Answered step by step

Verified Expert Solution

Question

1 Approved Answer

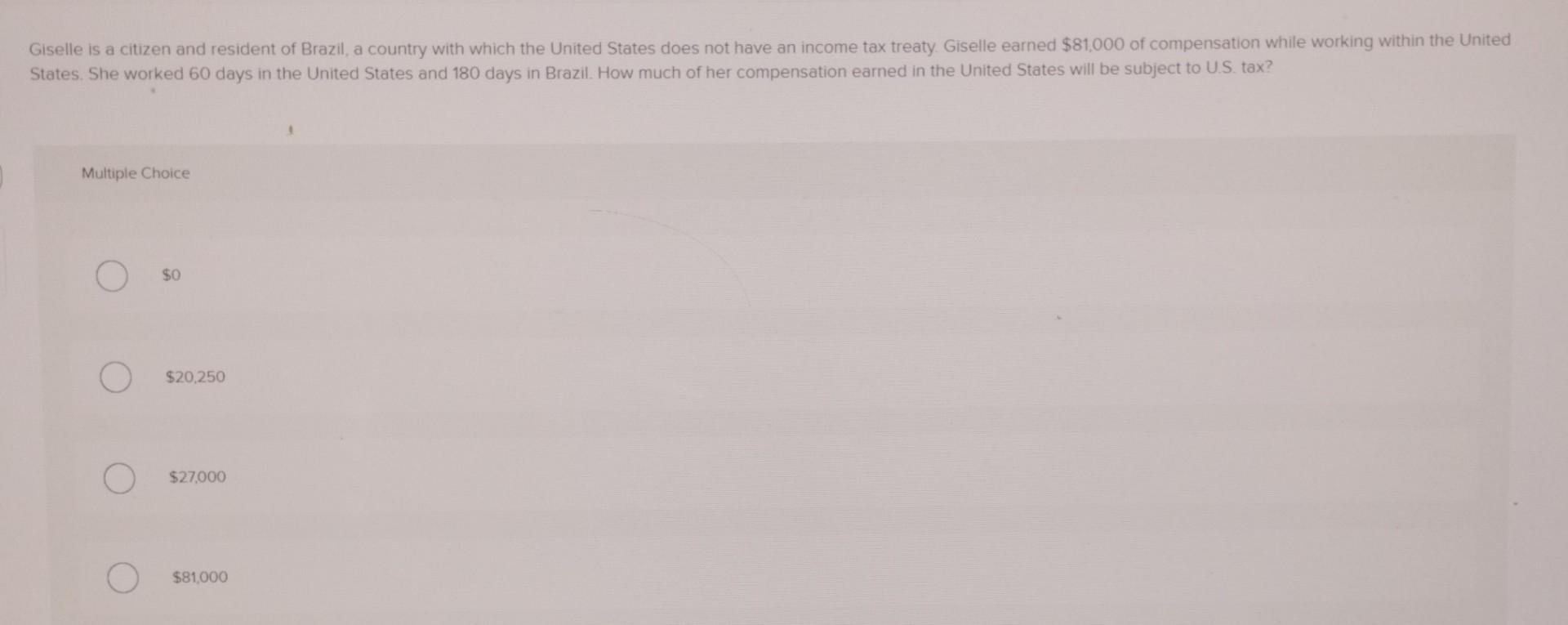

35 Giselle is a citizen and resident of Brazil, a country with which the United States does not have an income tax treaty. Giselle earned

35

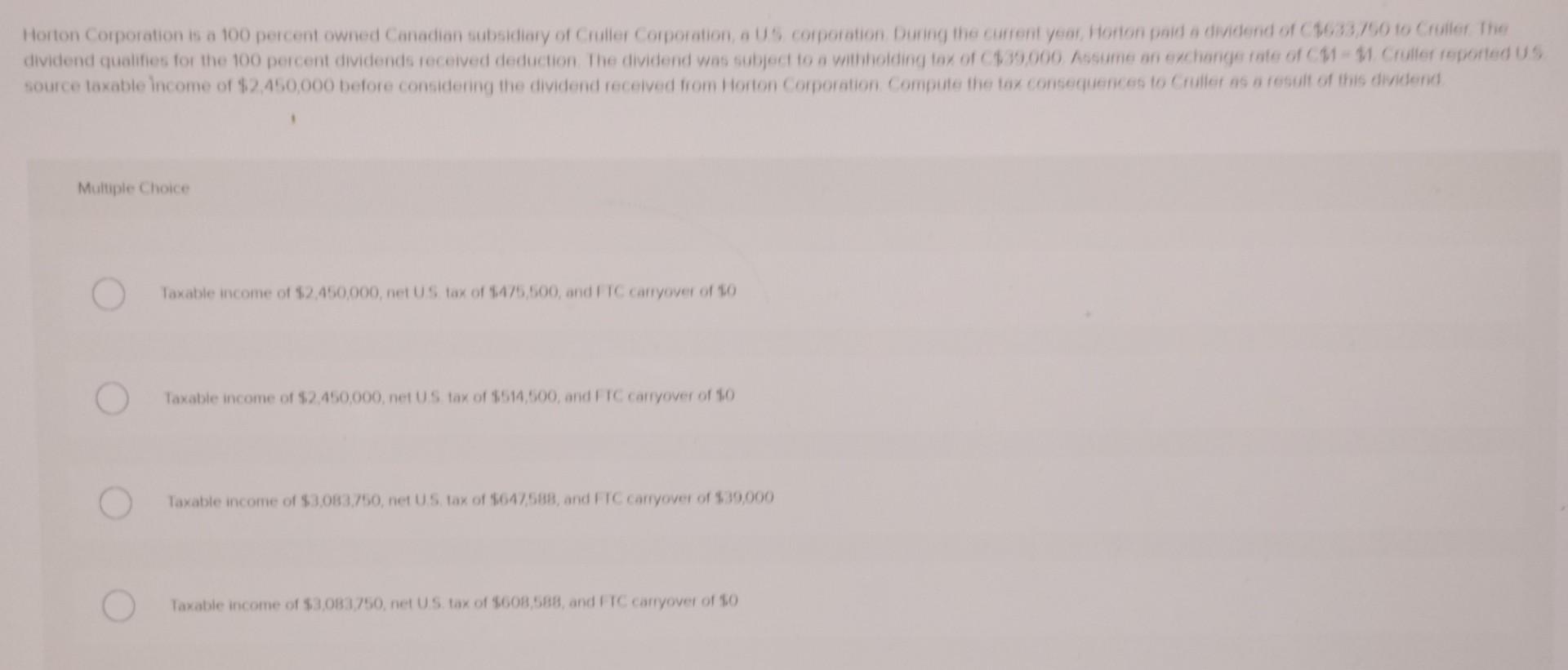

Giselle is a citizen and resident of Brazil, a country with which the United States does not have an income tax treaty. Giselle earned $81,000 of compensation while working within the United States. She worked 60 days in the United States and 180 days in Brazil. How much of her compensation earned in the United States will be subject to U.S. tax? Multiple Choice $0 $20,250 $27,000 $81,000 Horton Corporation is a 100 percent owned Canadian subsidiofy of Cruller Corporation, a US corporation During the current yeat, Horion paid a dividend of C bez3./50 to Criller The dividend qualifies for the 100 percent dividends received deduction. The dividend was subject to a withinolding tax of C539,000 Assume an exchange rate of CM = hi Cruller teported us source taxable income of $2,450,000 betore considening the dividend received from Horton Corporation Compute the tax consecuences to Cruiler as a resuit of this dividend Multiple Choice Taxable income of $2,450,000, net US tak of $,4/5,500, and I IC cartyoyer of 40 Taxable income of $2,450,000, net US tax of $544,600, and I IC carryover of 40 Taxable income of 83,083,750, net US, lak of $647,588, and I IC carryover of $39,000 Taxable income of $3,083750, ne US. tax of $608,588, and I IC carlyove of $0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started