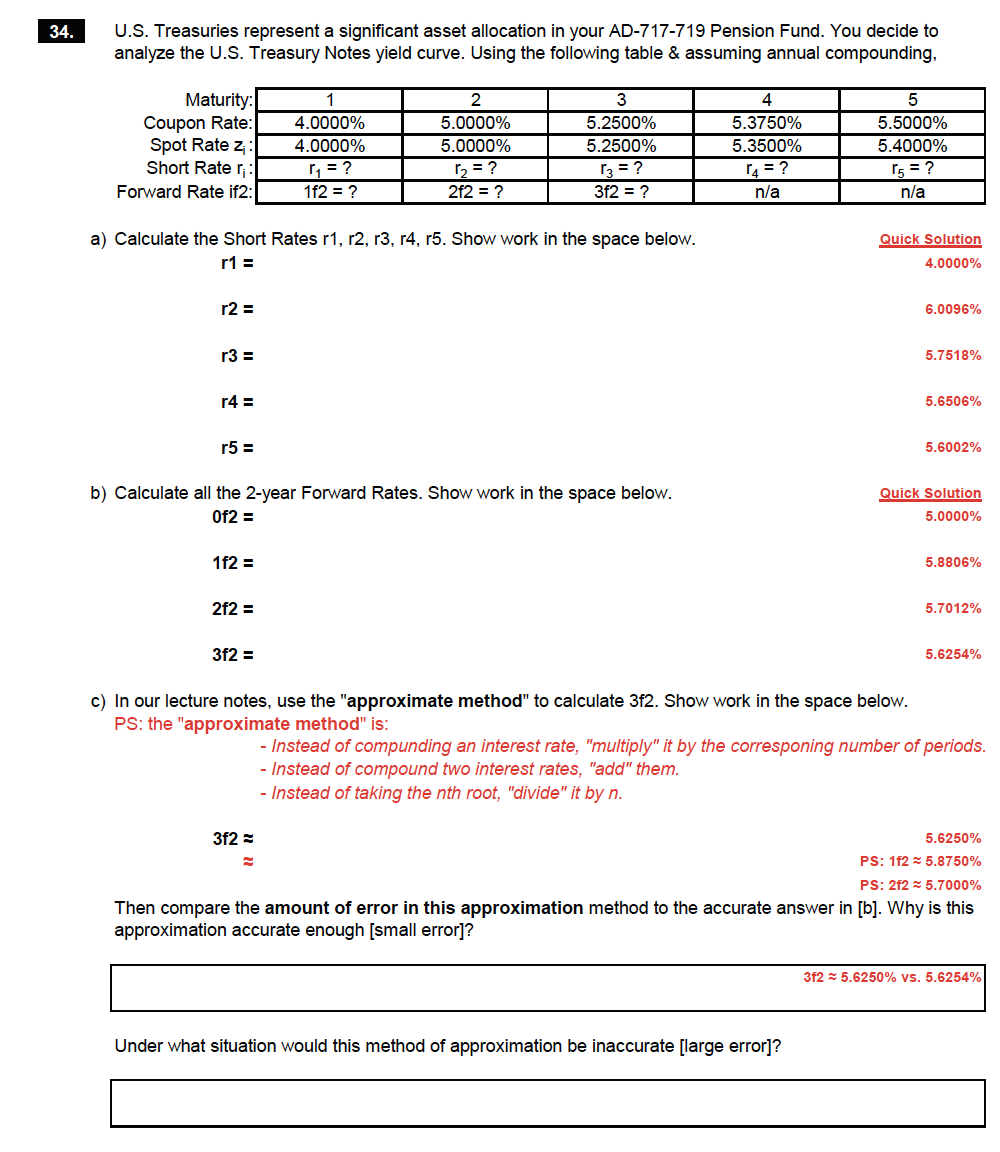

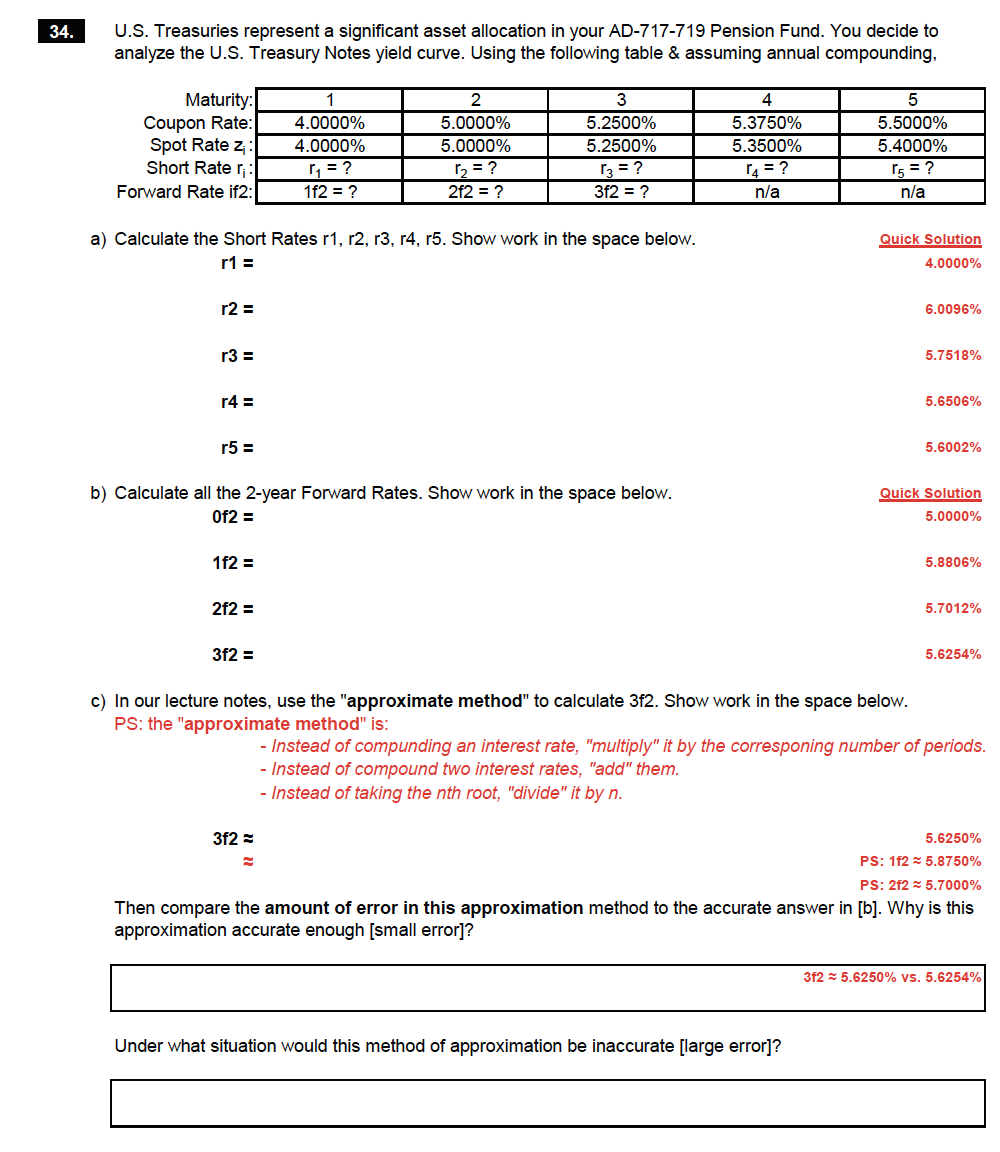

34. U.S. Treasuries represent a significant asset allocation in your AD-717-719 Pension Fund. You decide to analyze the U.S. Treasury Notes yield curve. Using the following table & assuming annual compounding, 4 5 5.5000% Maturity: Coupon Rate: Spot Rate z: Short Rate : Forward Rate if2: 1 4.0000% 4.0000% 11 = ? 1f2 = ? 2 5.0000% 5.0000% r2 = ? 2f2 = ? 3 5.2500% 5.2500% r3 = ? 3f2 = ? 5.3750% 5.3500% 14 = ? n/a 5.4000% 15 = ? n/a Quick Solution a) Calculate the Short Rates r1, r2, r3, r4, r5. Show work in the space below. r1 = 4.0000% r2 = 6.0096% r3 = 5.7518% r4 = 5.6506% r5 = 5.6002% b) Calculate all the 2-year Forward Rates. Show work in the space below. Quick Solution Of2 = 5.0000% 1f2 = 5.8806% 2f2 = 5.7012% 3f2 = 5.6254% c) In our lecture notes, use the "approximate method" to calculate 3f2. Show work in the space below. PS: the "approximate method" is: Instead of compunding an interest rate, "multiply" it by the corresponing number of periods. - Instead of compound two interest rates, "add" them. Instead of taking the nth root, "divide" it by n. 3f2= 5.6250% PS: 162 5.8750% PS: 2f2 5.7000% Then compare the amount of error in this approximation method to the accurate answer in [b]. Why is this approximation accurate enough (small error]? 3f25.6250% vs. 5.6254% Under what situation would this method of approximation be inaccurate [large error]? 34. U.S. Treasuries represent a significant asset allocation in your AD-717-719 Pension Fund. You decide to analyze the U.S. Treasury Notes yield curve. Using the following table & assuming annual compounding, 4 5 5.5000% Maturity: Coupon Rate: Spot Rate z: Short Rate : Forward Rate if2: 1 4.0000% 4.0000% 11 = ? 1f2 = ? 2 5.0000% 5.0000% r2 = ? 2f2 = ? 3 5.2500% 5.2500% r3 = ? 3f2 = ? 5.3750% 5.3500% 14 = ? n/a 5.4000% 15 = ? n/a Quick Solution a) Calculate the Short Rates r1, r2, r3, r4, r5. Show work in the space below. r1 = 4.0000% r2 = 6.0096% r3 = 5.7518% r4 = 5.6506% r5 = 5.6002% b) Calculate all the 2-year Forward Rates. Show work in the space below. Quick Solution Of2 = 5.0000% 1f2 = 5.8806% 2f2 = 5.7012% 3f2 = 5.6254% c) In our lecture notes, use the "approximate method" to calculate 3f2. Show work in the space below. PS: the "approximate method" is: Instead of compunding an interest rate, "multiply" it by the corresponing number of periods. - Instead of compound two interest rates, "add" them. Instead of taking the nth root, "divide" it by n. 3f2= 5.6250% PS: 162 5.8750% PS: 2f2 5.7000% Then compare the amount of error in this approximation method to the accurate answer in [b]. Why is this approximation accurate enough (small error]? 3f25.6250% vs. 5.6254% Under what situation would this method of approximation be inaccurate [large error]