Answered step by step

Verified Expert Solution

Question

1 Approved Answer

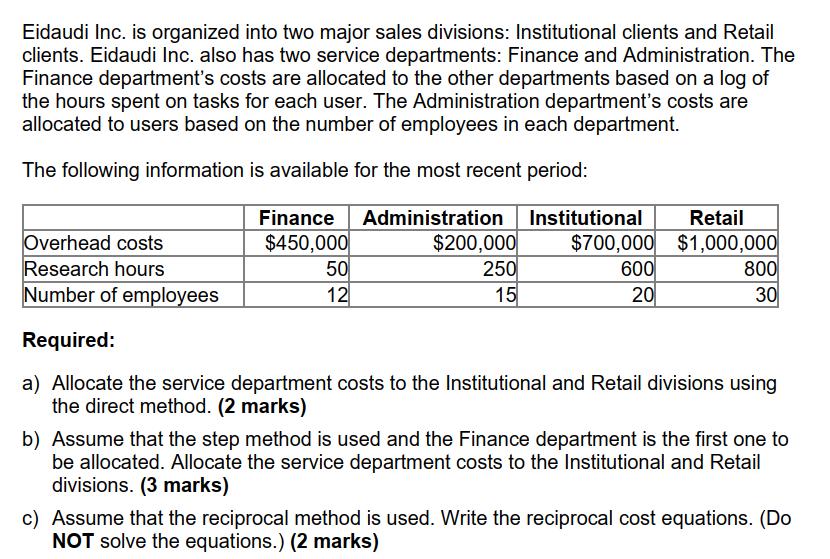

Eidaudi Inc. is organized into two major sales divisions: Institutional clients and Retail clients. Eidaudi Inc. also has two service departments: Finance and Administration.

Eidaudi Inc. is organized into two major sales divisions: Institutional clients and Retail clients. Eidaudi Inc. also has two service departments: Finance and Administration. The Finance department's costs are allocated to the other departments based on a log of the hours spent on tasks for each user. The Administration department's costs are allocated to users based on the number of employees in each department. The following information is available for the most recent period: Administration Institutional $700,000 600 20 Finance $450,000 Overhead costs Research hours Number of employees Required: a) Allocate the service department costs to the Institutional and Retail divisions using the direct method. (2 marks) 50 12 Retail $1,000,000 $200,000 250 15 800 30 b) Assume that the step method is used and the Finance department is the first one to be allocated. Allocate the service department costs to the Institutional and Retail divisions. (3 marks) c) Assume that the reciprocal method is used. Write the reciprocal cost equations. (Do NOT solve the equations.) (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution a Direct Method Finance Department Costs 450000 Administration Department Costs 200000 Total Service Department Costs 650000 Institutional Di...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started