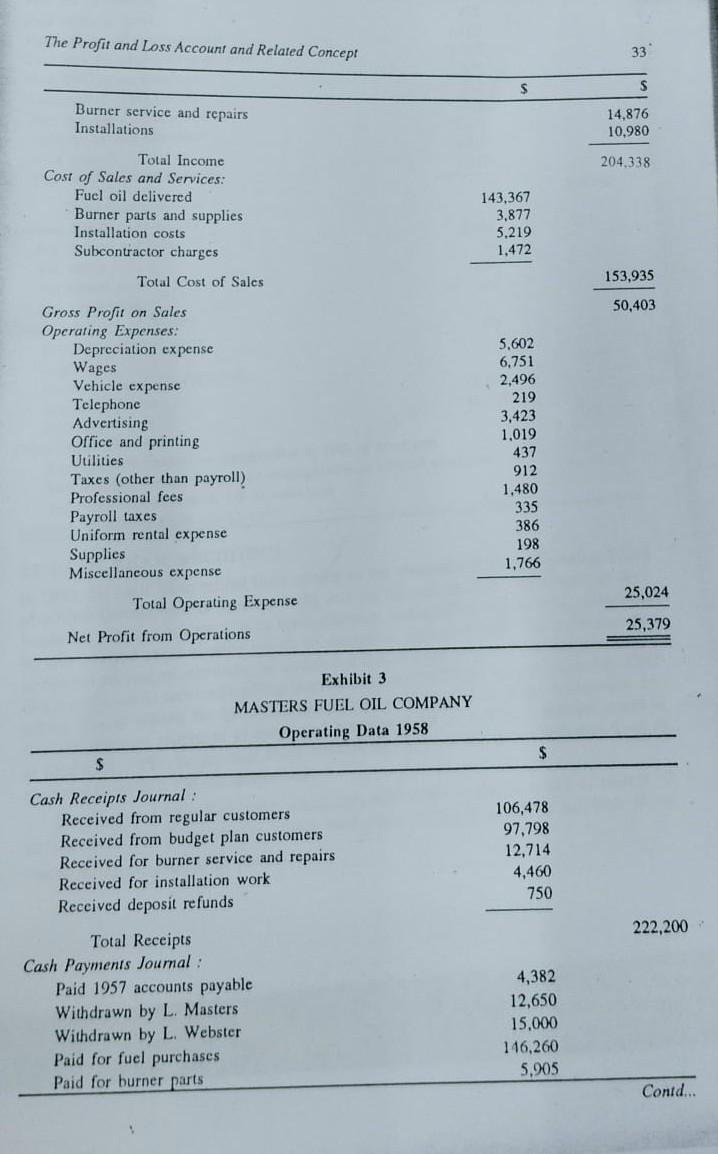

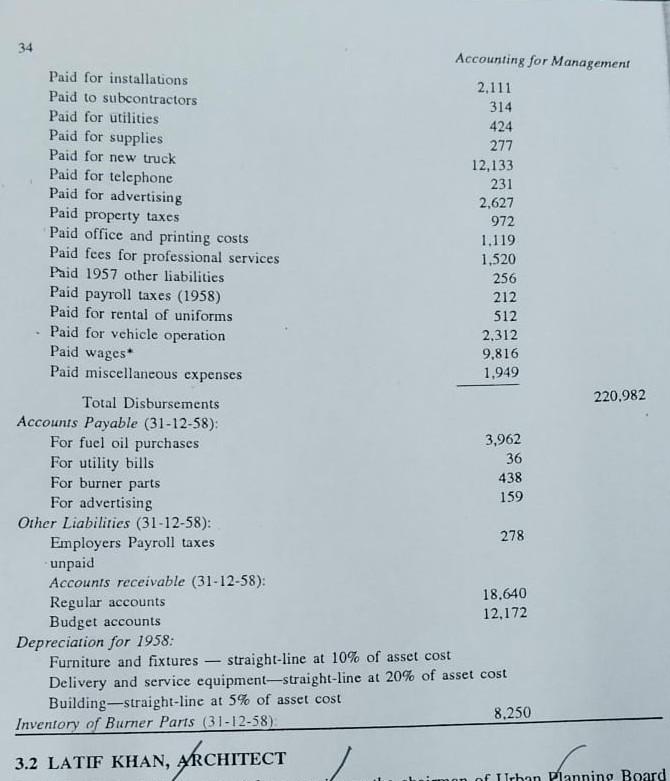

31 The Profit and Loss Account and Related Concept several years. Cleaning service, on the other hand, was much simpler to plan for; it involved a fixed commitment which could be scheduled conveniently and discharged under predictable conditions of cost and time. Mr Masters was particularly enthusiastic about the cleaning portion of the service contracts. Except for incidental costs of replacing filters, labour time was his only real cost. Masters maintained that the cleaning work done under the Budget Plan Service Contract was at least as good as the work billed to noncontract customers. These customers were charged $15 for cleaning and inspection. Although relatively few noncontract accounts called for cleaning service, Masters denied that his rate was established to induce customers to enroll in the Budget Group. Competing firms offered similar cleaning services for $10 to $12. The foregoing is a reasonably complete summation of Wallace Stone's knowledge of the Masters company up to the time of Mr Masters' visit to his office. He did, of course, have a complete file of data on the 1958 operations (see Exhibit 3) and was about to prepare the annual statements for the partners. Now that Masters had questioned the profit figures, Stone felt obliged to spend a little more time before releasing any statements. Stone discussed the matter briefly with Masters and then agreed to meet with him. and the other members of the family the following evening at Masters' home. At the meeting, attention soon centered on the marked difference in accounts receivable at the end of the two years in question. Mrs Masters recalled, then, that there was some problem in setting up the balance of receivables at the end of last year. The friend who had been helping with the books had completed preparation of the tax returns before Mrs Masters had totaled all of the accounts. Explaining to Stone, Mrs Masters said, "He had only the tape on the budget accounts. When I called him and told him that I had the tape on all the other accounts he said that he'd already finished the work and that it would all balance out." Mrs Masters searched her desk and found the listing of accounts receivable that had not been recorded on December 31, 1957. The adding machine tape showed a total of $14,377.18. QUESTIONS 1. Using the data that Stone had prior to Masters' visit on January 14, prepare the income statement and balance sheet for Masters Fuel Oil Corporation. 2. How shall Mr Stone explain the situation to the Masters and Webster? Will it "all balance. out?" Why? 3. What accounts if any, were misstated on December 31, 1957? December 31, 1958? 4. What corrections, if any, would you make in the two sets of statements ? 5. Do you have any recommendations for the handling of the record of customers' accounts in the future? 6. How should Stone reflect Masters'

year-end liability on service contracts ? Under the system used by this company, receipts on budget accounts had been recorded as budget plan income when received. The excess of delivery values over budget receipts had not been formally recorded. It was these amounts that Mrs Masters calculated so that they could be added to budget plan income for the year.

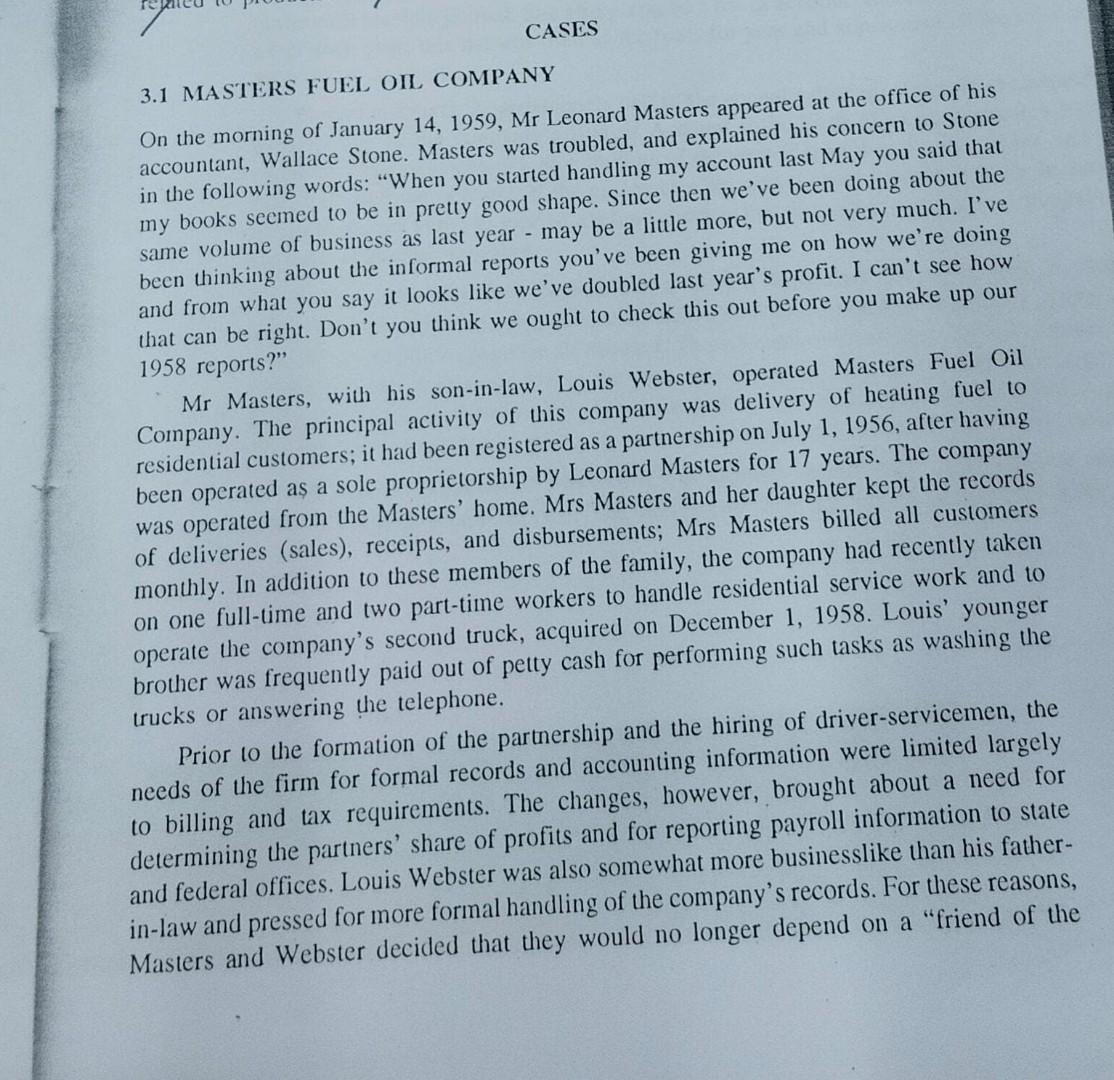

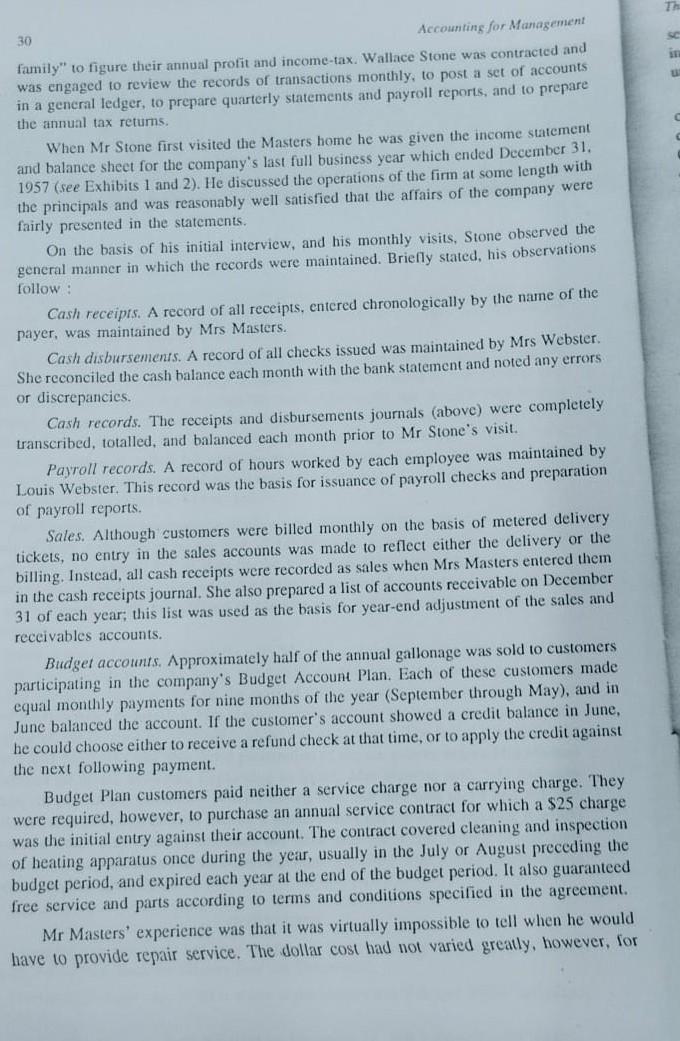

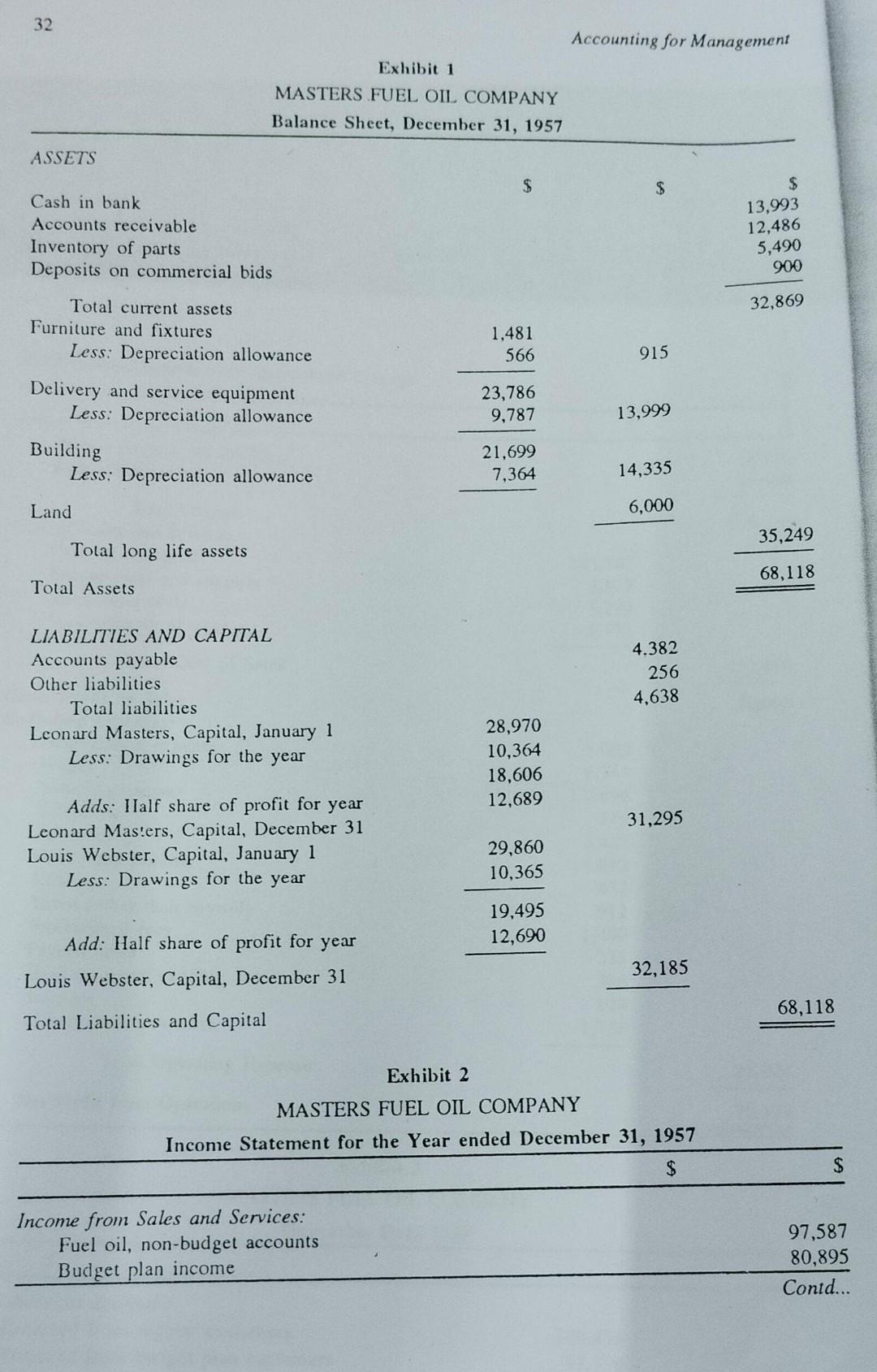

3.1 MASTERS FUEL OIL COMPANY On the morning of January 14,1959, Mr Leonard Masters appeared at the office of his accountant, Wallace Stone. Masters was troubled, and explained his concern to Stone in the following words: "When you started handling my account last May you said that my books seemed to be in pretty good shape. Since then we've been doing about the same volume of business as last year - may be a little more, but not very much. I've been thinking about the informal reports you've been giving me on how we're doing and from what you say it looks like we've doubled last year's profit. I can't see how that can be right. Don't you think we ought to check this out before you make up our 1958 reports?" Mr Masters, with his son-in-law, Louis Webster, operated Masters Fuel Oil Company. The principal activity of this company was delivery of heating fuel to residential customers; it had been registered as a partnership on July 1, 1956, after having been operated as a sole proprietorship by Leonard Masters for 17 years. The company was operated from the Masters' home. Mrs Masters and her daughter kept the records of deliveries (sales), receipts, and disbursements; Mrs Masters billed all customers monthly. In addition to these members of the family, the company had recently taken on one full-time and two part-time workers to handle residential service work and to operate the company's second truck, acquired on December 1, 1958. Louis' younger brother was frequently paid out of petty cash for performing such tasks as washing the trucks or answering the telephone. Prior to the formation of the partnership and the hiring of driver-servicemen, the needs of the firm for formal records and accounting information were limited largely to billing and tax requirements. The changes, however, brought about a need for determining the partners' share of profits and for reporting payroll information to state and federal offices. Louis Webster was also somewhat more businesslike than his father in-law and pressed for more formal handling of the company's records. For these reasons Masters and Webster decided that they would no longer depend on a "friend of th 30 Accounting for Management family" to figure their annual profit and income-tax. Wallace Stone was contracted and was engaged to review the records of transactions monthly, to post a set of accounts in a general ledger, to prepare quarterly statements and payroll reports, and to prepare the annual tax returns. When Mr Stone first visited the Masters home he was given the income statement and balance sheet for the company's last full business year which ended December 31. 1957 (see Exhibits 1 and 2). He discussed the operations of the firm at some length with the principals and was reasonably well satisfied that the affairs of the company were fairly presented in the statements. On the basis of his initial interview, and his monthly visits, Stone observed the general manner in which the records were maintained. Briefly stated, his observations follow : Cash receipts. A record of all receipts, entered chronologically by the name of the payer, was maintained by Mrs Masters. Cash disbursements. A record of all checks issued was maintained by Mrs Webster. She reconciled the cash balance each month with the bank statement and noted any errors or discrepancies. Cash records. The receipts and disbursements journals (above) were completely transcribed, totalled, and balanced each month prior to Mr Stone's visit. Payroll records. A record of hours worked by each employee was maintained by Louis Webster. This record was the basis for issuance of payroll checks and preparation of payroll reports. Sales. Although customers were billed monthly on the basis of metered delivery tickets, no entry in the sales accounts was made to reflect either the delivery or the billing. Instead, all cash receipts were recorded as sales when Mrs Masters entered them in the cash receipts journal. She also prepared a list of accounts receivable on December 31 of each year; this list was used as the basis for year-end adjustment of the sales and receivables accounts. Budget accounts. Approximately half of the annual gallonage was sold to customers participating in the company's Budget Account Plan. Each of these customers made equal monthly payments for nine months of the year (September through May), and in June balanced the account. If the customer's account showed a credit balance in June, he could choose either to receive a refund check at that time, or to apply the credit against the next following payment. Budget Plan customers paid neither a service charge nor a carrying charge. They were required, however, to purchase an annual service contract for which a $25 charge was the initial entry against their account. The contract covered cleaning and inspection of heating apparatus once during the year, usually in the July or August preceding the budget period, and expired each year at the end of the budget period. It also guaranteed free service and parts according to terms and conditions specified in the agreement. Mr Masters' experience was that it was virtually impossible to tell when he would have to provide repair service. The dollar cost had not varied greally, however, for The Profit and Loss Account and Related Concept 31 several years. Cleaning service, on the other hand, was much simpler to plan for; it involved a fixed commitment which could be scheduled conveniently and discharged under predictable conditions of cost and time. Mr Masters was particularly enthusiastic about the cleaning portion of the service contracts. Except for incidental costs of replacing filters, labour time was his only real cost. Masters maintained that the cleaning work done under the Budget Plan Service Contract was at least as good as the work billed to noncontract customers. These customers were charged $15 for cleaning and inspection. Although relatively few noncontract accounts called for cleaning service, Masters denied that his rate was established to induce customers to enroll in the Budget Group. Competing firms offered similar cleaning services for $10 to $12. The foregoing is a reasonably complete summation of Wallace Stone's knowledge of the Masters company up to the time of Mr Masters' visit to his office. He did, of course, have a complete file of data on the 1958 operations (see Exhibit 3) and was about to prepare the annual statements for the partners. Now that Masters had questioned the profit figures, Stone felt obliged to spend a little more time before releasing any statements. Stone discussed the matter briefly with Masters and then agreed to meet with him and the other members of the family the following evening at Masters' home. At the meeting, attention soon centered on the marked difference in accounts receivable at the end of the two years in question. Mrs Masters recalled, then, that there was some problem in setting up the balance of receivables at the end of last year. The friend who had been helping with the books had completed preparation of the tax returns before Mrs Masters had totaled all of the accounts. Explaining to Stone, Mrs Masters said, "He had only the tape on the budget accounts. 2 When I called him and told him that I had the tape on all the other accounts he said that he'd already finished the work and that it would all balance out." Mrs Masters searched her desk and found the listing of accounts receivable that had not been recorded on December 31, 1957. The adding machine tape showed a total of $14,377.18. QUESTIONS 1. Using the data that Stone had prior to Masters' visit on January 14, prepare the income statement and balance sheet for Masters Fuel Oil Corporation. 2. How shall Mr Stone explain the situation to the Masters and Webster? Will it "all balance out?" Why ? 3. What accounts if any, were misstatd on December 31, 1957? December 31, 1958? 4. What corrections, if any, would you make in the two sets of statements ? 5. Do you have any recommendations for the handling of the record of customers' accounts in the future? 6. Ilow should Stone reflect Masters' year-end liability on service contracts ? 2 Under the system used by this company, receipts on budget accounts had been recorded as budget plan income when received. The excess of delivery values over budget receipts had not been formally recorded. It was these amounts that Mrs Masters calculated so that they could be added to budget plan income for the year. Accounting for Management Ctotament for the Year ended December 31, 1957 The Profit and Loss Account and Relntad Comin.. 34 Accounting for Management Paid for installations Paid to subcontractors Paid for utilities Paid for supplies Paid for new truck Paid for telephone Paid for advertising Paid property taxes Paid office and printing costs Paid fees for professional services Paid 1957 other liabilities Paid payroll taxes (1958) Paid for rental of uniforms - Paid for vehicle operation Paid wages* Paid miscellaneous expenses Total Disbursements Accounts Payable (31-12-58): For fuel oil purchases For utility bills For burner parts For advertising Other Liabilities (31-12-58): Employers Payroll taxes unpaid Accounts receivable (31-12-58): Regular accounts Budget accounts 2,111 314 424 277 12,133 231 2,627 972 1,119 1,520 256 212 512 2,312 9.816 1,949 220,982 3,962 36 438 159 278 Depreciation for 1958 : 18.640 12,172 Furniture and fixtures - straight-line at 10% of asset cost Delivery and service equipment-straight-line at 20% of asset cost Building-straight-line at 5% of asset cost Inventory of Burner Parts (31-12-58) 8,250 3.2 LATIF KHAN, A/RCHITECT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started