Answered step by step

Verified Expert Solution

Question

1 Approved Answer

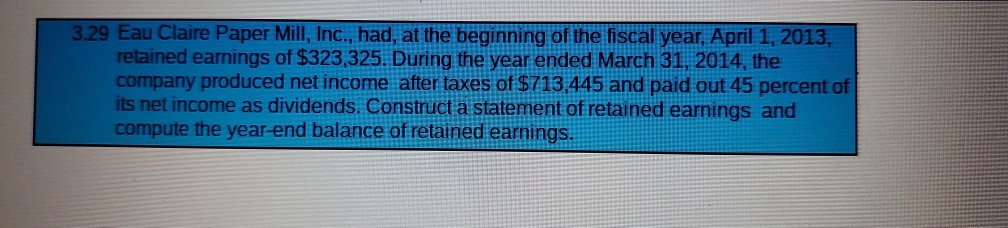

3.29 Eau Claire Paper Mill, Inc., had, at the beginning of the fiscal year, April 1, 2013, retained earnings of $323,325. During the year ended

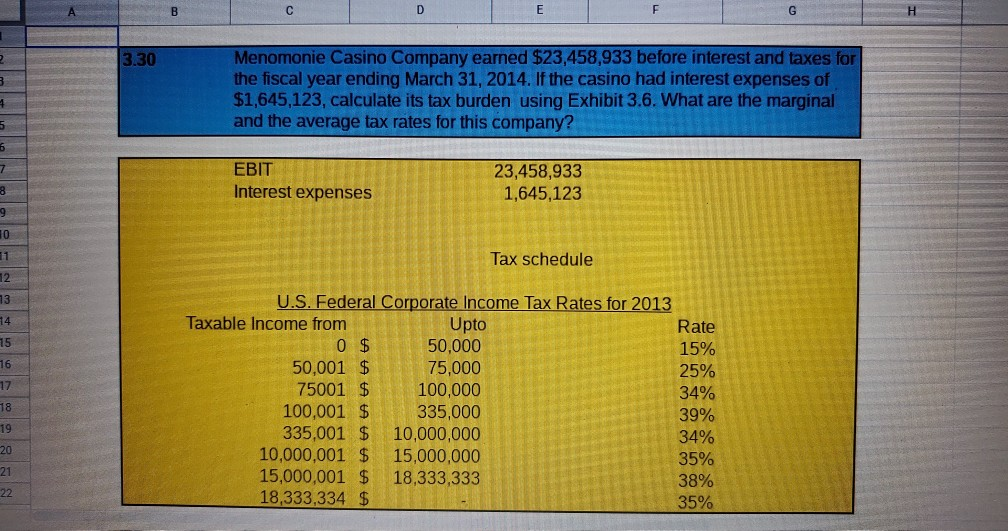

3.29 Eau Claire Paper Mill, Inc., had, at the beginning of the fiscal year, April 1, 2013, retained earnings of $323,325. During the year ended March 31, 2014, the company produced net income after taxes of $713,445 and paid out 45 percent of its net income as dividends. Construct a statement of retained earnings and compute the year-end balance of retained earnings. B D G H 13.30 Menomonie Casino Company earned $23,458,933 before interest and taxes for the fiscal year ending March 31, 2014. If the casino had interest expenses of $1,645,123, calculate its tax burden using Exhibit 3.6. What are the marginal and the average tax rates for this company? + 5 6 7 8 9 EBIT Interest expenses 23,458,933 1,645,123 10 11 12 Tax schedule 13 14 15 16 17 18 19 U.S. Federal Corporate Income Tax Rates for 2013 Taxable income from Upto Rate 0 $ 50,000 15% 50,001 $ 75,000 25% 75001 $ 100,000 34% 100,001 $ 335,000 39% 335,001 $ 10,000,000 34% 10,000,001 $ 15,000,000 35% 15,000,001 $ 18,333,333 38% 18,333,334 $ 35% 20 21 22

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started