Answered step by step

Verified Expert Solution

Question

1 Approved Answer

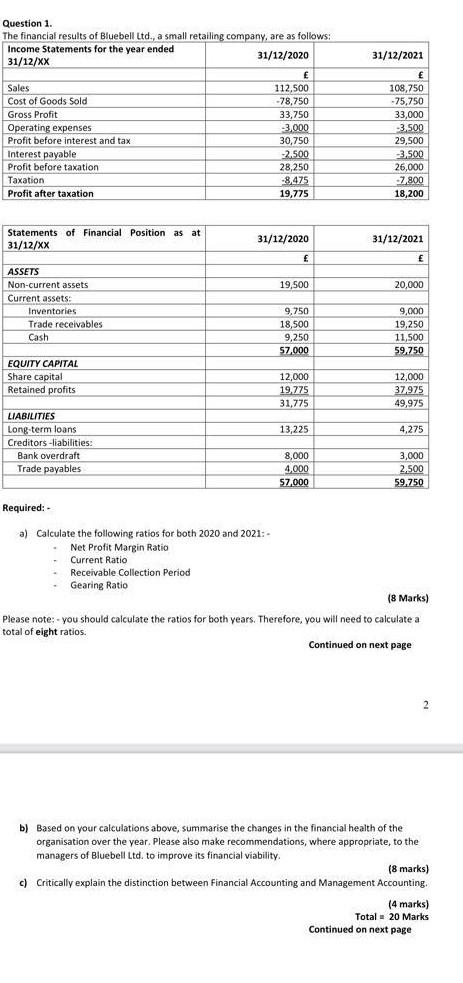

31/12/2021 Question 1 The financial results of Bluebell Ltd., a small retailing company, are as follows: Income Statements for the year ended 31/12/2020 31/12/xx E

31/12/2021 Question 1 The financial results of Bluebell Ltd., a small retailing company, are as follows: Income Statements for the year ended 31/12/2020 31/12/xx E Sales 112,500 Cost of Goods Sold -78,750 Gross Profit 33,750 Operating expenses -3.000 Profit before interest and tax 30,750 Interest payable -2.500 Profit before taxation 28,250 Taxation -8,475 Profit after taxation 19,775 E 108,750 -75,750 33,000 -3,500 29,500 -3.500 26,000 -7.800 18,200 Statements of Financial Position as at 31/12/xx 31/12/2020 31/12/2021 19,500 20,000 ASSETS Non-current assets Current assets: Inventories Trade receivables Cash 9,750 18,500 9,250 57,000 9,000 19,250 11,500 59,750 EQUITY CAPITAL Share capital Retained profits 12,000 19.775 31,775 12,000 37.975 49,975 13,225 4,275 LIABILITIES Long-term loans Creditors-liabilities Bank overdraft Trade payables 8,000 4,000 57.000 3,000 2,500 59.750 Required: - a) Calculate the following ratios for both 2020 and 2021: - Net Profit Margin Ratio Current Ratio Receivable Collection Period Gearing Ratio (8 Marks) ) Please note: - you should calculate the ratios for both years. Therefore, you will need to calculate a , total of eight ratios. Continued on next page 2 b) Based on your calculations above, summarise the changes in the financial health of the organisation over the year. Please also make recommendations, where appropriate, to the managers of Bluebell Ltd. to improve its financial viability (8 marks) c) Critically explain the distinction between Financial Accounting and Management Accounting, (4 marks) Total 20 Marks Continued on next page

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started