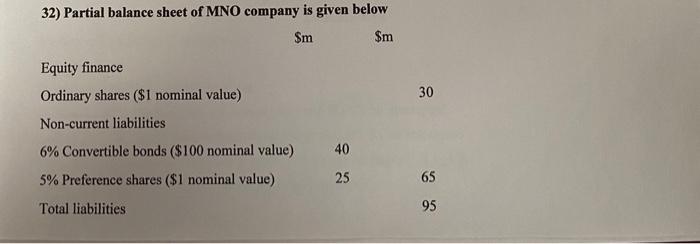

32) Partial balance sheet of MNO company is given below Sm $m Equity finance Ordinary shares ($1 nominal value) Non-current liabilities 6% Convertible bonds

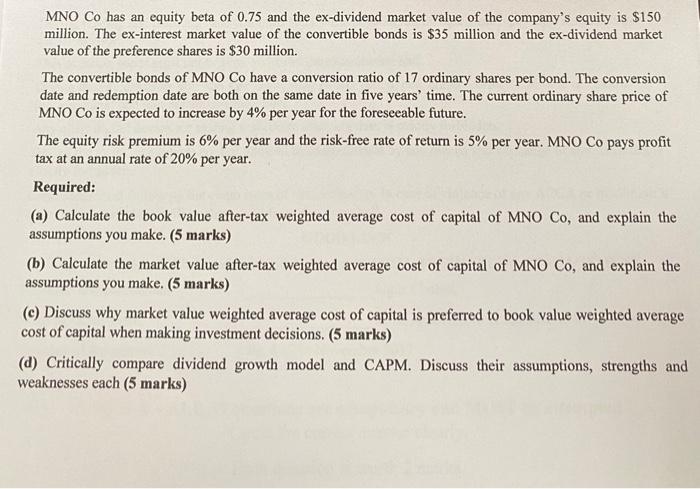

32) Partial balance sheet of MNO company is given below Sm $m Equity finance Ordinary shares ($1 nominal value) Non-current liabilities 6% Convertible bonds ($100 nominal value) 5% Preference shares ($1 nominal value) Total liabilities 40 25 30 65 95 MNO Co has an equity beta of 0.75 and the ex-dividend market value of the company's equity is $150 million. The ex-interest market value of the convertible bonds is $35 million and the ex-dividend market value of the preference shares is $30 million. The convertible bonds of MNO Co have a conversion ratio of 17 ordinary shares per bond. The conversion date and redemption date are both on the same date in five years' time. The current ordinary share price of MNO Co is expected to increase by 4% per year for the foreseeable future. The equity risk premium is 6% per year and the risk-free rate of return is 5% per year. MNO Co pays profit tax at an annual rate of 20% per year. Required: (a) Calculate the book value after-tax weighted average cost of capital of MNO Co, and explain the assumptions you make. (5 marks) (b) Calculate the market value after-tax weighted average cost of capital of MNO Co, and explain the assumptions you make. (5 marks) (e) Discuss why market value weighted average cost of capital is preferred to book value weighted average cost of capital when making investment decisions. (5 marks) (d) Critically compare dividend growth model and CAPM. Discuss their assumptions, strengths and weaknesses each (5 marks)

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a The book value aftertax weighted average cost of capital WACC of MNO Co is calculated as follows Equity Book Value 150 million Convertible Bonds Boo...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started