Answered step by step

Verified Expert Solution

Question

1 Approved Answer

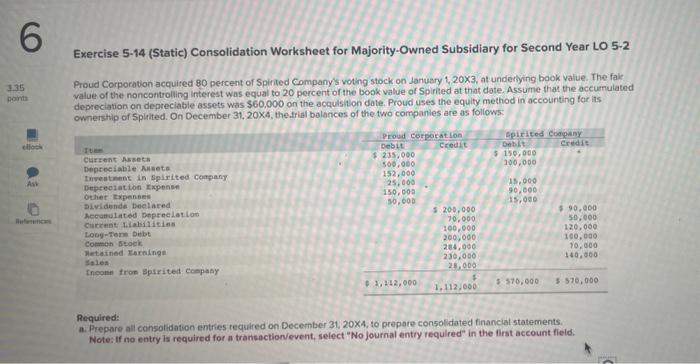

3.35 6 points Exercise 5-14 (Static) Consolidation Worksheet for Majority-Owned Subsidiary for Second Year LO 5-2 Proud Corporation acquired 80 percent of Spirited Company's

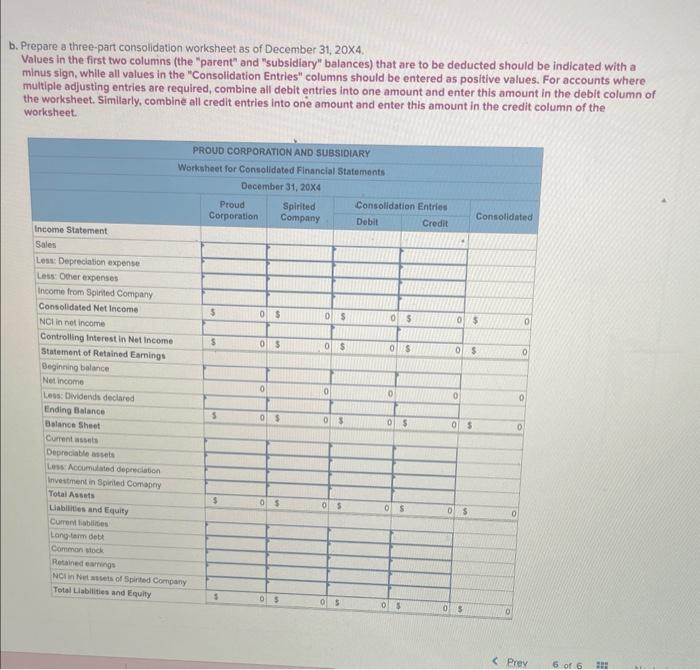

3.35 6 points Exercise 5-14 (Static) Consolidation Worksheet for Majority-Owned Subsidiary for Second Year LO 5-2 Proud Corporation acquired 80 percent of Spirited Company's voting stock on January 1, 20X3, at underlying book value. The fair value of the noncontrolling interest was equal to 20 percent of the book value of Spirited at that date. Assume that the accumulated depreciation on depreciable assets was $60,000 on the acquisition date. Proud uses the equity method in accounting for its ownership of Spirited. On December 31, 20X4, the trial balances of the two companies are as follows: ellock Item Current Assets Ask References Depreciable Assets Investment in Spirited Company Depreciation Expense Other Expenses Dividends Declared Accumulated Depreciation Current Liabilities Long-Term Debt Common Stock Retained Earnings Sales Income from Spirited Company Required: Proud Corporation Debit Credit $235,000 500,000 152,000 Spirited Company Debit $150,000 100,000 Credit 25,000 150,000 50,000 15,000 90,000 15,000 $ 200,000 $ 90,000 70,000 50,000 100,000 120,000 200,000 100,000 284,000 10,000 230,000 140,000 28,000 4 $1,112,000 $570,000 $570,000 1,112,000 a. Prepare all consolidation entries required on December 31, 20X4, to prepare consolidated financial statements. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. b. Prepare a three-part consolidation worksheet as of December 31, 20X4. Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet. Income Statement Sales Less: Depreciation expense Less: Other expenses PROUD CORPORATION AND SUBSIDIARY Worksheet for Consolidated Financial Statements December 31, 20X4 Proud Corporation Spirited Company Consolidation Entries Consolidated Debit Credit Income from Spirited Company Consolidated Net Income $ 0 $ 0 $ 0 $ 0 $ 0 NCI in net income Controlling Interest in Net Income $ 0 $ 0 $ 0 $ 0 $ Statement of Retained Earnings Beginning balance Net income 0 0 0 0 Less: Dividends declared Ending Balance $ 0 $ 0 $ 0 $ 0 $ 0 Balance Sheet Current assets Depreciable assets Less: Accumulated depreciation Investment in Spirited Comapny Total Assets $ 0 $ 05 0 $ 0 $ 0 Liabilities and Equity Current liabilities Long-term debt Common stock Retained earnings NCI in Net assets of Spirited Company Total Liabilities and Equity $ 0 $ 05 0 $ 05 0 < Prev 6 of 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started