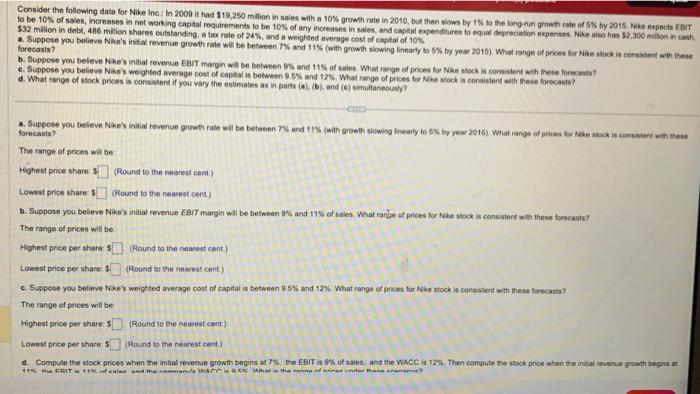

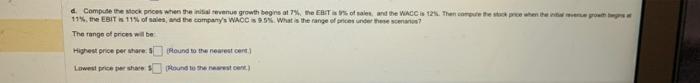

$32 milion in debt, 486 milion shares eutntanding, a tiex rate of 24%, and a weighled average cost af copital of 10% lorecasta 6. Suppose you believe Nikn's weighted average cost of captal is between 9.5% and 12% What range of prices tot N.ie stock is contisient with these forecasts? d. What range of aiock prices is oonsintent if you vary the eatimates as in parts (a). (b) and (c) simultaneously? forecasta? The range of prices will be Highest price share: (Round to the nearest cent.) Lowest price share: 5 (Round to the namst cent.) b. Suppose you believe Nike's initial revenue EBrT margin will be between 9% and 11% of sales. What rarJ. of prices for Nike stock is consistent with these forecasis? The range of prices will be: Highest price per share: 1 (Round to the nearest cent) Lowest price per thare 5 (Round to the nearest cent) c. Suppose you believe Nike's weighiled average cost of capital is between 9.5% and 12K. What range of prices for N Ne stock is consistent with these forecasts? The range of prices will be: Highest price per share:s (Reund to the nearest cent) Lowest pribe per share 5 (Round to the nearest ceni ) 11\%. the EBIT 411% of sales, and the campany's Whoc is 95N. What is the range of pricer unce these ssenanos? The range of erices will be Highest price per share.3 (Rlound to the nearest cert.) Lowest price ter ahace 1 (Hound le the nasest cere) $32 milion in debt, 486 milion shares eutntanding, a tiex rate of 24%, and a weighled average cost af copital of 10% lorecasta 6. Suppose you believe Nikn's weighted average cost of captal is between 9.5% and 12% What range of prices tot N.ie stock is contisient with these forecasts? d. What range of aiock prices is oonsintent if you vary the eatimates as in parts (a). (b) and (c) simultaneously? forecasta? The range of prices will be Highest price share: (Round to the nearest cent.) Lowest price share: 5 (Round to the namst cent.) b. Suppose you believe Nike's initial revenue EBrT margin will be between 9% and 11% of sales. What rarJ. of prices for Nike stock is consistent with these forecasis? The range of prices will be: Highest price per share: 1 (Round to the nearest cent) Lowest price per thare 5 (Round to the nearest cent) c. Suppose you believe Nike's weighiled average cost of capital is between 9.5% and 12K. What range of prices for N Ne stock is consistent with these forecasts? The range of prices will be: Highest price per share:s (Reund to the nearest cent) Lowest pribe per share 5 (Round to the nearest ceni ) 11\%. the EBIT 411% of sales, and the campany's Whoc is 95N. What is the range of pricer unce these ssenanos? The range of erices will be Highest price per share.3 (Rlound to the nearest cert.) Lowest price ter ahace 1 (Hound le the nasest cere)