Answered step by step

Verified Expert Solution

Question

1 Approved Answer

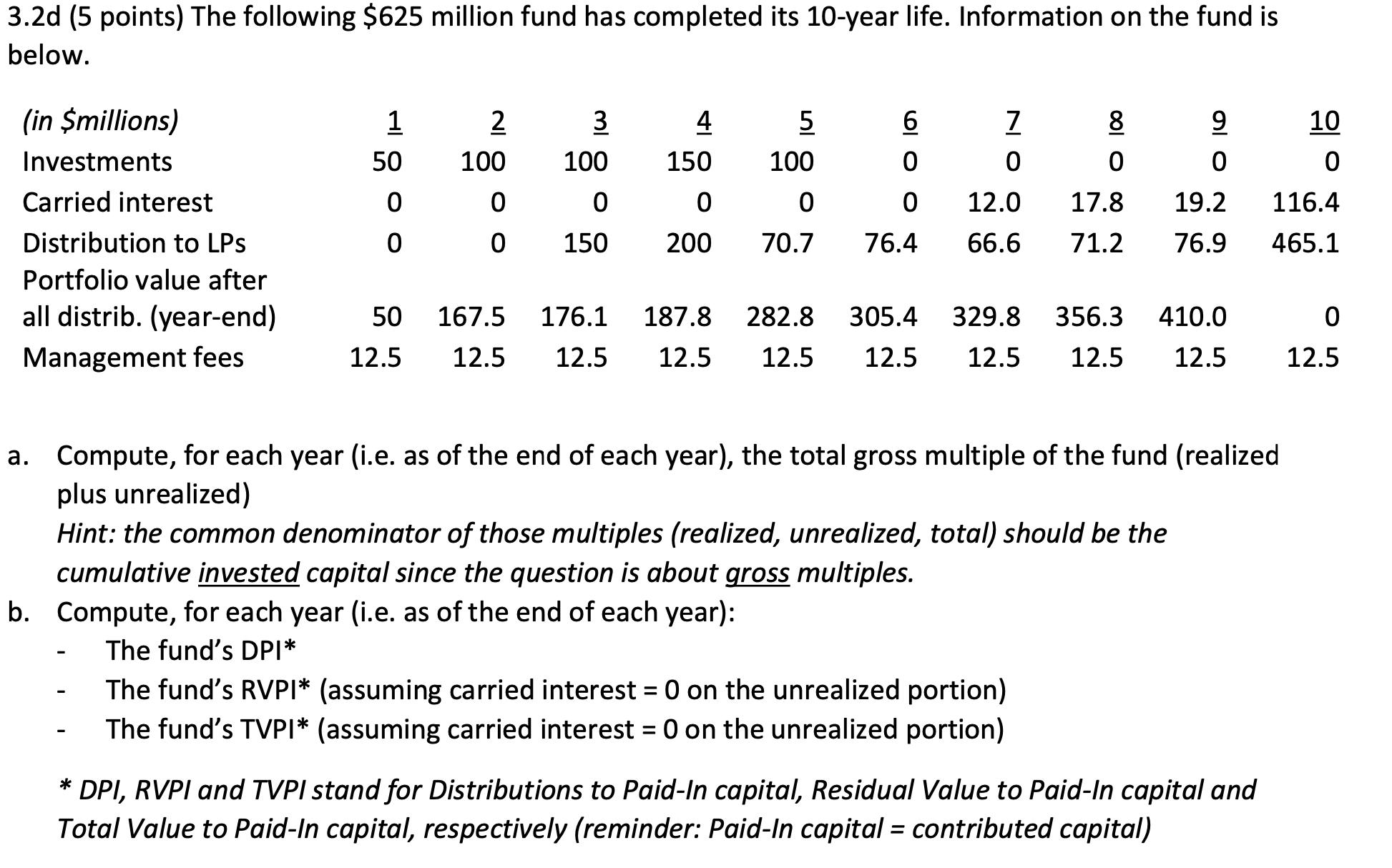

3.2d (5 points) The following $625 million fund has completed its 10-year life. Information on the fund is below. (in $millions) Investments Carried interest

3.2d (5 points) The following $625 million fund has completed its 10-year life. Information on the fund is below. (in $millions) Investments Carried interest Distribution to LPs Portfolio value after all distrib. (year-end) Management fees 1 50 0 0 3 100 100 0 0 0 150 2 IN 4 150 0 200 5 100 0 70.7 6 0 0 76.4 7 0 8 0 9 0 12.0 17.8 19.2 66.6 71.2 76.9 The fund's RVPI* (assuming carried interest = 0 on the unrealized portion) The fund's TVPI* (assuming carried interest = 0 on the unrealized portion) 176.1 187.8 282.8 305.4 329.8 356.3 410.0 0 50 167.5 12.5 12.5 12.5 12.5 12.5 12.5 12.5 12.5 12.5 12.5 a. Compute, for each year (i.e. as of the end of each year), the total gross multiple of the fund (realized plus unrealized) Hint: the common denominator of those multiples (realized, unrealized, total) should be the cumulative invested capital since the question is about gross multiples. b. Compute, for each year (i.e. as of the end of each year): The fund's DPI* 10 0 116.4 465.1 * DPI, RVPI and TVPI stand for Distributions to Paid-In capital, Residual Value to Paid-In capital and Total Value to Paid-In capital, respectively (reminder: Paid-In capital = contributed capital)

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a To compute the total gross multiple of the fund for each year we need to calculate the ratio of the portfolio value after all distributions yearend to the cumulative invested capital The cumulative ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started