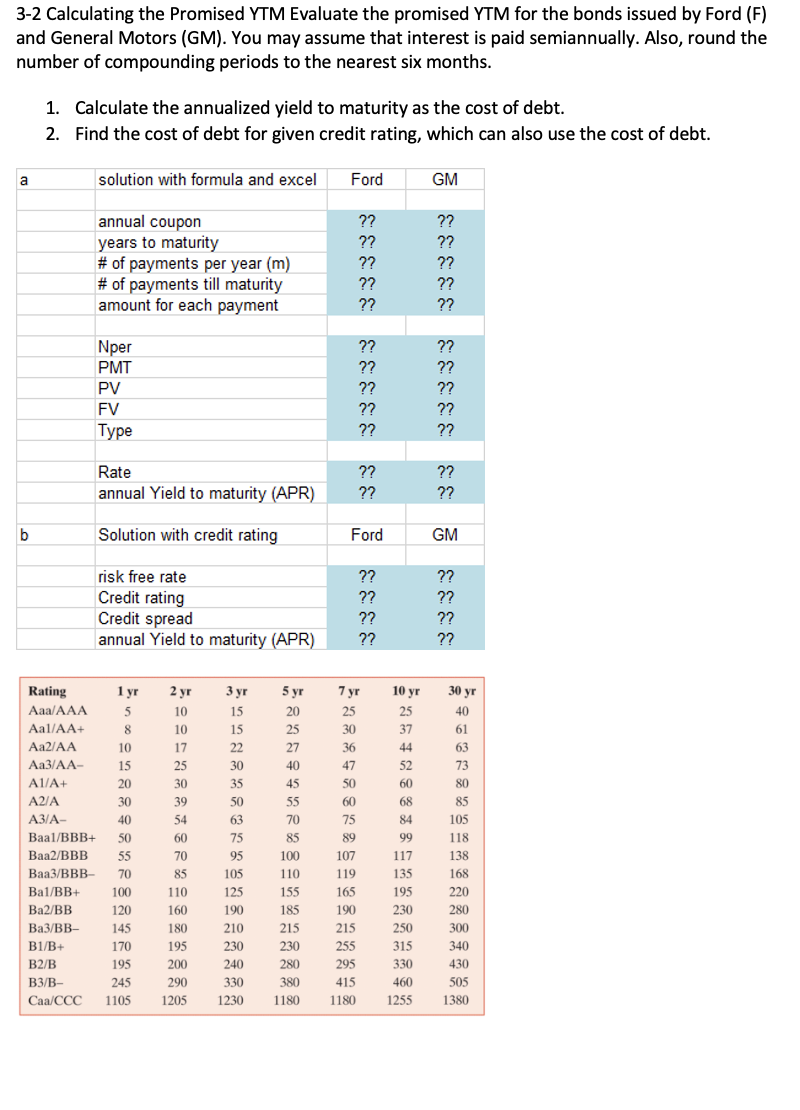

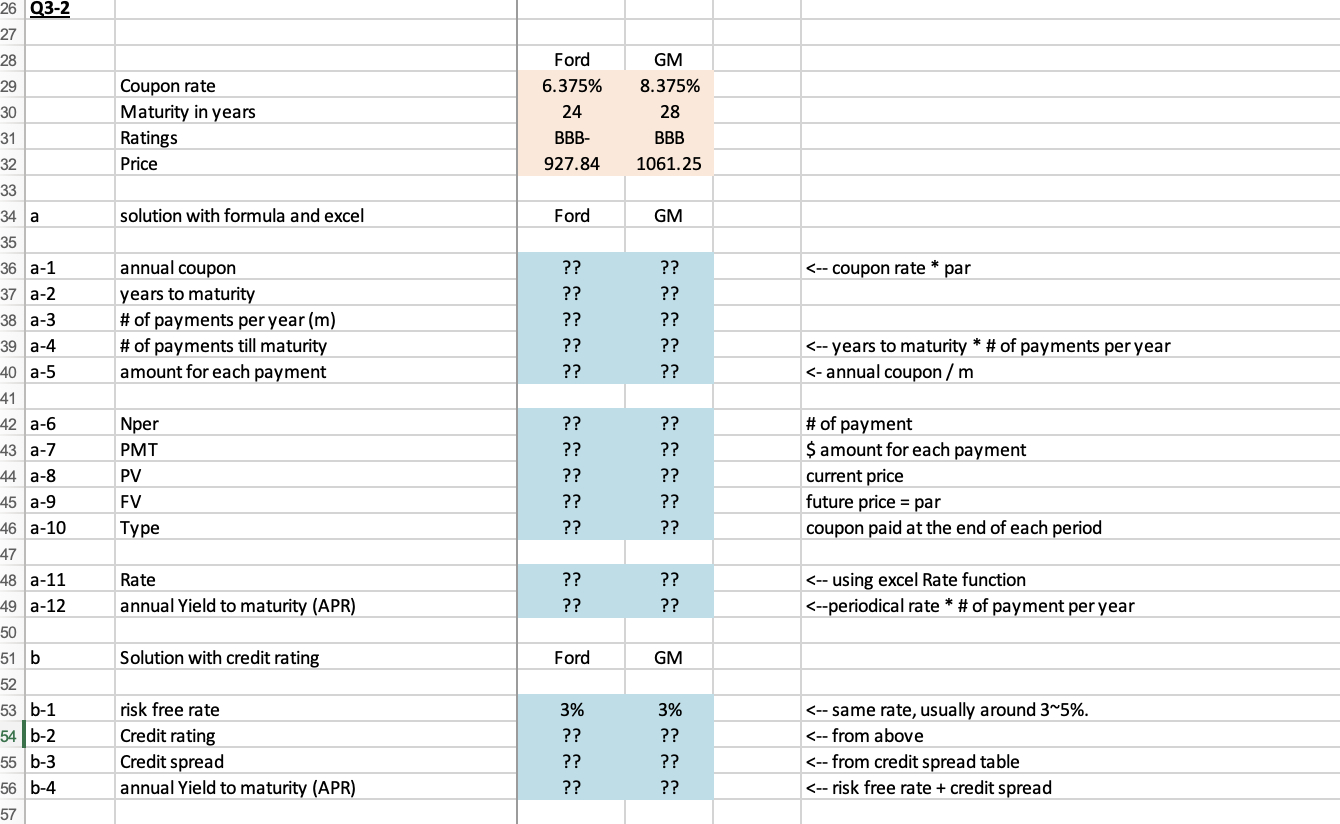

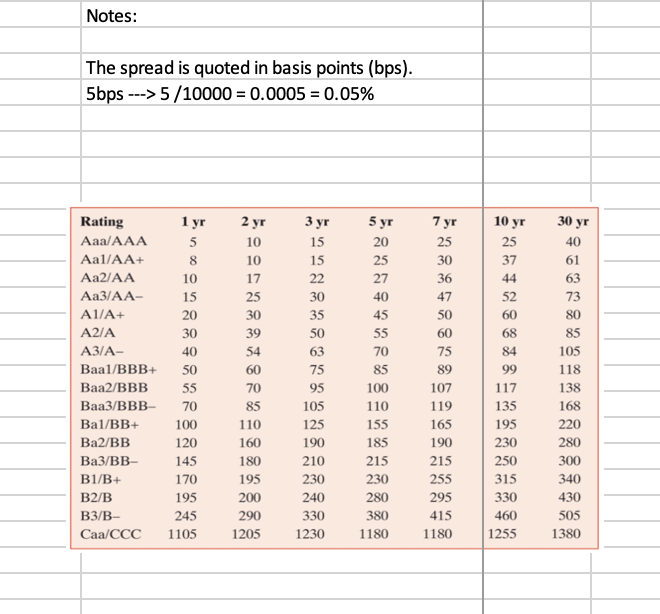

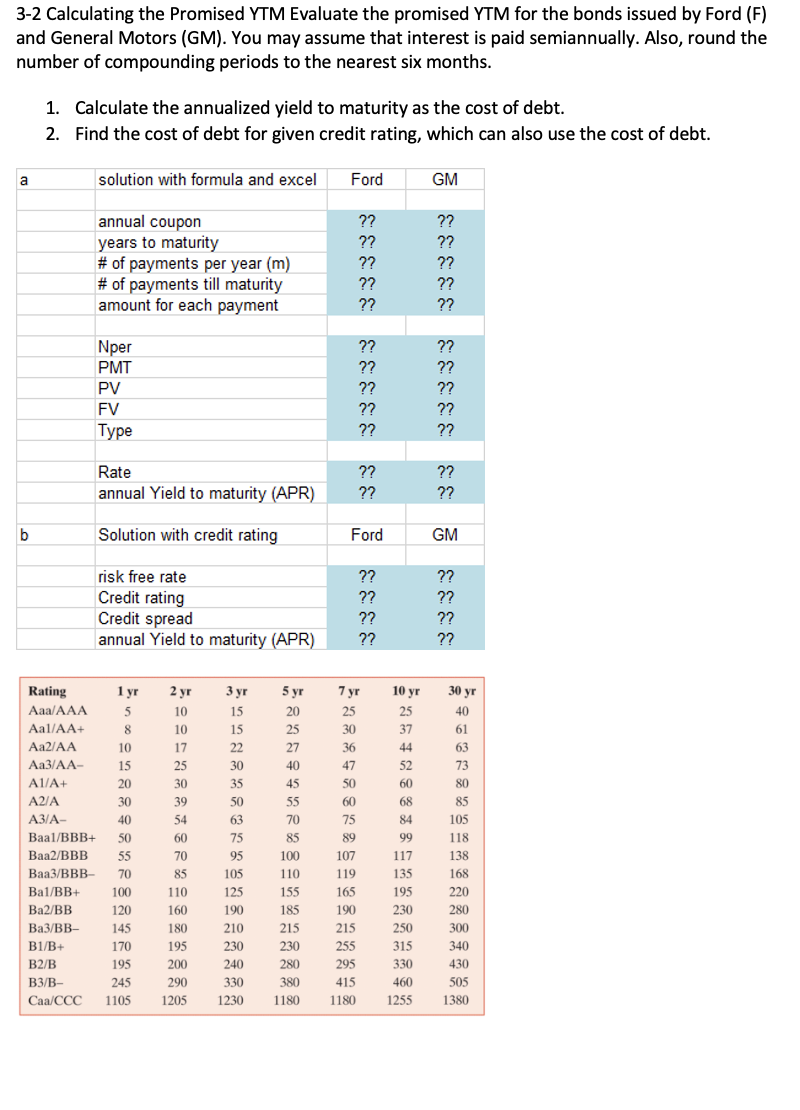

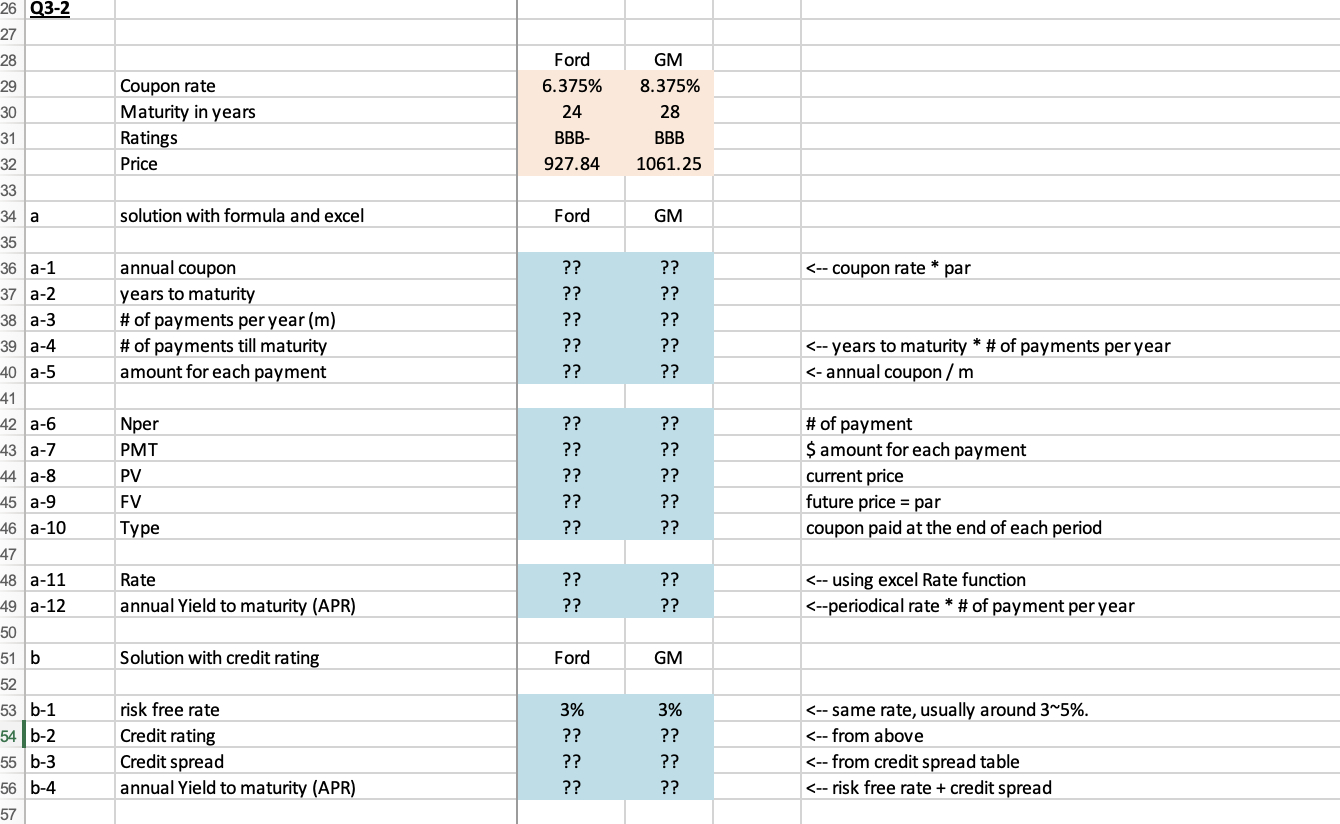

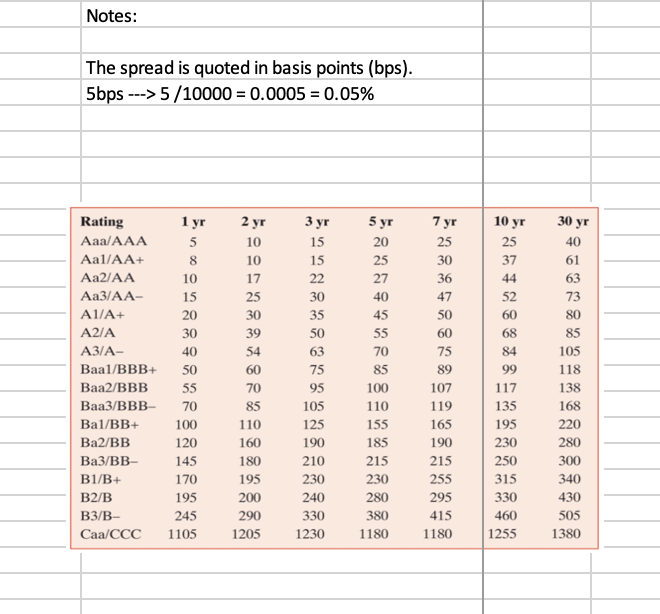

3-2 Calculating the Promised YTM Evaluate the promised YTM for the bonds issued by Ford (F) and General Motors (GM). You may assume that interest is paid semiannually. Also, round the number of compounding periods to the nearest six months. 1. Calculate the annualized yield to maturity as the cost of debt. 2. Find the cost of debt for given credit rating, which can also use the cost of debt. a solution with formula and excel Ford GM annual coupon years to maturity # of payments per year (m) # of payments till maturity amount for each payment ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? Nper PMT PV FV Type ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? Rate annual Yield to maturity (APR) ?? ?? ?? b Solution with credit rating Ford GM risk free rate Credit rating Credit spread annual Yield to maturity (APR) ?? ?? ?? ?? ?? ?? ?? ?? 5 yr 30 yr 2 yr 10 10 17 25 30 39 54 10 yr 25 37 44 52 60 20 25 27 40 45 55 70 1 yr 5 8 10 15 20 30 40 50 55 70 100 120 145 170 68 Rating Aaa/AAA Aal/AA+ Aa2/AA 3/AA- A1/A+ A2/A - Baal/BBB+ Baa2/BBB Baa3/BBB- Bal/BB+ Ba2/BB Ba3/BB B1/B B2/B B3/B- Caa/CCC 60 3 yr 15 15 22 30 35 50 63 75 95 105 125 190 210 230 240 330 1230 7 yr 25 30 36 47 50 60 75 89 107 119 165 190 215 255 295 415 1180 85 100 110 155 185 215 230 280 380 1180 70 85 110 160 180 195 200 290 1205 84 99 117 135 195 230 250 315 330 460 1255 40 61 63 73 80 85 105 118 138 168 220 280 300 340 430 505 1380 195 245 1105 26 93-2 27 28 29 30 31 Coupon rate Maturity in years Ratings Price Ford 6.375% 24 BBB- 927.84 GM 8.375% 28 BBB 1061.25 32 33 34 a solution with formula and excel Ford GM 35 5/10000 = 0.0005 = 0.05% 5 yr 10 yr 20 25 1 yr 5 8 10 15 20 30 40 2 yr 10 10 17 25 30 39 54 27 3 yr 15 15 22 30 35 50 63 40 45 55 70 25 37 44 52 60 68 84 99 117 135 195 230 250 315 50 60 7 yr 25 30 36 47 50 60 75 89 107 119 165 190 215 255 295 75 Rating Aaa/AAA Aal/AA+ Aa2/AA Aa3/AA- A1/A+ A2/A A3/A- Baal/BBB+ Baa2/BBB Baa3/BBB- Ba1/BB+ Ba2/BB Ba3/BB- B1/B+ B2/B B3/B- Caa/CCC 85 30 yr 40 61 63 73 80 85 105 118 138 168 220 280 300 340 430 505 1380 55 70 100 120 145 170 70 85 110 160 180 195 200 290 1205 95 105 125 190 210 230 240 330 1230 100 110 155 185 215 230 280 380 1180 195 330 415 245 1105 460 1255 1180