3-10 Below the green ones are right and do not need to be double checked, just thought they would help solve for what the red ones should be

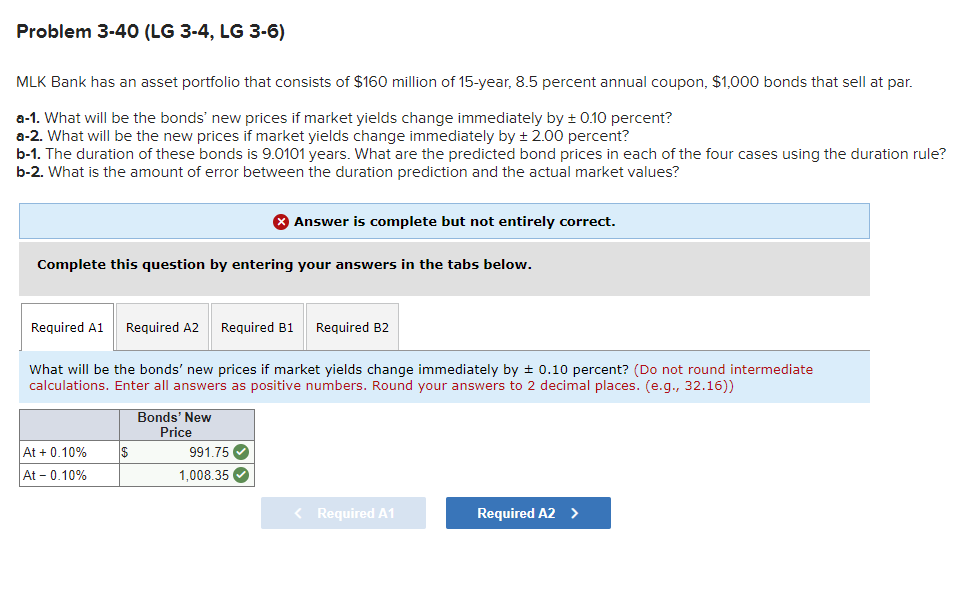

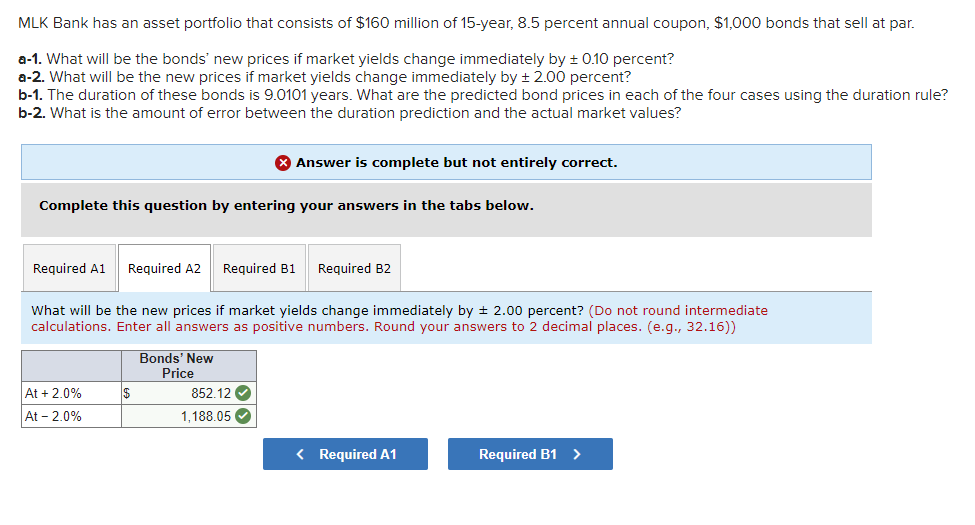

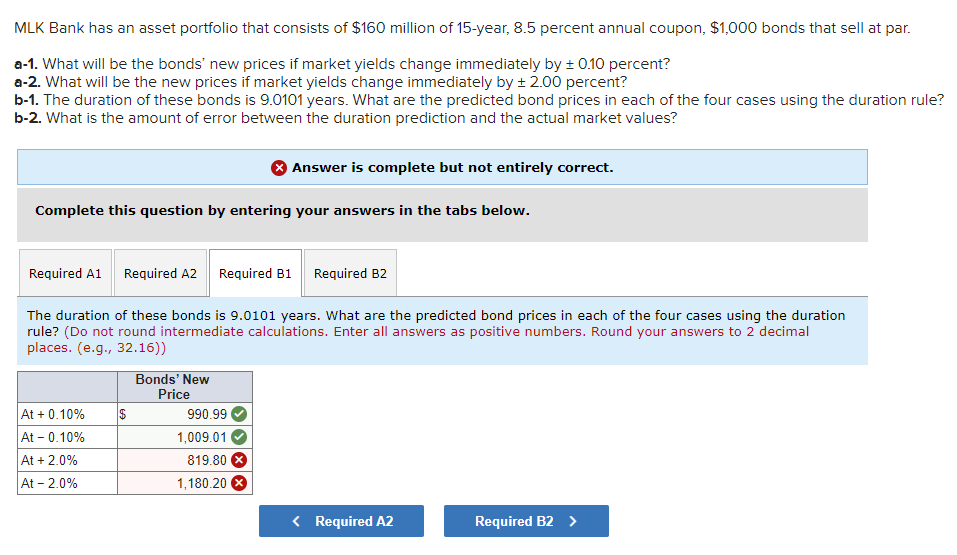

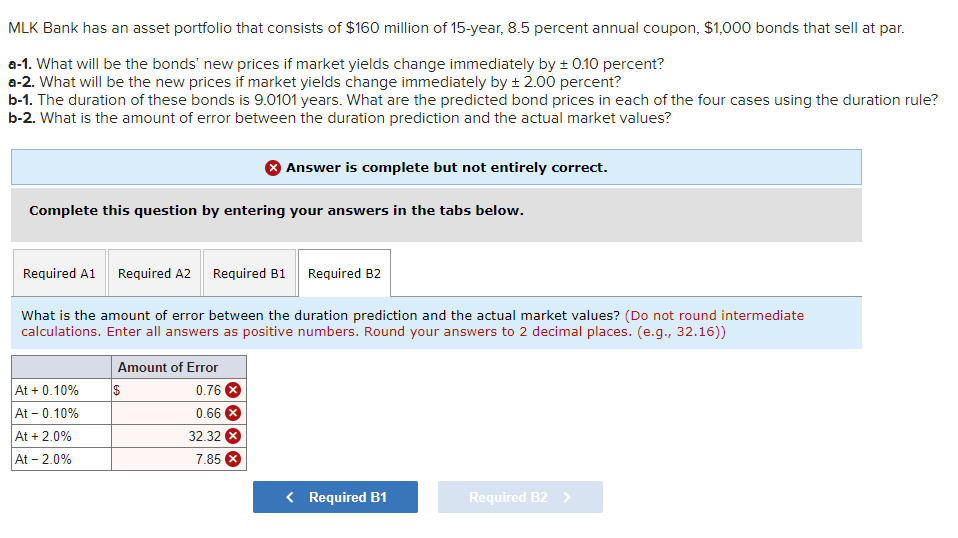

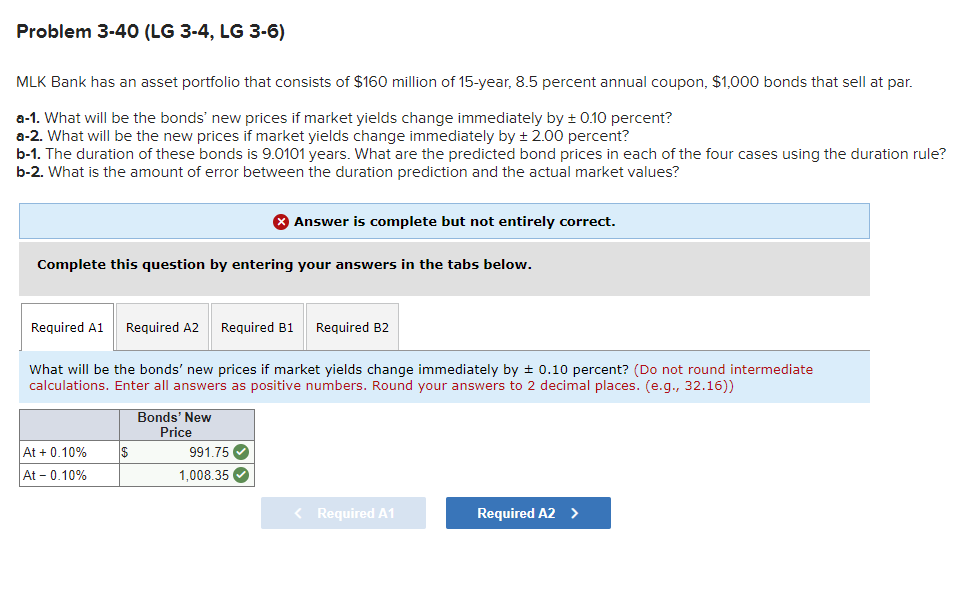

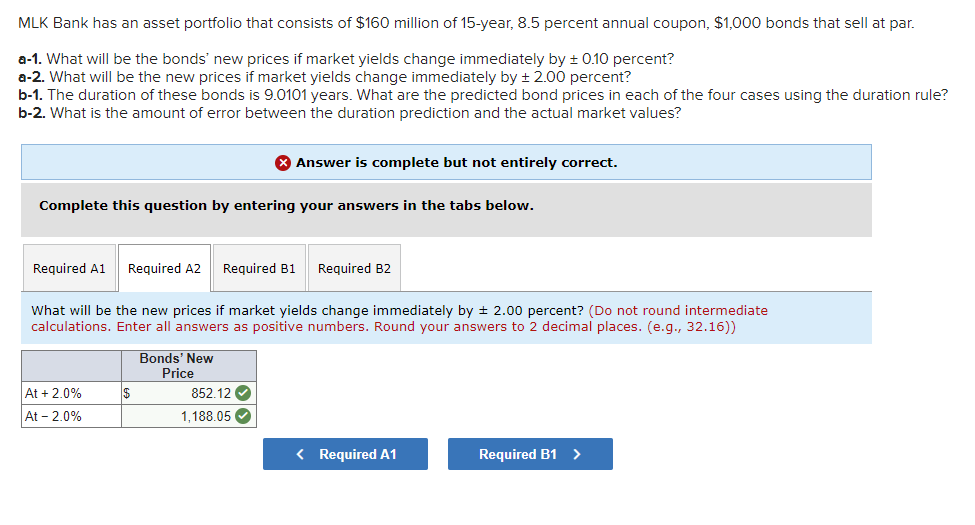

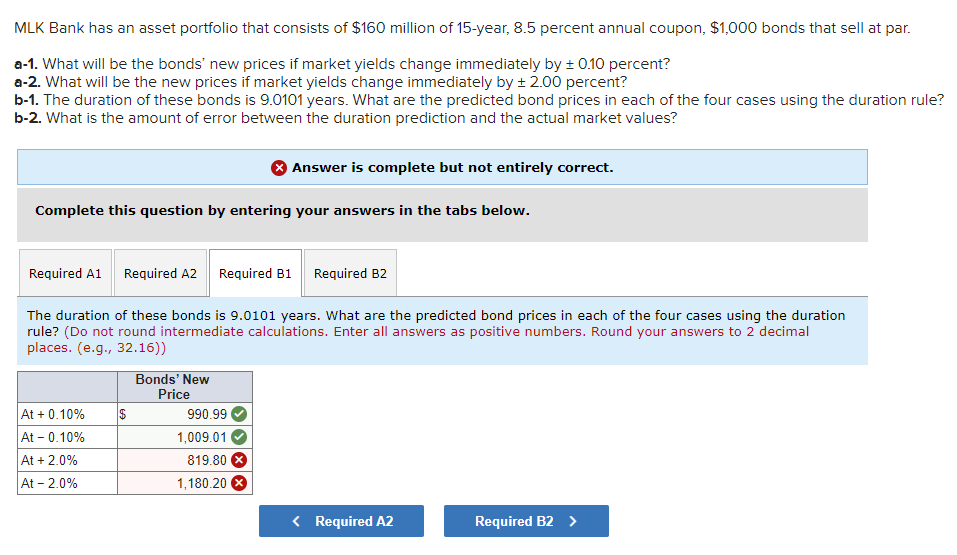

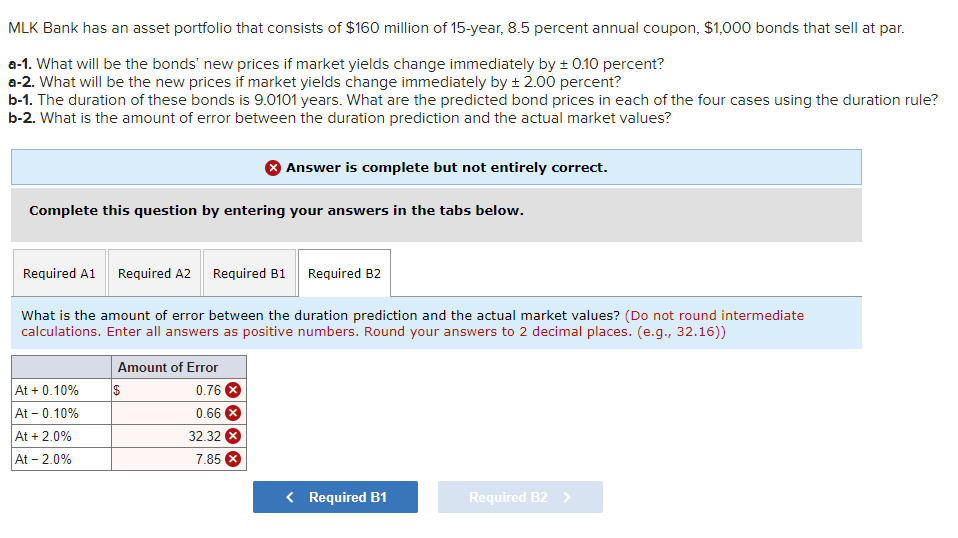

MLK Bank has an asset portfolio that consists of $160 million of 15 -year, 8.5 percent annual coupon, $1,000 bonds that sell at par. a-1. What will be the bonds' new prices if market yields change immediately by 0.10 percent? a-2. What will be the new prices if market yields change immediately by 2.00 percent? b-1. The duration of these bonds is 9.0101 years. What are the predicted bond prices in each of the four cases using the duration rule b2. What is the amount of error between the duration prediction and the actual market values? x Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What will be the bonds' new prices if market yields change immediately by 0.10 percent? (Do not round intermediate calculations. Enter all answers as positive numbers. Round your answers to 2 decimal places. (e.g., 32.16) ) MLK Bank has an asset portfolio that consists of $160 million of 15 -year, 8.5 percent annual coupon, $1,000 bonds that sell at par. a-1. What will be the bonds' new prices if market yields change immediately by 0.10 percent? a-2. What will be the new prices if market yields change immediately by 2.00 percent? b-1. The duration of these bonds is 9.0101 years. What are the predicted bond prices in each of the four cases using the duration rul b2. What is the amount of error between the duration prediction and the actual market values? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What will be the new prices if market yields change immediately by 2.00 percent? (Do not round intermediate calculations. Enter all answers as positive numbers. Round your answers to 2 decimal places. (e.g., 32.16) ) MLK Bank has an asset portfolio that consists of $160 million of 15 -year, 8.5 percent annual coupon, $1,000 bonds that sell at par. a-1. What will be the bonds' new prices if market yields change immediately by 0.10 percent? a-2. What will be the new prices if market yields change immediately by 2.00 percent? b1. The duration of these bonds is 9.0101 years. What are the predicted bond prices in each of the four cases using the duration ru b-2. What is the amount of error between the duration prediction and the actual market values? x Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. The duration of these bonds is 9.0101 years. What are the predicted bond prices in each of the four cases using the duration rule? (Do not round intermediate calculations. Enter all answers as positive numbers. Round your answers to 2 decimal places. (e.g., 32.16)) MLK Bank has an asset portfolio that consists of $160 million of 15 -year, 8.5 percent annual coupon, $1,000 bonds that sell at par. a-1. What will be the bonds' new prices if market yields change immediately by 0.10 percent? a-2. What will be the new prices if market yields change immediately by 2.00 percent? b-1. The duration of these bonds is 9.0101 years. What are the predicted bond prices in each of the four cases using the duration rul b-2. What is the amount of error between the duration prediction and the actual market values? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What is the amount of error between the duration prediction and the actual market values? (Do not round intermediate calculations. Enter all answers as positive numbers. Round your answers to 2 decimal places. (e.g., 32.16) )