Answered step by step

Verified Expert Solution

Question

1 Approved Answer

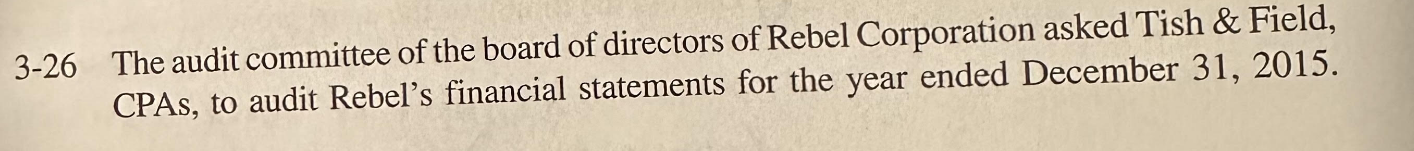

3-26 The audit committee of the board of directors of Rebel Corporation asked Tish & Field, CPAs, to audit Rebel's financial statements for the

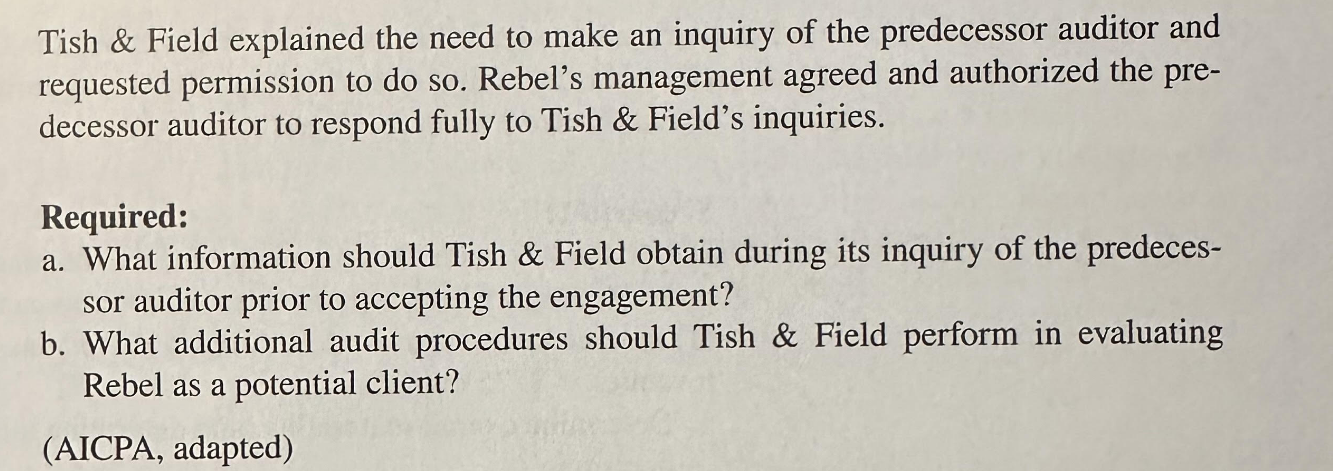

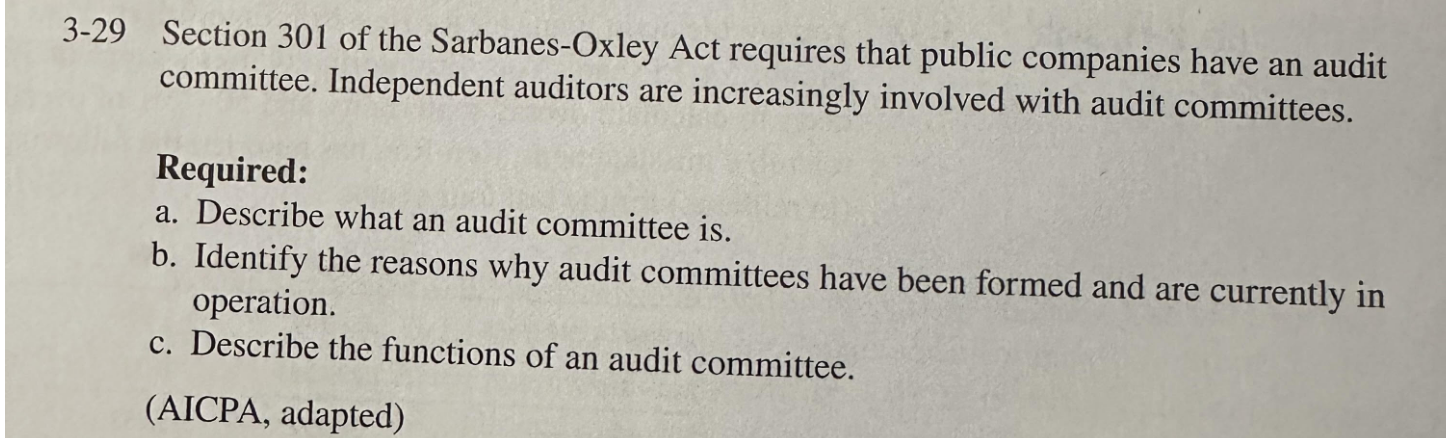

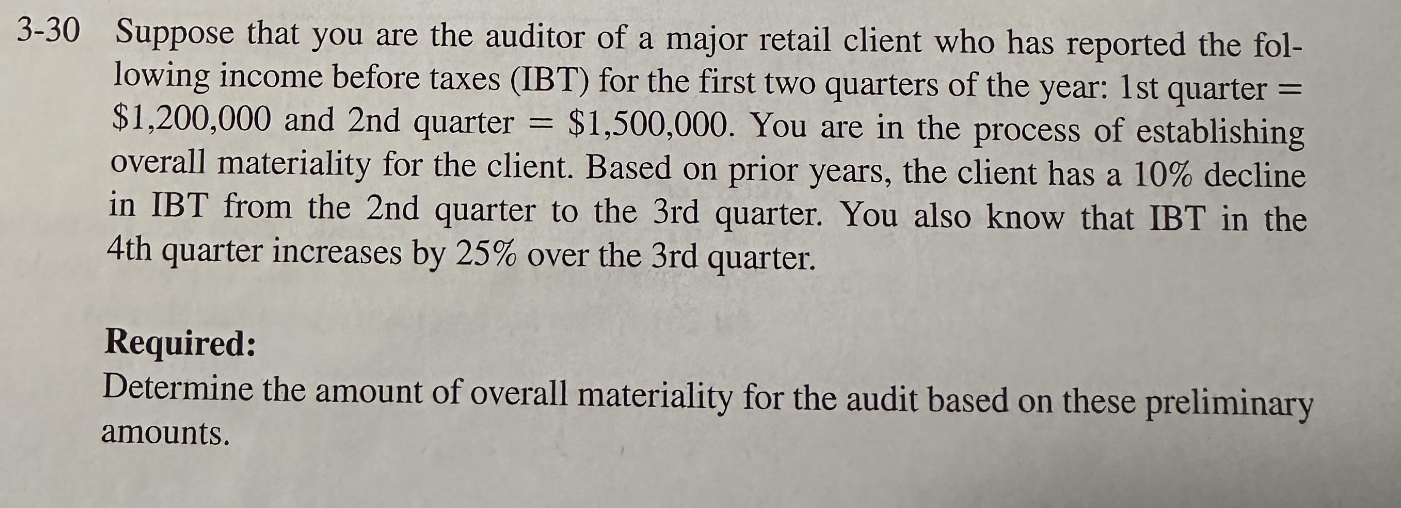

3-26 The audit committee of the board of directors of Rebel Corporation asked Tish & Field, CPAs, to audit Rebel's financial statements for the year ended December 31, 2015. Tish & Field explained the need to make an inquiry of the predecessor auditor and requested permission to do so. Rebel's management agreed and authorized the pre- decessor auditor to respond fully to Tish & Field's inquiries. Required: a. What information should Tish & Field obtain during its inquiry of the predeces- sor auditor prior to accepting the engagement? b. What additional audit procedures should Tish & Field perform in evaluating Rebel as a potential client? (AICPA, adapted) 3-29 Section 301 of the Sarbanes-Oxley Act requires that public companies have an audit committee. Independent auditors are increasingly involved with audit committees. Required: a. Describe what an audit committee is. b. Identify the reasons why audit committees have been formed and are currently in operation. c. Describe the functions of an audit committee. (AICPA, adapted) = 3-30 Suppose that you are the auditor of a major retail client who has reported the fol- lowing income before taxes (IBT) for the first two quarters of the year: 1st quarter = $1,200,000 and 2nd quarter $1,500,000. You are in the process of establishing overall materiality for the client. Based on prior years, the client has a 10% decline in IBT from the 2nd quarter to the 3rd quarter. You also know that IBT in the 4th quarter increases by 25% over the 3rd quarter. Required: Determine the amount of overall materiality for the audit based on these preliminary amounts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started