Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3.4 ROE and the DuPont Identity Calculate the 2018 ROE for the Philippe Corporation and then break down your answer into its component parts using

3.4 ROE and the DuPont Identity Calculate the 2018 ROE for the Philippe Corporation and then break down your answer into its component parts using the DuPont identity.

I only need 3.4, i posted the other screenshots for context.

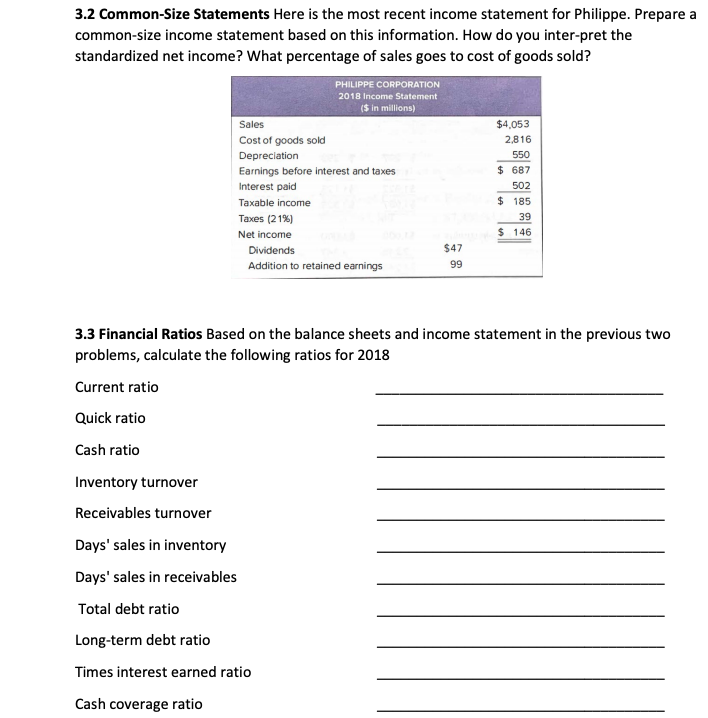

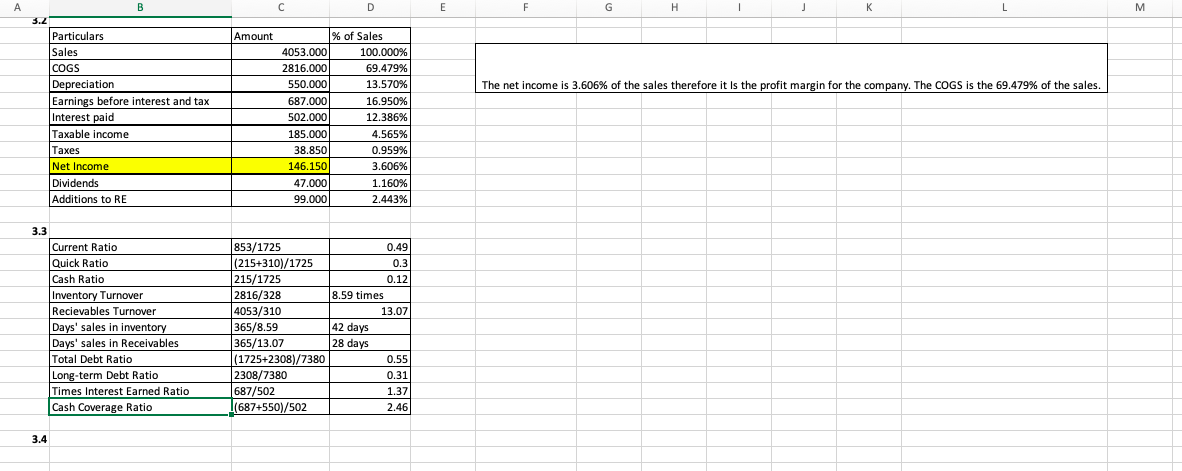

3.2 Common-Size Statements Here is the most recent income statement for Philippe. Prepare a common-size income statement based on this information. How do you inter-pret the standardized net income? What percentage of sales goes to cost of goods sold? PHILIPPE CORPORATION 2018 Income Statement ($ in millions) Sales $4,053 Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes (21%) Net income Dividends Addition to retained earnings 2,816 550 $ 687 502 $ 185 39 $ 146 $47 99 3.3 Financial Ratios Based on the balance sheets and income statement in the previous two problems, calculate the following ratios for 2018 Current ratio Quick ratio Cash ratio Inventory turnover Receivables turnover Days' sales in inventory Days' sales in receivables Total debt ratio Long-term debt ratio Times interest earned ratio Cash coverage ratio . B D E F G H 1 K M 3.2 Amount The net income is 3.606% of the sales therefore it is the profit margin for the company. The COGS is the 69.479% of the sales. Particulars Sales COGS Depreciation Earnings before interest and tax Interest paid Taxable income Taxes Net Income Dividends Additions to RE % of Sales 4053.000 100.000% 2816.000 69.479% 550.000 13.570% 687.000 16.950% 502.000 12.386% 185.000 4.565% 38.850 0.959% 146.150 3.606% 47.000 1.160% 99.000 2.443% 3.3 Current Ratio Quick Ratio Cash Ratio Inventory Turnover Recievables Turnover Believable Days' sales in inventory Days' sales in Receivables ay Sales 853/1725 0.49 (215+310)/1725 0.3 215/1725 0.12 2816/328 8.59 times 4053/310 13.07 NUDIBIU 365/8.59 42 days POD 365/13.07 28 days (1725+2308)/7380 0.55 2308/7380 0.31 687/502 1.37 |(687+550)/502 2.46 Total Debt Ratio Long-term Debt Ratio Times Interest Earned Ratio Cash Coverage Ratio 3.4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started