Answered step by step

Verified Expert Solution

Question

1 Approved Answer

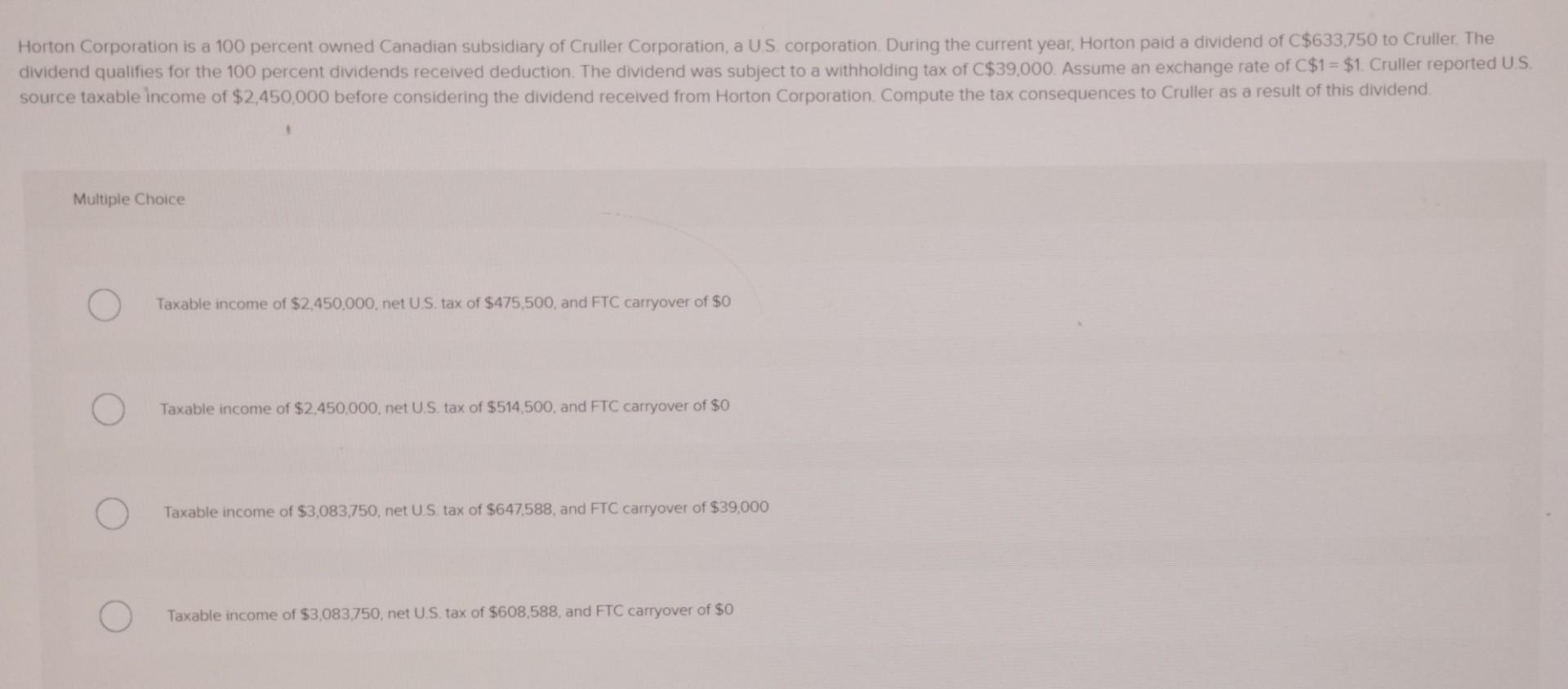

34 Horton Corporation is a 100 percent owned Canadian subsidiary of Cruller Corporation, a U.S. corporation. During the current year. Horton paid a dividend of

34

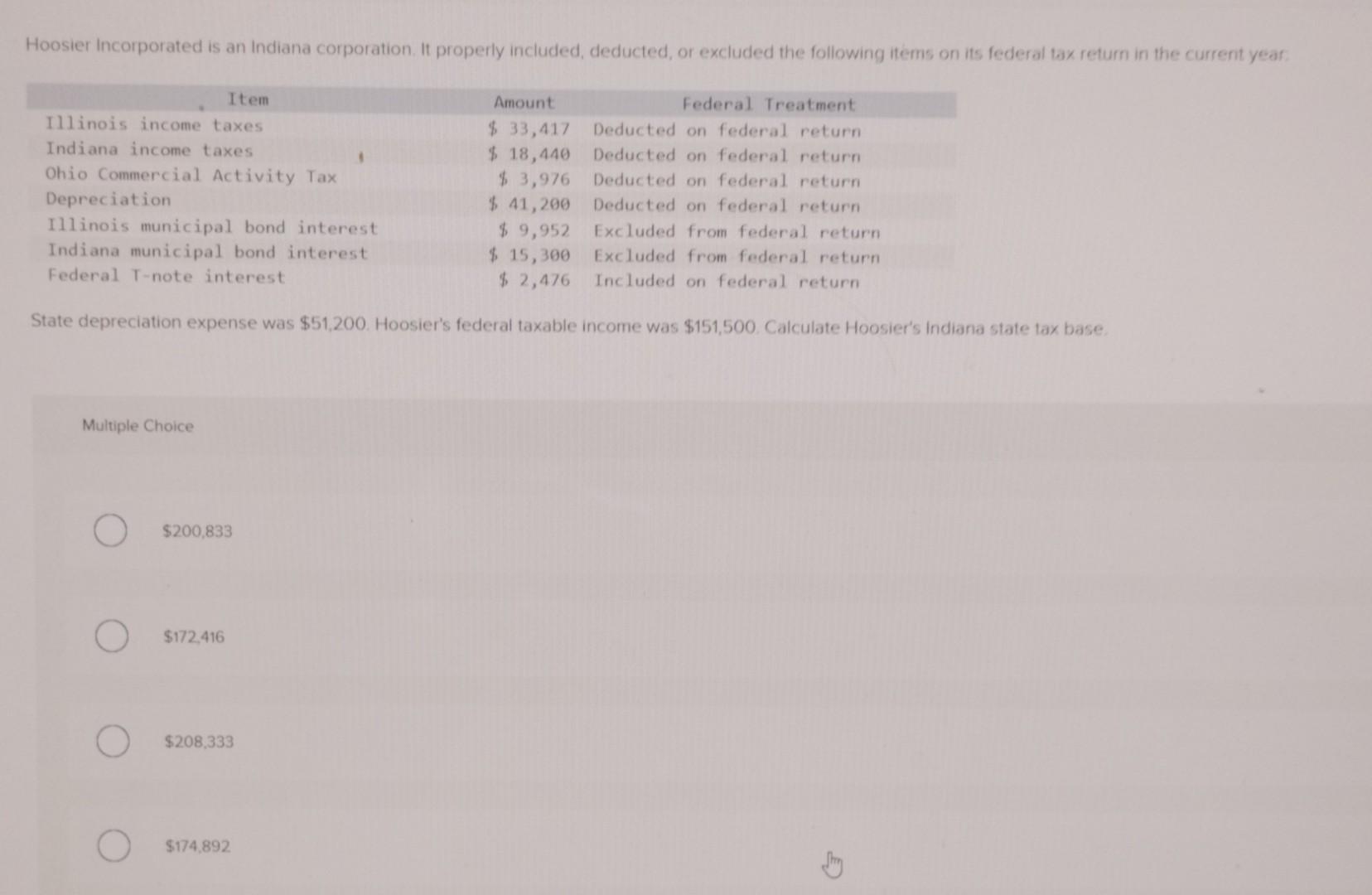

Horton Corporation is a 100 percent owned Canadian subsidiary of Cruller Corporation, a U.S. corporation. During the current year. Horton paid a dividend of C $633,750 to Cruller. The dividend qualifies for the 100 percent dividends received deduction. The dividend was subject to a withholding tax of C$39,000. Assume an exchange rate of C$1=$1 Cruller reported U.S. source taxable income of $2,450,000 before considering the dividend received from Horton Corporation. Compute the tax consequences to Cruller as a result of this dividend. Multiple Choice Taxable income of $2,450,000, net U.S. tax of $475,500, and FTC carryover of $0 Taxable income of $2,450,000, net U.S. tax of $514,500, and FTC carryover of $0 Taxable income of $3,083,750, net U.S. tax of $647,588, and FTC carryover of $39,000 Taxable income of $3,083,750, net U.S. tax of $608,588, and FTC carryover of $0 Hoosier Incorporated is an Indiana corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year. State depreciation expense was $51,200. Hoosier's federal taxable income was $151,500. Calculate Hoosier's indiana state tax base. Multiple Choice $200,833 $172.416 $208,333 $174,892Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started