Answered step by step

Verified Expert Solution

Question

1 Approved Answer

34 35 36 37 38 39 40 40 A 41 42 43 43 44 45 46 47 48 49 50 51 52 53 SA

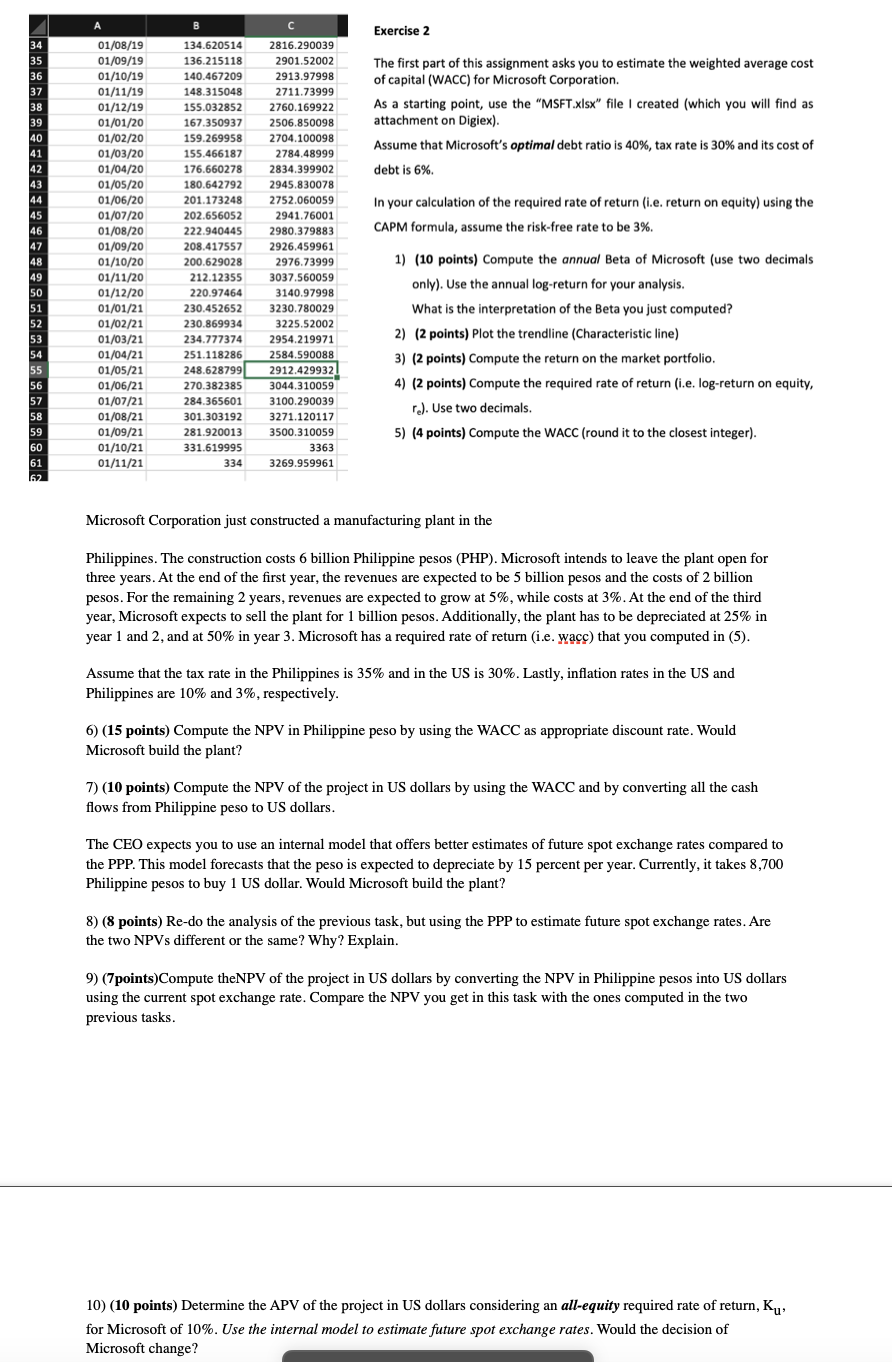

34 35 36 37 38 39 40 40 A 41 42 43 43 44 45 46 47 48 49 50 51 52 53 SA 54 EE 55 56 57 58 59 60 61 62 A 01/08/19 01/09/19 01/10/19 01/11/19 01/12/19 01/01/20 01/02/20 01/02/20 01/02/20 01/03/20 01/04/20 01/04/20 01/05/20 01/06/20 01/07/20 01/08/20 01/09/20 01/10/20 CATATAN 01/11/20 et habe 01/12/20 01/01/21 6103.61 01/02/21 ***** 01/03/21 men 01/04/21 01/05/21 01/06/21 01/07/21 01/08/21 01/09/21 01/10/21 01/11/21 B 134.620514 2816.290039 136.215118 140.467209 2901.52002 2913.97998 148.315048 2711.73999 155.032852 2760.169922 2506.850098 167.350937 $50 360058 159.269958 155.466187 176.660278 180.642792 201.173248 202.656052 222.940445 222:340443 208.417557 EVONATOS 200.629028 EWIVERVED 212.12355 414:44333 220.97464 230.452652 2976.73999 370:19999 3037.560059 ********** 3140.97998 230.869934 3230.780029 3225.52002 2954.219971 2584.590088 248.628799 2912.429932 234.777374 251.118286 270.382385 3044.310050 284.365601 301.303192 281.920013 331.619995 2704 100008 2704.100098 334 2784.48999 2834.399902 2945.830078 2752.060059 2941.76001 2980.379883 300:973009 2926.459961 wwwwwwwww 3100.290039 3271.120117 3500.310059 3363 3269.959961 Exercise 2 The first part of this assignment asks you to estimate the weighted average cost of capital (WACC) for Microsoft Corporation. As a starting point, use the "MSFT.xlsx" file I created (which you will find as attachment on Digiex). Assume that Microsoft's optimal debt ratio is 40%, tax rate is 30% and its cost of debt is 6%. In your calculation of the required rate of return (i.e. return on equity) using the CAPM formula, assume the risk-free rate to be 3%. 1) (10 points) Compute the annual Beta of Microsoft (use two decimals only). Use the annual log-return for your analysis. What is the interpretation of the Beta you just computed? 2) (2 points) Plot the trendline (Characteristic line) 3) (2 points) Compute the return on the market portfolio. 4) (2 points) Compute the required rate of return (i.e. log-return on equity, re). Use two decimals. 5) (4 points) Compute the WACC (round it to the closest integer). Microsoft Corporation just constructed a manufacturing plant in the Philippines. The construction costs 6 billion Philippine pesos (PHP). Microsoft intends to leave the plant open for three years. At the end of the first year, the revenues are expected to be 5 billion pesos and the costs of 2 billion pesos. For the remaining 2 years, revenues are expected to grow at 5%, while costs at 3%. At the end of the third year, Microsoft expects to sell the plant for 1 billion pesos. Additionally, the plant has to be depreciated at 25% in year 1 and 2, and at 50% in year 3. Microsoft has a required rate of return (i.e. wacc) that you computed in (5). Assume that the tax rate in the Philippines is 35% and in the US is 30%. Lastly, inflation rates in the US and Philippines are 10% and 3%, respectively. 6) (15 points) Compute the NPV in Philippine peso by using the WACC as appropriate discount rate. Would Microsoft build the plant? 7) (10 points) Compute the NPV of the project in US dollars by using the WACC and by converting all the cash flows from Philippine peso to US dollars. The CEO expects you to use an internal model that offers better estimates of future spot exchange rates compared to the PPP. This model forecasts that the peso is expected to depreciate by 15 percent per year. Currently, it takes 8,700 Philippine pesos to buy 1 US dollar. Would Microsoft build the plant? 8) (8 points) Re-do the analysis of the previous task, but using the PPP to estimate future spot exchange rates. Are the two NPVs different or the same? Why? Explain. 9) (7points)Compute theNPV of the project in US dollars by converting the NPV in Philippine pesos into US dollars using the current spot exchange rate. Compare the NPV you get in this task with the ones computed in the two previous tasks. 10) (10 points) Determine the APV of the project in US dollars considering an all-equity required rate of return, Ku, for Microsoft of 10%. Use the internal model to estimate future spot exchange rates. Would the decision of Microsoft change?

Step by Step Solution

★★★★★

3.47 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 The annual Beta of Microsoft Corporation is 084 Beta is a measure of a stocks volatility re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started