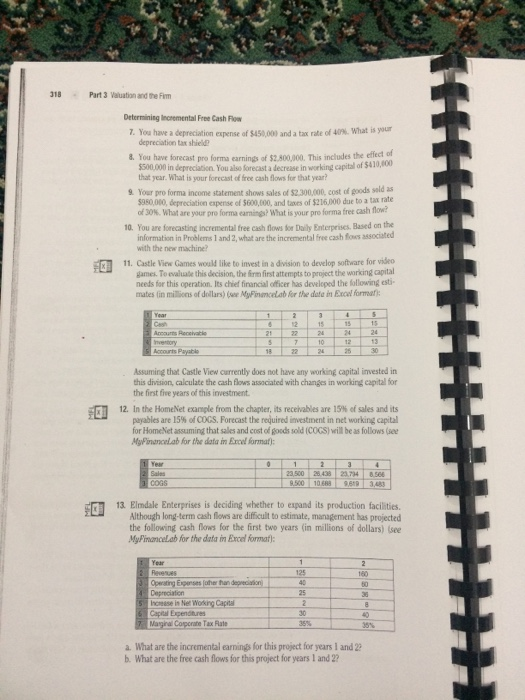

318 Part 3 Valuation and the Fim Oetermining Incremental Free Cash Flow What is your &. You have forecast pro forma earnings of $2.800,000. This includes the effect of 9 Your pro forma income statement shows sales of $2.300,000, cost of goods seld as 10. You are forecasting incremental free cash fows for Daily Enterprises Based on the You have a depreciation expense of $450,000 and a tax rate of 40% depreciation tax shieke $500,000 in depreciation You also forecast a decrease in working capital of $410,00 that year. What is your forecast of free cash flows for that year? $950,000, depreciation expense of $600,000, and taves of $216.000 due to a tax rate of30%. what are your pro forma eamngs? what is your pro forma free cash flow.' information in Problems 1 and 2, what are the incremental free cash fows associated with the new machine? 11. Castle View Games would like to invest in a division to develop software for video 11. games. To evaluade this decision, the firm first attempts to project the working capital needs for this operation. Its chief financial oficer has develeped the following esti mates lin millions of dollars)(see MyPinmcelab for the data in Excel formati Arcourts Receivabie 18 224 30 Acorts Payable Assuming that Castle View currently does not have any working capital ivested in this division, calculate the cash flows associated with changes in working capital for the first five years of this investment 12. In the HomeNet example from thechapter, its receivables are 15% ef sales and its payables are 15% of COGS. Forecast the required investment in net working capital for HomeNet assuming that salles and cost of goods sold (COCS) wrill be as follows (see MgPinancelab for the data in Excol formaf) 23500 2438 24858 .500 10 68 S89 3.483 13 Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash fows for the first two years (in millions of dollars) (see MyPimancelab for the data in Excel formaf]: 160 Operating Expunses other than depreciasion 25 Increase is Ne Working Capital Capital Expenditures 30 40 35% Copcrate Tax Rate a. What are the incremental earnings for this project for years I and 2 b. What are the free cash flows for this project for years 1 and 2