Answered step by step

Verified Expert Solution

Question

1 Approved Answer

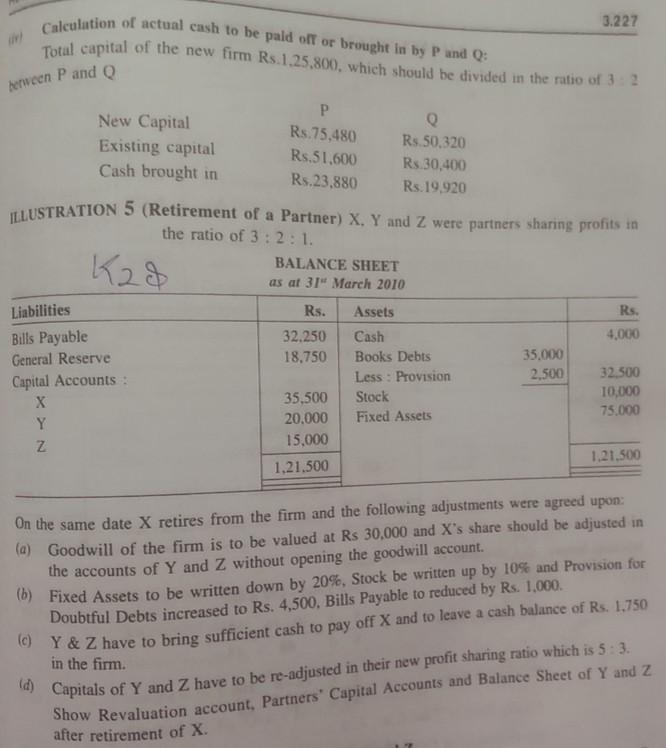

3.227 Calculation of actual cash to be paid off or brought in by P and Q: Total capital of the new firm Rs.1.25.800, which should

3.227 Calculation of actual cash to be paid off or brought in by P and Q: Total capital of the new firm Rs.1.25.800, which should be divided in the ratio of 32 terveen P and P Rs.75,480 Rs.51,600 Rs.23,880 K28 New Capital Q Existing capital Rs. 50,320 Cash brought in Rs.30,400 Rs. 19.920 ILLUSTRATION 5 (Retirement of a Partner) X, Y and Z were partners sharing profits in the ratio of 3: 2:1. BALANCE SHEET as at 31" March 2010 Liabilities Rs. Assets Rs. Bills Payable 32.250 Cash 4,000 General Reserve 18.750 Books Debts 35.000 Less : Provision 2,500 32.500 Capital Accounts 35,500 Stock 10,000 75.000 Y 20.000 Fixed Assets Z 15.000 1.21.500 1.21.500 On the same date X retires from the firm and the following adjustments were agreed upon: (a) Goodwill of the firm is to be valued at Rs 30,000 and X's share should be adjusted in the accounts of Y and Z without opening the goodwill account. (b) Fixed Assets to be written down by 20%, Stock be written up by 10% and Provision for Doubtful Debts increased to Rs. 4,500. Bills Payable to reduced by Rs. 1.000. (0) Y& Z have to bring sufficient cash to pay off X and to leave a cash balance of Rs. 1,750 d) Capitals of Y and Z have to be re-adjusted in their new profit sharing ratio which is 5 : 3. Show Revaluation account, Partners' Capital Accounts and Balance Sheet of Y and Z after retirement of X in the firm

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started