Answered step by step

Verified Expert Solution

Question

1 Approved Answer

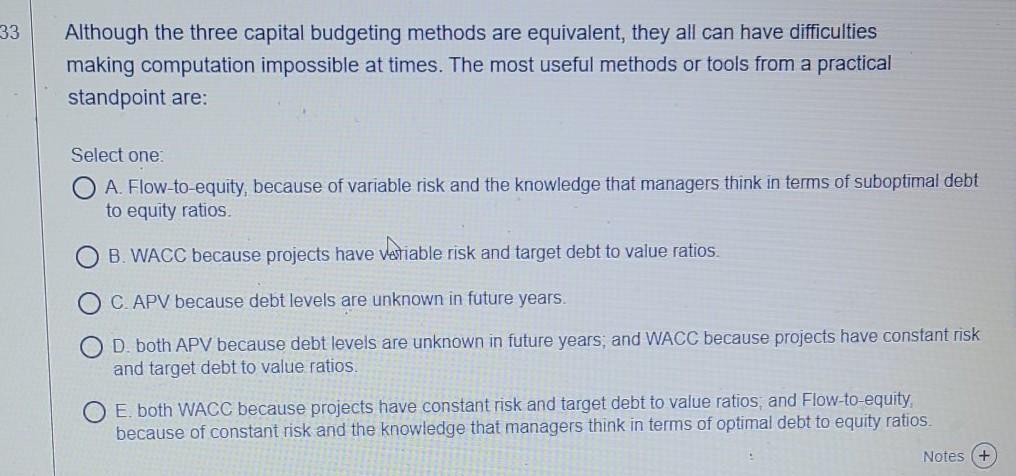

33 Although the three capital budgeting methods are equivalent, they all can have difficulties making computation impossible at times. The most useful methods or tools

33 Although the three capital budgeting methods are equivalent, they all can have difficulties making computation impossible at times. The most useful methods or tools from a practical standpoint are: Select one: O A. Flow-to-equity, because of variable risk and the knowledge that managers think in terms of suboptimal debt to equity ratios. B. WACC because projects have variable risk and target debt to value ratios. CAPV because debt levels are unknown in future years. D. both APV because debt levels are unknown in future years, and WACC because projects have constant risk and target debt to value ratios. E both WACC because projects have constant risk and target debt to value ratios, and Flow-to-equity, because of constant risk and the knowledge that managers think in terms of optimal debt to equity ratios. Notes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started