Answered step by step

Verified Expert Solution

Question

1 Approved Answer

31.1 Use the IRAC Method to breifly identify the Issue, the Legal Rule (Legal Test), the Facts Applied to the Test (Analysis), and the Conclusion/

31.1 Use the IRAC Method to breifly identify the Issue, the Legal Rule (Legal Test), the Facts Applied to the Test (Analysis), and the Conclusion/ Holding of the case.

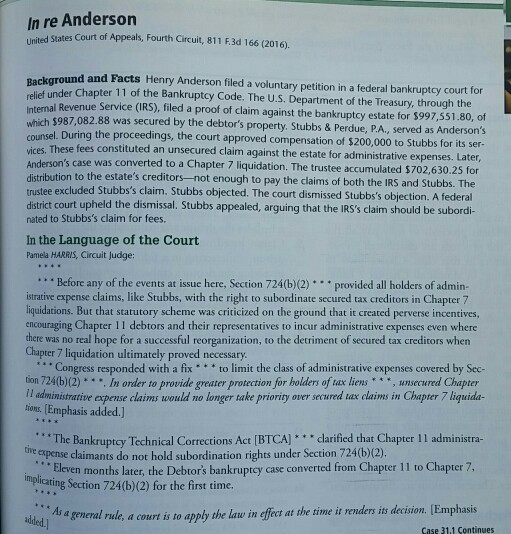

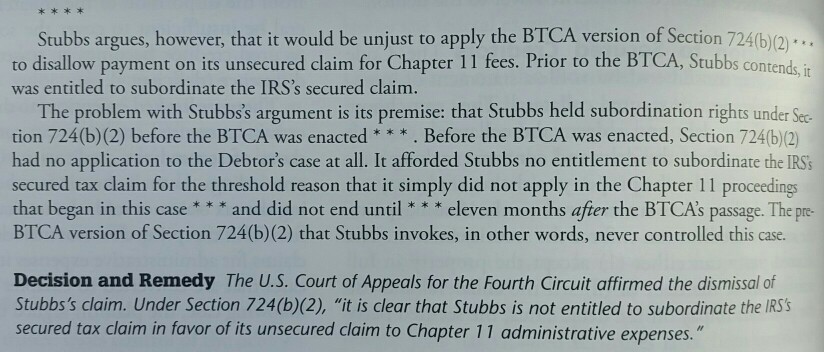

In re Anderson es Court of Appeals, Fourth Circuit, 811 F3d 166 (2016) Backg round and Facts Henry Anderson filed a voluntary petition in a federal bankruptcy court for ef under Chapter 11 of the Bankruptcy Code. The U.S. Department of the Treasury, through the relie Internal Revenue which $987,082 Service (IRS), filed a proof of claim against the bankruptcy estate for $997,551.80, of unsel. During the proceedings, the court approved compensation of $200,000 to Stubbs for its ser These fees constituted an unsecured claim against the estate for administrative expenses. Later vices. s case was converted to a Chapter 7 liquidation. The trustee accumulated $702,630.25 for distribution to the estate's creditors-not enough to pay the claims of both the IRS a trustee excluded Stubbs's claim. Stubbs objected. The court dismissed Stubbs's objection. A federal district court upheld the dismissal. Stubbs appealed, arguing that the IRS's claim should be subordi nated to Stubbs's claim for fees nd Stubbs. The In the Language of the Court Pamela HARRIS, Circuit Judge Before any of the events at issue here, Section 724(b)(2) provided all holders of admin istrative expense claims, like Stubbs, with the right to subordinate secured tax creditors in Chapter 7 liquidations. But that statutory scheme was criticized on the ground that it created perverse incentives encouraging Chapter 11 debtors and their representatives to incur administrative expenses even where re was no real hope for a successful reorganization, to the detriment of secured tax creditors when Chapter 7 liquidation ultimately proved necessary Congress responded with a fix *to limit the class of administrative expenses covered by Sec n724b)(2)** .. In order to provide greater protection for holders of tax liens*, unsecured Chapter l administrative expense claims would no longer take priority over secured tax claims in Chapter 7 liquida tions. Emphasis added.] The Bankruptcy Technical Corrections Act [BTCA] "dlarified that Chapter 11 administra epense claimants do not hold subordination rights under Section 724b)(2) implicating Section 724(b)(2) for the first time. Eleven months later, the Debtor's bankruptcy case converted from Chapter 11 to Chapter 7 added.] a general rule, a court is to apply the law in effect at the time it renders its decision. [Emphasis Case 311 Continues In re Anderson es Court of Appeals, Fourth Circuit, 811 F3d 166 (2016) Backg round and Facts Henry Anderson filed a voluntary petition in a federal bankruptcy court for ef under Chapter 11 of the Bankruptcy Code. The U.S. Department of the Treasury, through the relie Internal Revenue which $987,082 Service (IRS), filed a proof of claim against the bankruptcy estate for $997,551.80, of unsel. During the proceedings, the court approved compensation of $200,000 to Stubbs for its ser These fees constituted an unsecured claim against the estate for administrative expenses. Later vices. s case was converted to a Chapter 7 liquidation. The trustee accumulated $702,630.25 for distribution to the estate's creditors-not enough to pay the claims of both the IRS a trustee excluded Stubbs's claim. Stubbs objected. The court dismissed Stubbs's objection. A federal district court upheld the dismissal. Stubbs appealed, arguing that the IRS's claim should be subordi nated to Stubbs's claim for fees nd Stubbs. The In the Language of the Court Pamela HARRIS, Circuit Judge Before any of the events at issue here, Section 724(b)(2) provided all holders of admin istrative expense claims, like Stubbs, with the right to subordinate secured tax creditors in Chapter 7 liquidations. But that statutory scheme was criticized on the ground that it created perverse incentives encouraging Chapter 11 debtors and their representatives to incur administrative expenses even where re was no real hope for a successful reorganization, to the detriment of secured tax creditors when Chapter 7 liquidation ultimately proved necessary Congress responded with a fix *to limit the class of administrative expenses covered by Sec n724b)(2)** .. In order to provide greater protection for holders of tax liens*, unsecured Chapter l administrative expense claims would no longer take priority over secured tax claims in Chapter 7 liquida tions. Emphasis added.] The Bankruptcy Technical Corrections Act [BTCA] "dlarified that Chapter 11 administra epense claimants do not hold subordination rights under Section 724b)(2) implicating Section 724(b)(2) for the first time. Eleven months later, the Debtor's bankruptcy case converted from Chapter 11 to Chapter 7 added.] a general rule, a court is to apply the law in effect at the time it renders its decision. [Emphasis Case 311 ContinuesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started