Answered step by step

Verified Expert Solution

Question

1 Approved Answer

34. ROG Computers is wondering whether to offer its customers, a 2% cash discount if they pay within 10 days. At present, it has net

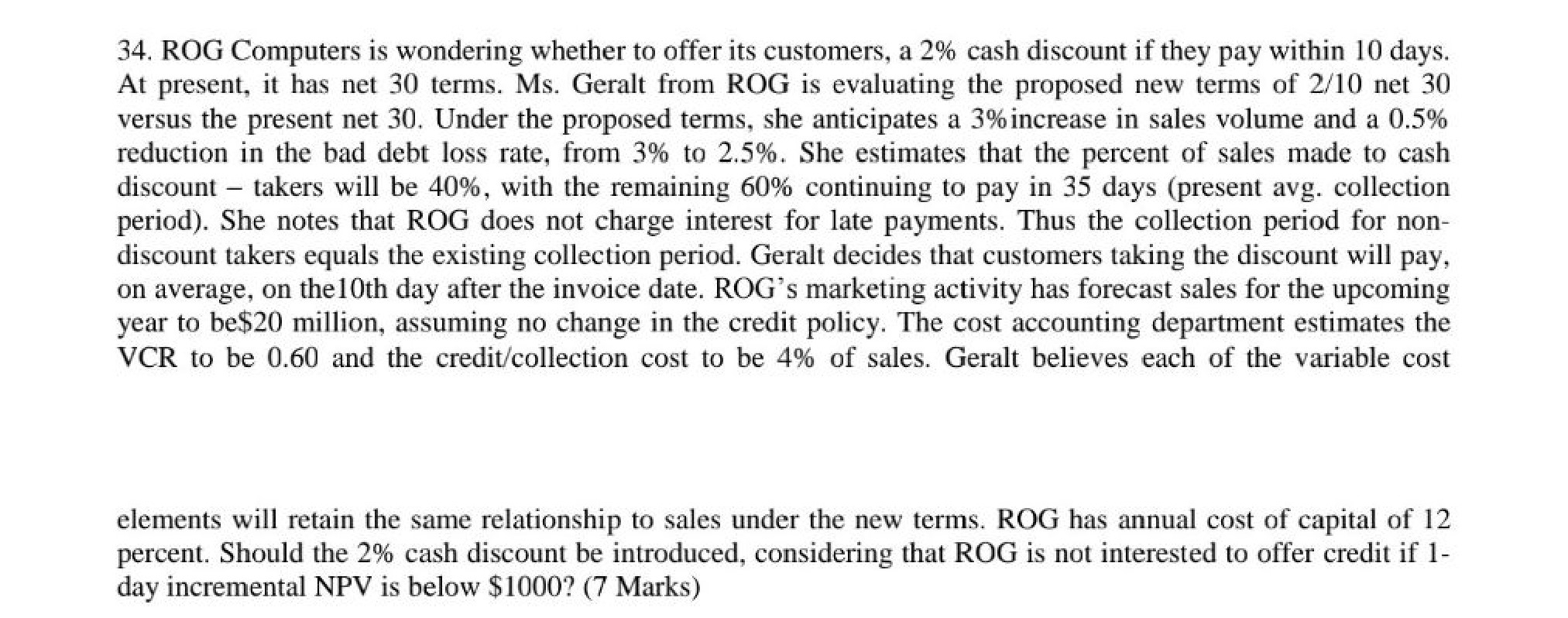

34. ROG Computers is wondering whether to offer its customers, a 2% cash discount if they pay within 10 days. At present, it has net 30 terms. Ms. Geralt from ROG is evaluating the proposed new terms of 2/10 net 30 versus the present net 30 . Under the proposed terms, she anticipates a 3% increase in sales volume and a 0.5% reduction in the bad debt loss rate, from 3% to 2.5%. She estimates that the percent of sales made to cash discount - takers will be 40%, with the remaining 60% continuing to pay in 35 days (present avg. collection period). She notes that ROG does not charge interest for late payments. Thus the collection period for nondiscount takers equals the existing collection period. Geralt decides that customers taking the discount will pay, on average, on the10th day after the invoice date. ROG's marketing activity has forecast sales for the upcoming year to be $20 million, assuming no change in the credit policy. The cost accounting department estimates the VCR to be 0.60 and the credit/collection cost to be 4% of sales. Geralt believes each of the variable cost elements will retain the same relationship to sales under the new terms. ROG has annual cost of capital of 12 percent. Should the 2% cash discount be introduced, considering that ROG is not interested to offer credit if 1 day incremental NPV is below $1000 ? (7 Marks)

34. ROG Computers is wondering whether to offer its customers, a 2% cash discount if they pay within 10 days. At present, it has net 30 terms. Ms. Geralt from ROG is evaluating the proposed new terms of 2/10 net 30 versus the present net 30 . Under the proposed terms, she anticipates a 3% increase in sales volume and a 0.5% reduction in the bad debt loss rate, from 3% to 2.5%. She estimates that the percent of sales made to cash discount - takers will be 40%, with the remaining 60% continuing to pay in 35 days (present avg. collection period). She notes that ROG does not charge interest for late payments. Thus the collection period for nondiscount takers equals the existing collection period. Geralt decides that customers taking the discount will pay, on average, on the10th day after the invoice date. ROG's marketing activity has forecast sales for the upcoming year to be $20 million, assuming no change in the credit policy. The cost accounting department estimates the VCR to be 0.60 and the credit/collection cost to be 4% of sales. Geralt believes each of the variable cost elements will retain the same relationship to sales under the new terms. ROG has annual cost of capital of 12 percent. Should the 2% cash discount be introduced, considering that ROG is not interested to offer credit if 1 day incremental NPV is below $1000 ? (7 Marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started