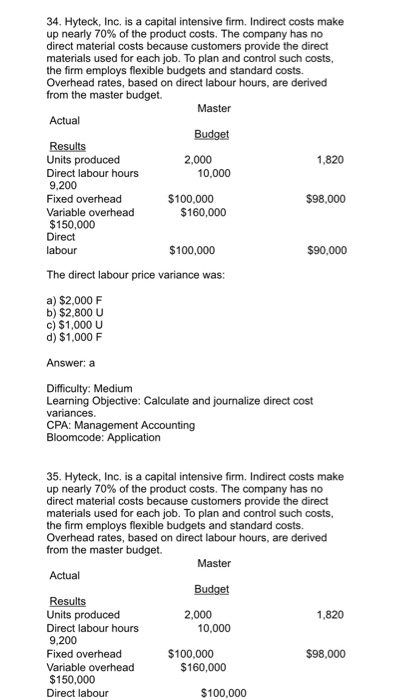

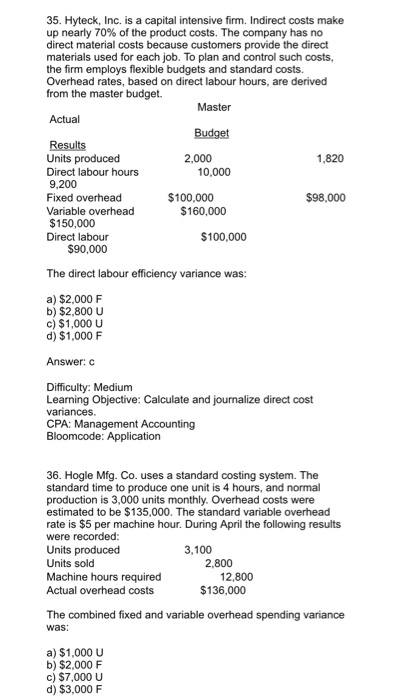

34. Hyteck, Inc. is a capital intensive firm. Indirect costs make up nearly 70% of the product costs. The company has no direct material costs because customers provide the direct materials used for each job. To plan and control such costs, the firm employs flexible budgets and standard costs. Overhead rates, based on direct labour hours, are derived from the master budget. Units produced Direct labour hours 9,200 Fixed overhead Variable overhead $150,000 Direct 2,000 1,820 10,000 $100,000 $98,000 $160,000 $100,000 $90,000 The direct labour price variance was: a) $2,000 F b) $2,800U c) $1,000 U d) $1,000F Answer: a Difficulty: Medium Learning Objective: Calculate and journalize direct cost vanances. 35. Hyteck, Inc. is a capital intensive firm. Indirect costs make up nearly 70% of the product costs. The company has no direct material costs because customers provide the direct materials used for each job. To plan and control such costs, the firm employs flexible budgets and standard costs. Overhead rates, based on direct labour hours, are derived from the master budget. Units produced Direct labour hours 9,200 Fixed overhead Variable overhead $150,000 Direct labour 2,000 1,820 10,000 $100,000 $98,000 $160,000 $100,000 35. Hyteck, Inc. is a capital intensive firm. Indirect costs make up nearly 70% of the product costs. The company has no direct material costs because customers provide the direct materials used for each job. To plan and control such costs, the firm employs flexible budgets and standard costs. Overhead rates, based on direct labour hours, are derived from the master budget. Master Actual Budget Results Units produced Direct labour hours 9.200 Fixed overhead Variable overhead $150,000 Direct labour 2,000 1,820 10,000 $100,000 $98,000 $160,000 $100,000 $90,000 The direct labour efficiency variance was: a) $2,000F b) $2,800U c) $1,000 U d) $1,000 F Answer: c Difficulty: Medium Learning Objective: Calculate and journalize direct cost variances CPA: Management Accounting 36. Hogle Mfg. Co. uses a standard costing system. The standard time to produce one unit is 4 hours, and normal production is 3,000 units monthly. Overhead costs were estimated to be $135,000. The standard variable overhead rate is $5 per machine hour. During April the following results were recorded Units produced Units sold Machine hours required Actual overhead costs 3,100 2,800 12,800 $136,000 The combined fixed and variable overhead spending variance was: a) $1,000 U b) $2,000 F c) $7,000 Uu d) $3,000 F