Answered step by step

Verified Expert Solution

Question

1 Approved Answer

33.C.2 Expansion Ltd is a well-known brand in the country looking forward to diversify its product portfolio by acquiring another firm in the same

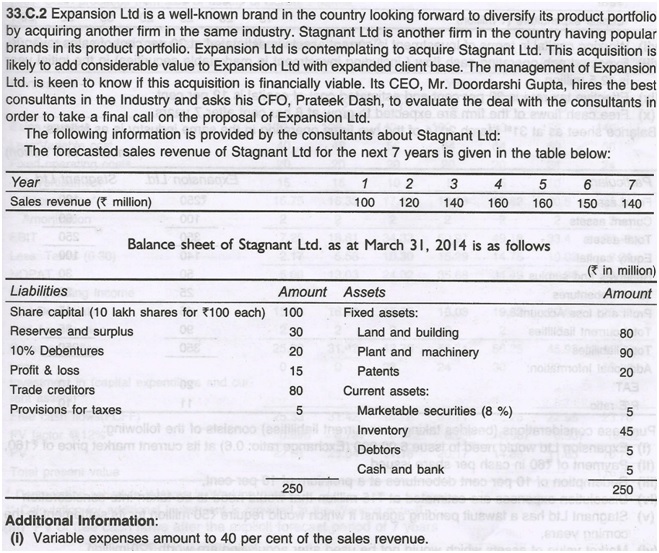

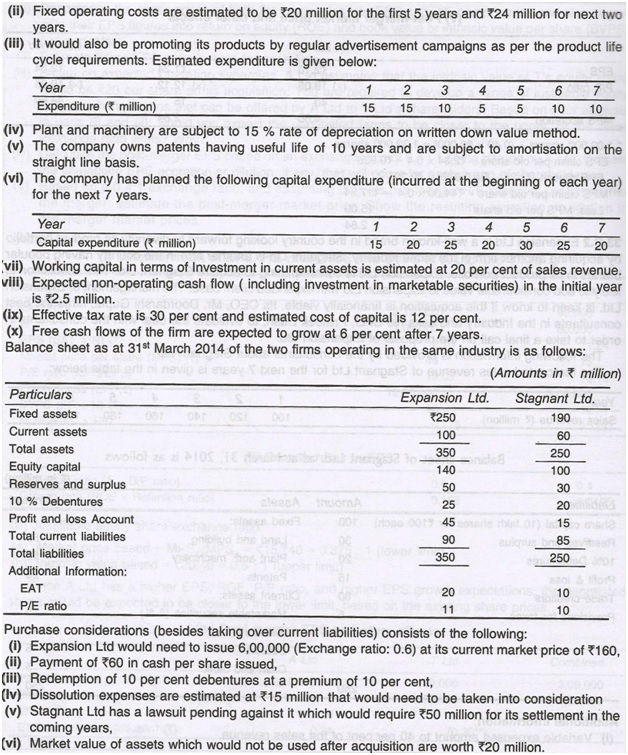

33.C.2 Expansion Ltd is a well-known brand in the country looking forward to diversify its product portfolio by acquiring another firm in the same industry. Stagnant Ltd is another firm in the country having popular brands in its product portfolio. Expansion Ltd is contemplating to acquire Stagnant Ltd. This acquisition is likely to add considerable value to Expansion Ltd with expanded client base. The management of Expansion Ltd. is keen to know if this acquisition is financially viable. Its CEO, Mr. Doordarshi Gupta, hires the best consultants in the Industry and asks his CFO, Prateek Dash, to evaluate the deal with the consultants in order to take a final call on the proposal of Expansion Ltd. The following information is provided by the consultants about Stagnant Ltd: The forecasted sales revenue of Stagnant Ltd for the next 7 years is given in the table below: Year Sales revenue ( million) Liabilities Share capital (10 lakh shares for 100 each) Reserves and surplus 10% Debentures Profit & loss Trade creditors Provisions for taxes Amount 100 30 20 15 80 priwollot erlito elelenco (esillid ham themuo ali is (9.0 cost opr 1 100 Balance sheet of Stagnant Ltd. as at March 31, 2014 is as follows 250 2 120 Assets Fixed assets: 3 140 Land and building Plant and machinery Patents Current assets: 4 160 Additional Information: (i) Variable expenses amount to 40 per cent of the sales revenue. Marketable securities (8 %) Inventory Debtors Cash and bank 5 160 6 7 150 140 (in million) Amount 8007 90 20 bA 5555 etabiano 45 5 250 Inanpal2 (v) encev pnimoo (ii) Fixed operating costs are estimated to be 20 million for the first 5 years and 24 million for next two years. (iii) It would also be promoting its products by regular advertisement campaigns as per the product life cycle requirements. Estimated expenditure is given below: Year Expenditure (R million) (iv) Plant and machinery are subject to 15 % rate of depreciation on written down value method. (v) The company owns patents having useful life of 10 years and are subject to amortisation on the straight line basis. Year Capital expenditure (3 million) (vi) The company has planned the following capital expenditure (incurred at the beginning of each year) for the next 7 years. Particulars Fixed assets Current assets Total assets Equity capital Reserves and surplus 10% Debentures Profit and loss Account Total current liabilities Total liabilities 1 2 3 15 15 10 OSI zwollol as a P10S E Additional Information: EAT P/E ratio vii) Working capital in terms of Investment in current assets is estimated at 20 per cent of sales revenue. viii) Expected non-operating cash flow (including investment in marketable securities) in the initial year is *2.5 million. Innsbrood (ix) Effective tax rate is 30 per cent and estimated cost of capital is 12 per cent. (x) Free cash flows of the firm are expected to grow at 6 per cent after 7 years. Balance sheet as at 31st March 2014 of the two firms operating in the same industry is as follows: erli ot bij trsnips12 (Amounts in million) 1 15 cleaca inuomA COT bra 4 5 6 7 5 5 10 10 2 3 4 5 6 20 25 20 30 en 25 Expansion Ltd. 250 100 350 140 50 25 20 11 (nolllim 3.0190 oncle8 Stagnant Ltd. (roso 0017 45 are hist 90 350 7 20 60 250 100 30 20 15 aulquue br85 250 230l 10 10 Purchase considerations (besides taking over current liabilities) consists of the following: (i) Expansion Ltd would need to issue 6,00,000 (Exchange ratio: 0.6) at its current market price of 160, (ii) Payment of 360 in cash per share issued, (iii) Redemption of 10 per cent debentures at a premium of 10 per cent, (lv) Dissolution expenses are estimated at 15 million that would need to be taken into consideration (v) Stagnant Ltd has a lawsuit pending against it which would require 50 million for its settlement in the coming years, Ob of Inilan (vi) Market value of assets which would not be used after acquisition are worth 720 million.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided information here is a breakdown of the financial details for Stagnant Ltd 1 Fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started