Answered step by step

Verified Expert Solution

Question

1 Approved Answer

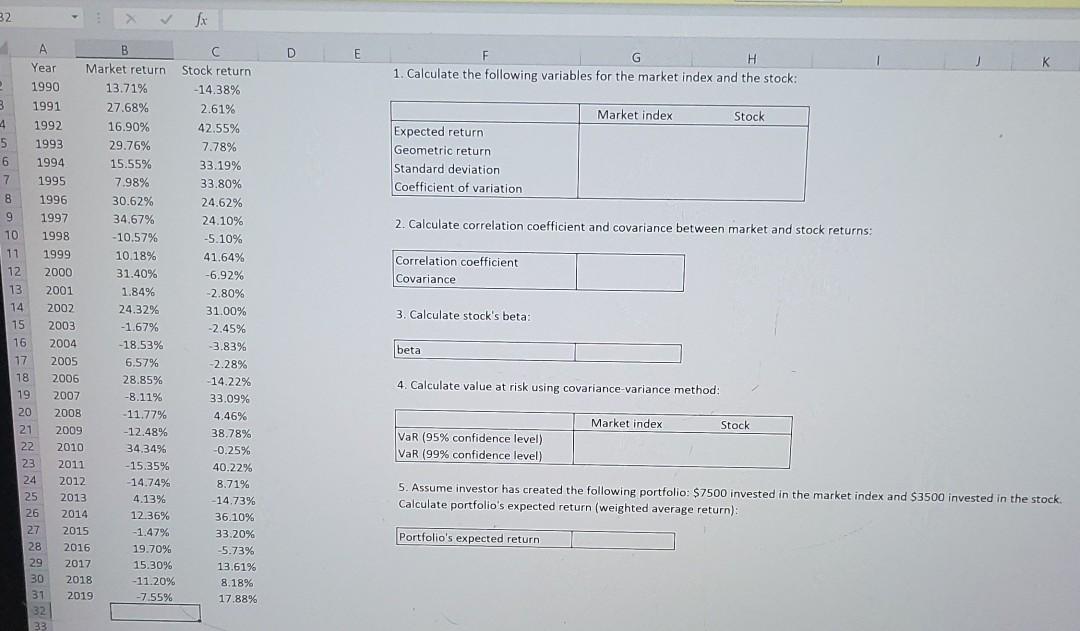

32 fx D E C Stock return -14.38% F G H 1. Calculate the following variables for the market index and the stock: Market index

32 fx D E C Stock return -14.38% F G H 1. Calculate the following variables for the market index and the stock: Market index Stock Expected return Geometric return Standard deviation Coefficient of variation 2. Calculate correlation coefficient and covariance between market and stock returns: Correlation coefficient Covariance 3. Calculate stock's beta: B Year Market return 1990 13.71% 3 1991 27.68% 4 1992 16.90% 5 1993 29.76% 6 6 1994 15.55% 7 1995 7.98% 8 1996 30.62% 9 1997 34.67% 10 1998 -10.57% 11 1999 10.18% 12 2000 31.40% 13 2001 1.84% 14 2002 24.32% 15 2003 -1.67% 16 2004 -18.53% 17 2005 6.57% 18 2006 28.85% 19 2007 -8.11% 20 200B -11.77% 21 2009 -12.48% 22 2010 34.34% 23 2011 -15.35% 24 2012 14.74% 25 2013 4.13% 26 2014 12.36% 27 2015 -1.47% 28 2016 19.70% 29 2017 15.30% 30 2018 - 11.20% 31 2019 -7.55% 32 33 2.61% 42.55% 7.78% 33.19% 33.80% 24.62% 24.10% -5.10% 41.64% -6.92% -2.80% 31.00% -2.45% 3.83% 2.28% 14.22% 33.09% 4.46% 38.78% -0.25% 40.22% 8.71% -14.73% 36.10% 33.20% -5.73% 13.61% 8.18% 17.88% beta 4. Calculate value at risk using covariance-variance method: Market index Stock VaR (95% confidence level) VaR (99% confidence level) 5. Assume investor has created the following portfolio: $7500 invested in the market index and $3500 invested in the stock. Calculate portfolio's expected return (weighted average return) Portfolio's expected return 32 fx D E C Stock return -14.38% F G H 1. Calculate the following variables for the market index and the stock: Market index Stock Expected return Geometric return Standard deviation Coefficient of variation 2. Calculate correlation coefficient and covariance between market and stock returns: Correlation coefficient Covariance 3. Calculate stock's beta: B Year Market return 1990 13.71% 3 1991 27.68% 4 1992 16.90% 5 1993 29.76% 6 6 1994 15.55% 7 1995 7.98% 8 1996 30.62% 9 1997 34.67% 10 1998 -10.57% 11 1999 10.18% 12 2000 31.40% 13 2001 1.84% 14 2002 24.32% 15 2003 -1.67% 16 2004 -18.53% 17 2005 6.57% 18 2006 28.85% 19 2007 -8.11% 20 200B -11.77% 21 2009 -12.48% 22 2010 34.34% 23 2011 -15.35% 24 2012 14.74% 25 2013 4.13% 26 2014 12.36% 27 2015 -1.47% 28 2016 19.70% 29 2017 15.30% 30 2018 - 11.20% 31 2019 -7.55% 32 33 2.61% 42.55% 7.78% 33.19% 33.80% 24.62% 24.10% -5.10% 41.64% -6.92% -2.80% 31.00% -2.45% 3.83% 2.28% 14.22% 33.09% 4.46% 38.78% -0.25% 40.22% 8.71% -14.73% 36.10% 33.20% -5.73% 13.61% 8.18% 17.88% beta 4. Calculate value at risk using covariance-variance method: Market index Stock VaR (95% confidence level) VaR (99% confidence level) 5. Assume investor has created the following portfolio: $7500 invested in the market index and $3500 invested in the stock. Calculate portfolio's expected return (weighted average return) Portfolio's expected return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started