Answered step by step

Verified Expert Solution

Question

1 Approved Answer

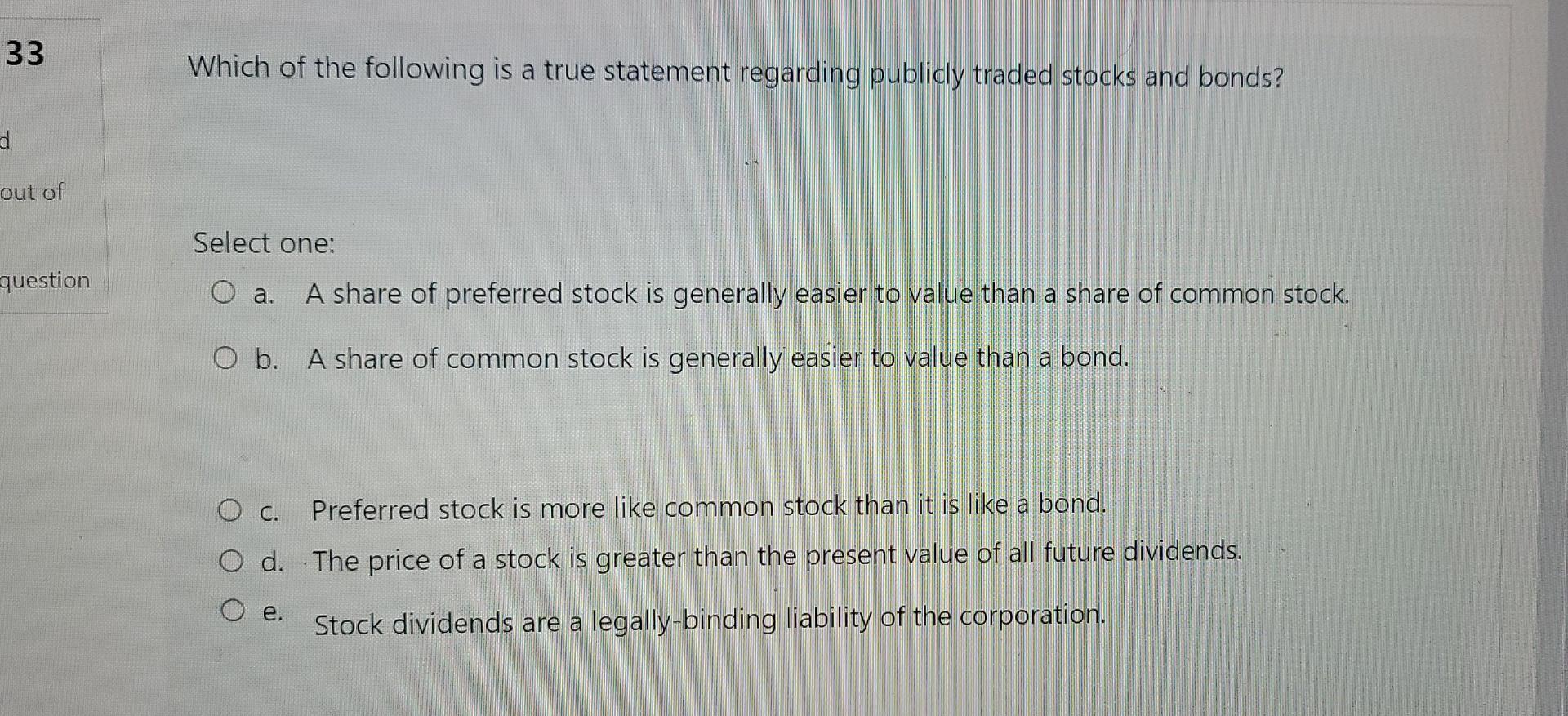

33 d out of question Which of the following is a true statement regarding publicly traded stocks and bonds? Select one: O a. A share

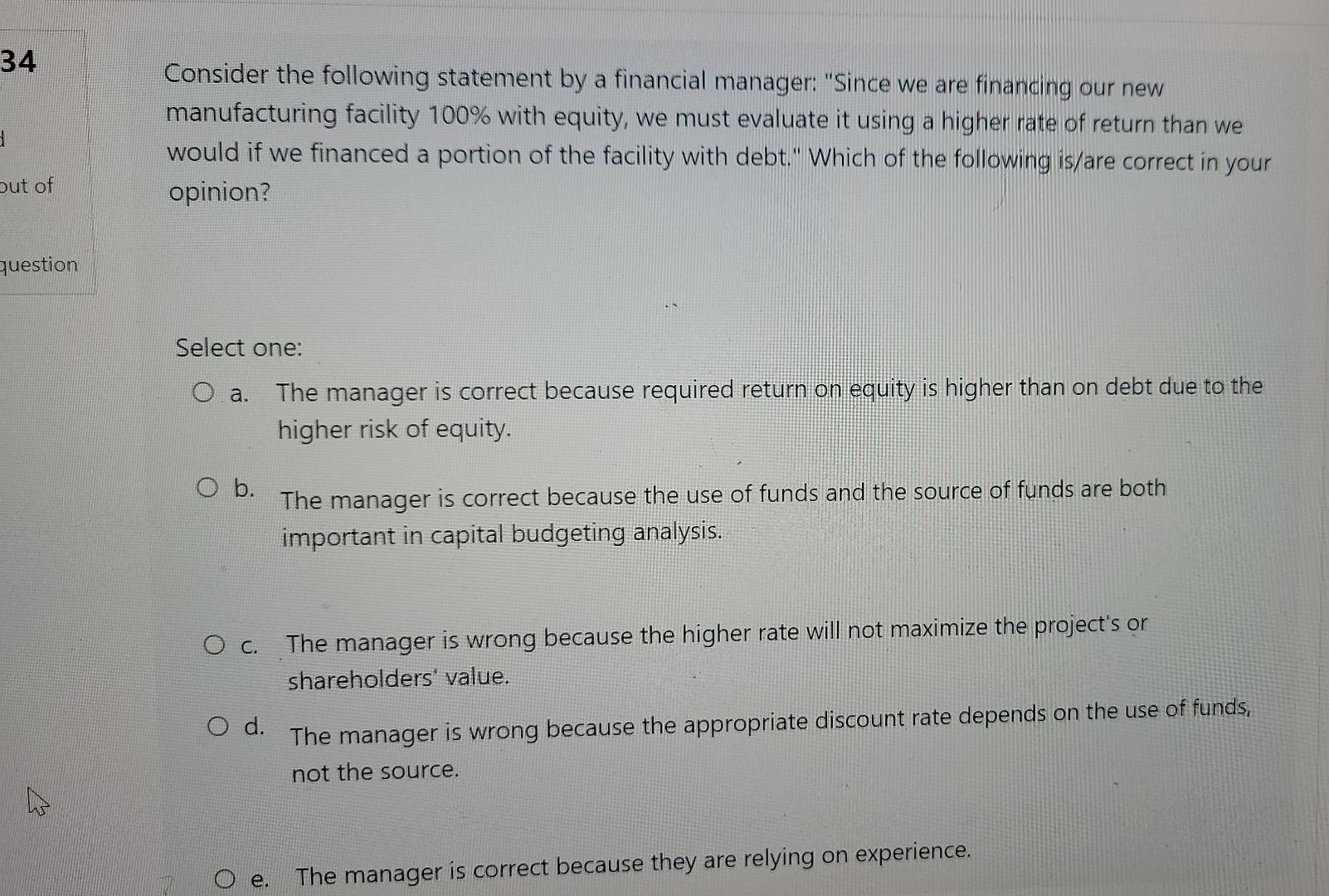

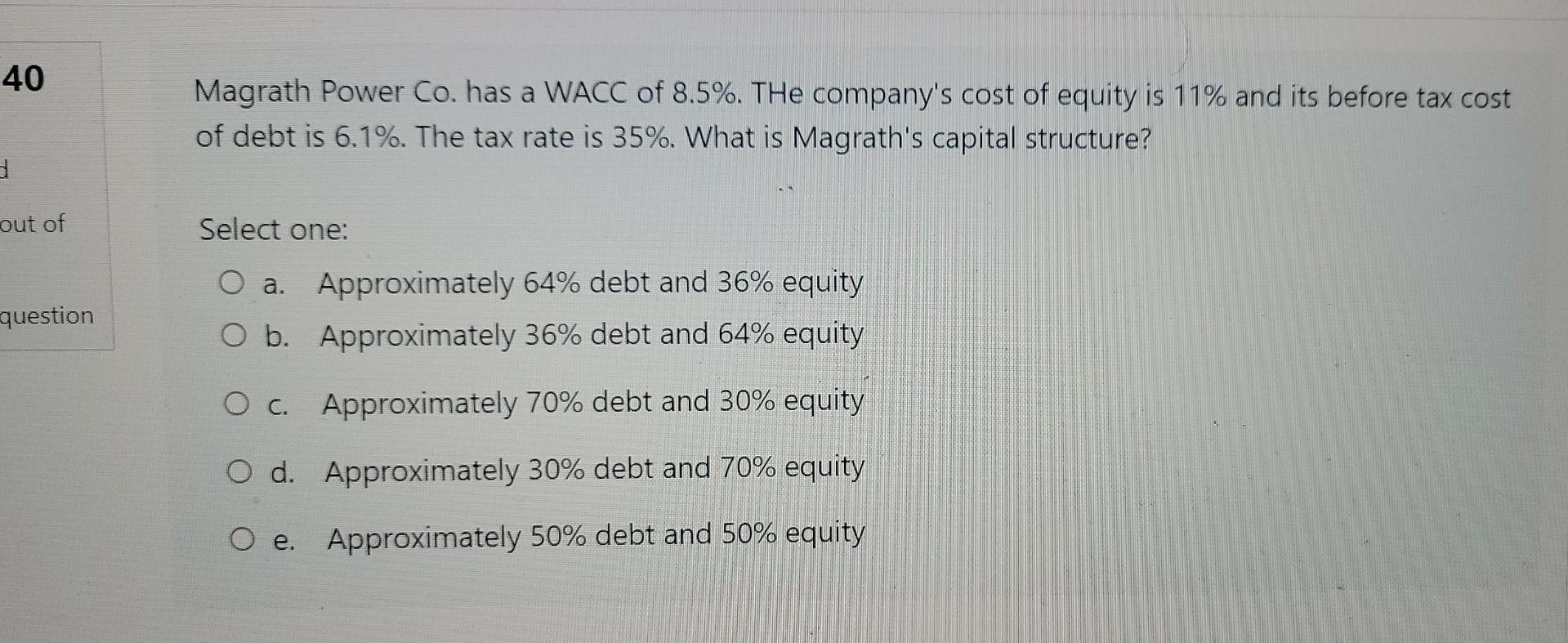

33 d out of question Which of the following is a true statement regarding publicly traded stocks and bonds? Select one: O a. A share of preferred stock is generally easier to value than a share of common stock. O b. A share of common stock is generally easier to value than a bond. C. Preferred stock is more like common stock than it is like a bond. O d. The price of a stock is greater than the present value of all future dividends. O e. Stock dividends are a legally-binding liability of the corporation. 34 3 Out of question Consider the following statement by a financial manager: "Since we are financing our new manufacturing facility 100% with equity, we must evaluate it using a higher rate of return than we would if we financed a portion of the facility with debt." Which of the following is/are correct in your opinion? Select one: O.a. The manager is correct because required return on equity is higher than on debt due to the higher risk of equity. O b. The manager is correct because the use of funds and the source of funds are both important in capital budgeting analysis. O C. The manager is wrong because the higher rate will not maximize the project's or shareholders' value. O d. The manager is wrong because the appropriate discount rate depends on the use of funds, not the source. The manager is correct because they are relying on experience. 40 3 out of question Magrath Power Co. has a WACC of 8.5%. THe company's cost of equity is 11% and its before tax cost of debt is 6.1%. The tax rate is 35%. What is Magrath's capital structure? Select one: O a. Approximately 64% debt and 36% equity O b. Approximately 36% debt and 64% equity O c. Approximately 70% debt and 30% equity O d. Approximately 30% debt and 70% equity O e. Approximately 50% debt and 50% equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started