Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3.12 A hometown dialysis center is not able to meet the increased dialysis demand from patients with renal failure. The administration is exploring possibilities

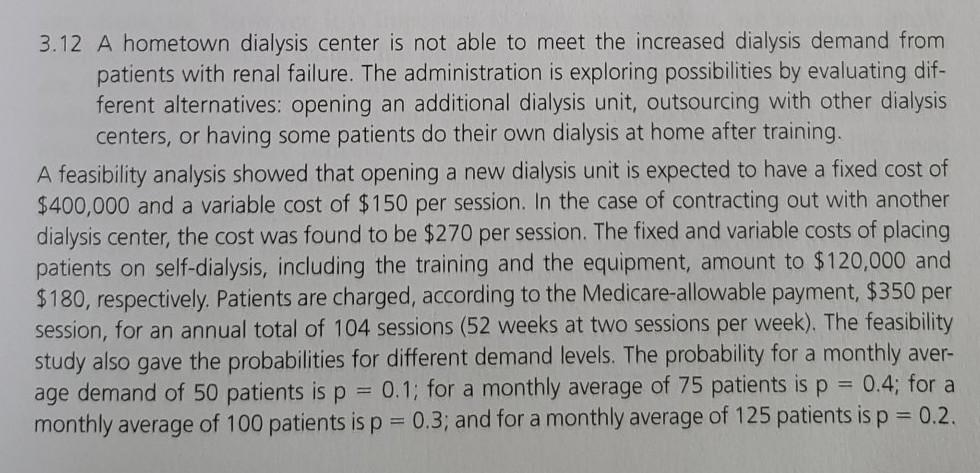

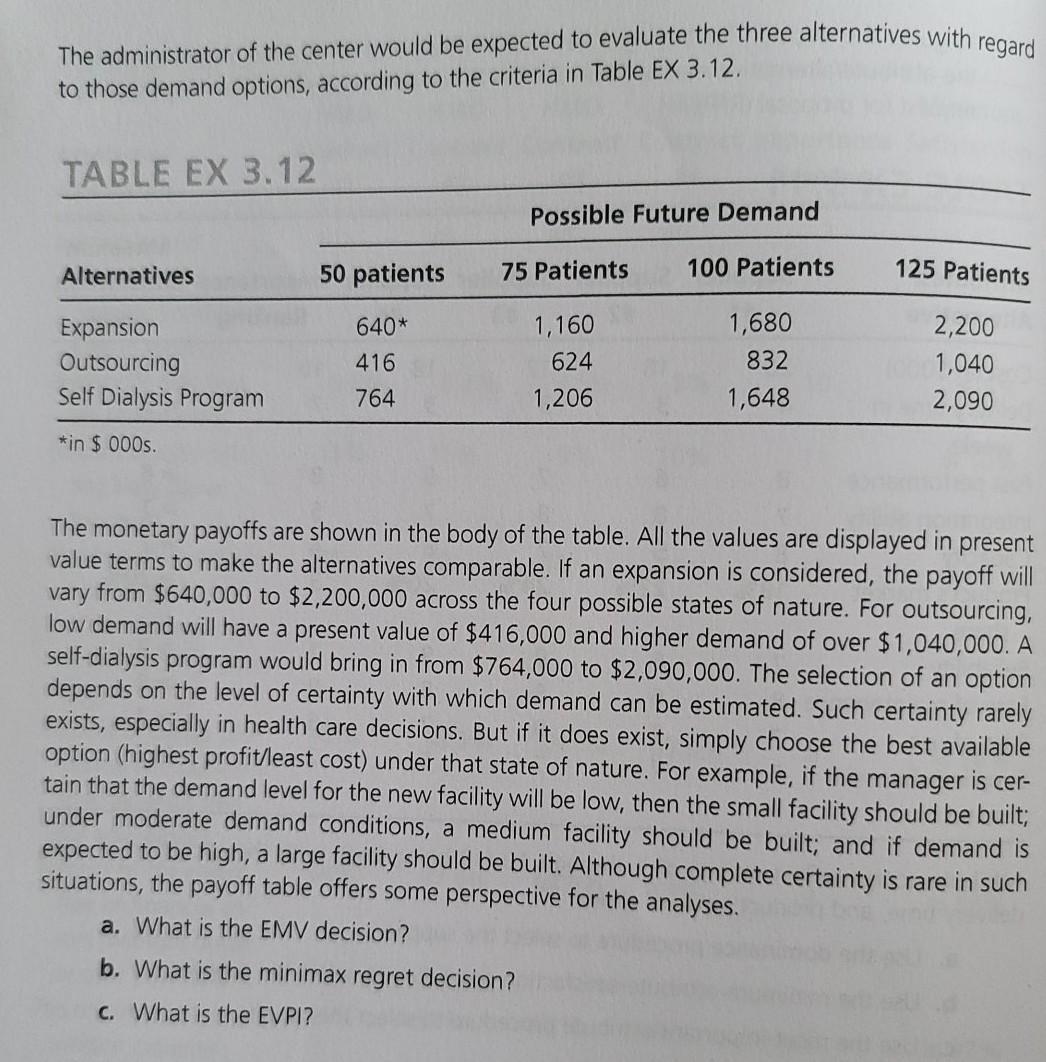

3.12 A hometown dialysis center is not able to meet the increased dialysis demand from patients with renal failure. The administration is exploring possibilities by evaluating dif- ferent alternatives: opening an additional dialysis unit, outsourcing with other dialysis centers, or having some patients do their own dialysis at home after training. A feasibility analysis showed that opening a new dialysis unit is expected to have a fixed cost of $400,000 and a variable cost of $150 per session. In the case of contracting out with another dialysis center, the cost was found to be $270 per session. The fixed and variable costs of placing patients on self-dialysis, including the training and the equipment, amount to $120,000 and $180, respectively. Patients are charged, according to the Medicare-allowable payment, $350 per session, for an annual total of 104 sessions (52 weeks at two sessions per week). The feasibility study also gave the probabilities for different demand levels. The probability for a monthly aver- age demand of 50 patients is p = 0.1; for a monthly average of 75 patients is p = monthly average of 100 patients is p = 0.3; and for a monthly average of 125 patients is p = 0.2. 0.4; for a The administrator of the center would be expected to evaluate the three alternatives with re . to those demand options, according to the criteria in Table EX 3.12. TABLE EX 3.12 Possible Future Demand Alternatives 50 patients 75 Patients 100 Patients 125 Patients Expansion 640* 1,160 1,680 2,200 624 832 1,040 Outsourcing Self Dialysis Program 416 764 1,206 1,648 2,090 *in $ 000s. The monetary payoffs are shown in the body of the table. All the values are displayed in present value terms to make the alternatives comparable. If an expansion is considered, the payoff will from $640,000 to $2,200,000 across the four possible states of nature. For outsourcing, low demand will have a present value of $416,000 and higher demand of over $1,040,000. A self-dialysis program would bring in from $764,000 to $2,090,000. The selection of an option depends on the level of certainty with which demand can be estimated. Such certainty rarely exists, especially in health care decisions. But if it does exist, simply choose the best available option (highest profit/least cost) under that state of nature. For example, if the manager is cer- tain that the demand level for the new facility will be low, then the small facility should be built; under moderate demand conditions, a medium facility should be built; and if demand is expected to be high, a large facility should be built. Although complete certainty is rare in such situations, the payoff table offers some perspective for the analyses. vary a. What is the EMV decision? b. What is the minimax regret decision? C. What is the EVPI? Also, what does EVPI measure?

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started