Question

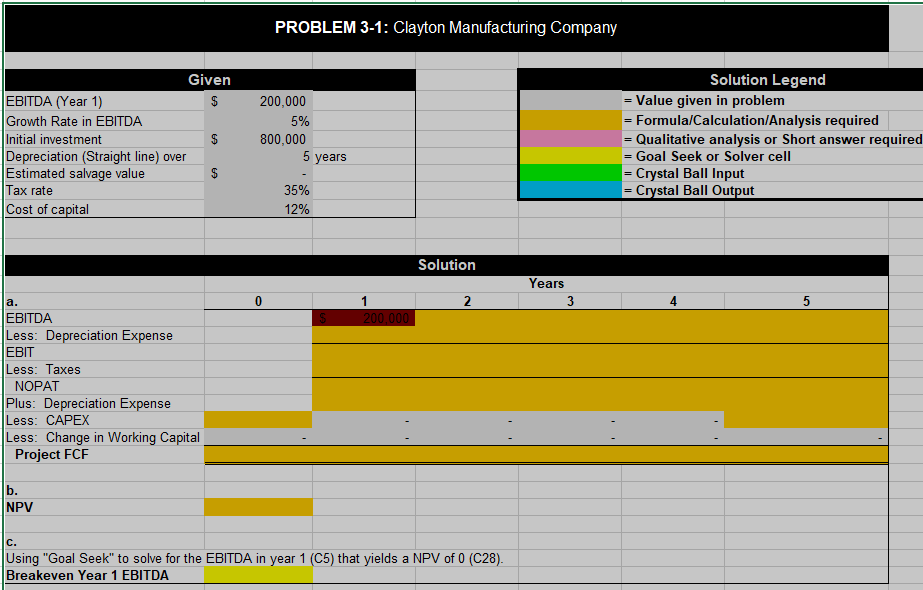

3-4 Breakeven Sensitivity Analysis The Clayton Manufacturing Company is considering an investment in a new automated inventory system for its warehouse that will provide cash

3-4 Breakeven Sensitivity Analysis The Clayton Manufacturing Company is considering an investment in a new automated inventory system for its warehouse that will provide cash savings to the firm over the next five years. The firms CFO anticipates additional earnings before interest, taxes, depreciation, and amortization (EBITDA)18 from cost savings equal to $200,000 for the first year of operation of the center; over the next four years, the firm estimates that this amount will grow at a rate of 5% per year. The system will require an initial investment of $800,000 that will be depreciated over a five-year period using straight-line depreciation of $160,000 per year and a zero estimated salvage value. 18 EBITDA is a widely used measure of firm earnings that we will encounter many times throughout the balance of the text. It is simply earnings before interest and taxes (EBIT), plus depreciation and amortization expense. Calculate the projects annual free cash flow (FCF) for each of the next five years, where the firms tax rate is 35%. If the cost of capital for the project is 12%, what is the projected NPV for the investment? What is the minimum year 1 dollar savings (i.e., EBITDA) required to produce a breakeven NPV = 0?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started