Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3.5- *PLEASE ANSWER ALL 5 QUESTIONS* 5 multiple choice questions. 1. 2. 3. TRUE OR FALSE 4. 5. Regarding the relationships of depreciation expense, book

3.5-*PLEASE ANSWER ALL 5 QUESTIONS*

5 multiple choice questions.

1.

2.

3. TRUE OR FALSE

4.

5.

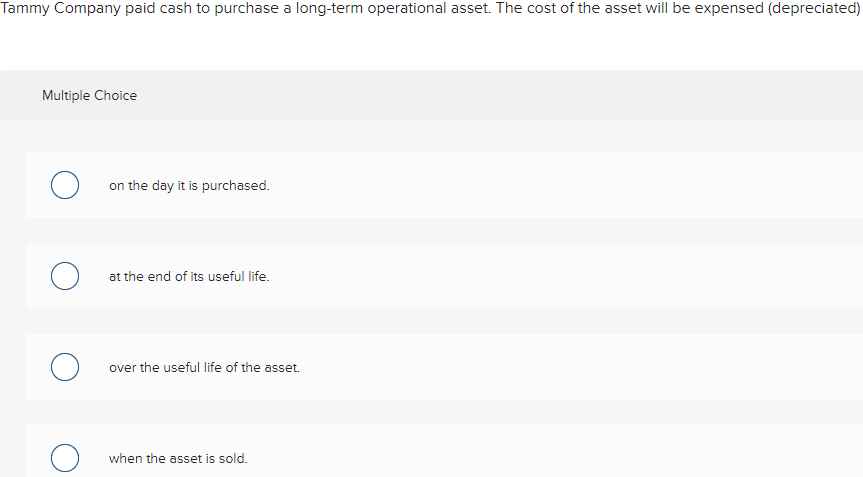

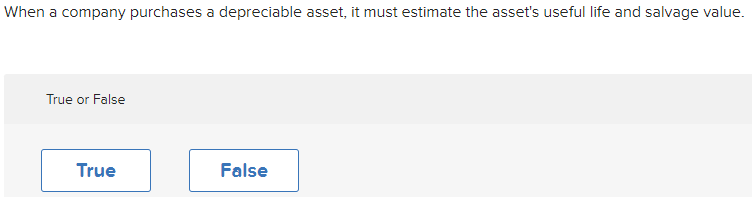

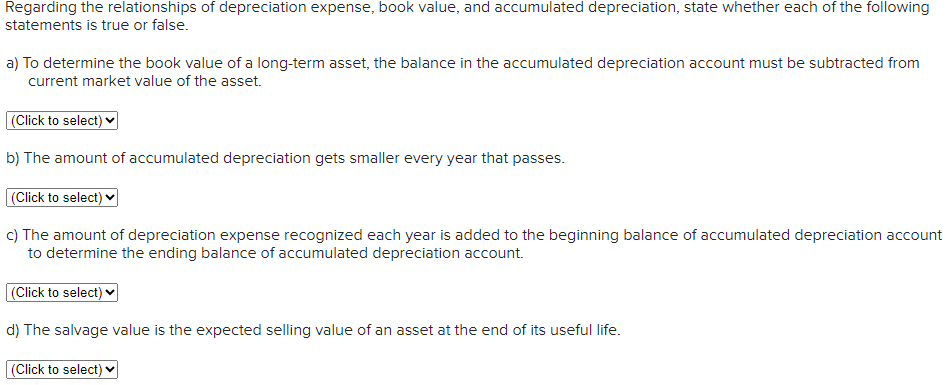

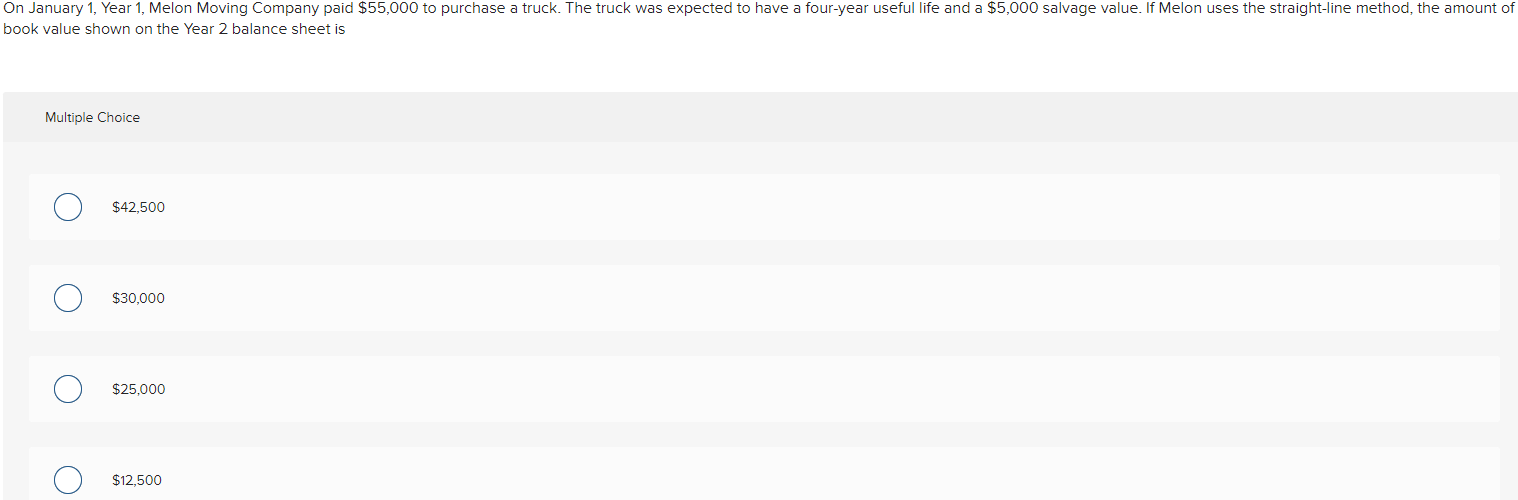

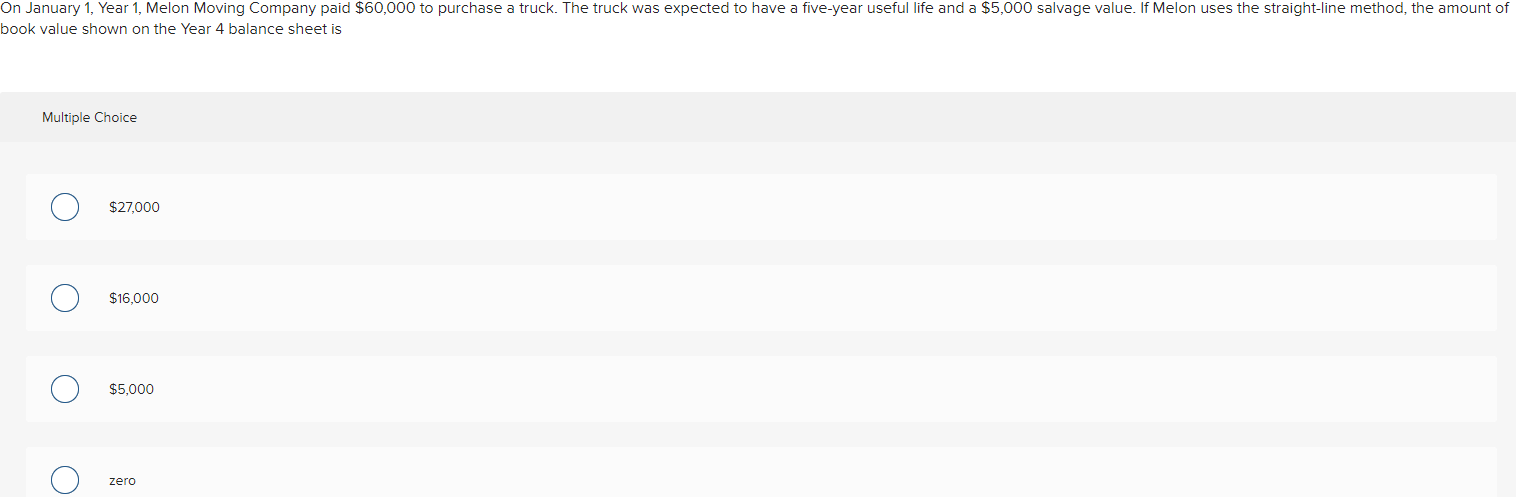

Regarding the relationships of depreciation expense, book value, and accumulated depreciation, state whether each of the following statements is true or false. a) To determine the book value of a long-term asset, the balance in the accumulated depreciation account must be subtracted from current market value of the asset. b) The amount of accumulated depreciation gets smaller every year that passes. c) The amount of depreciation expense recognized each year is added to the beginning balance of accumulated depreciation account to determine the ending balance of accumulated depreciation account. d) The salvage value is the expected selling value of an asset at the end of its useful life. ook value shown on the Year 4 balance sheet is Multiple Choice $27,000 $16,000 $5,000 zero When a company purchases a depreciable asset, it must estimate the asset's useful life and salvage value. True or False pook value shown on the Year 2 balance sheet is Multiple Choice $42,500 $30,000 $25,000 $12,500 ammy Company paid cash to purchase a long-term operational asset. The cost of the asset will be expensed (depreciated) Multiple Choice on the day it is purchased. at the end of its useful life. over the useful life of the asset. when the asset is sold

Regarding the relationships of depreciation expense, book value, and accumulated depreciation, state whether each of the following statements is true or false. a) To determine the book value of a long-term asset, the balance in the accumulated depreciation account must be subtracted from current market value of the asset. b) The amount of accumulated depreciation gets smaller every year that passes. c) The amount of depreciation expense recognized each year is added to the beginning balance of accumulated depreciation account to determine the ending balance of accumulated depreciation account. d) The salvage value is the expected selling value of an asset at the end of its useful life. ook value shown on the Year 4 balance sheet is Multiple Choice $27,000 $16,000 $5,000 zero When a company purchases a depreciable asset, it must estimate the asset's useful life and salvage value. True or False pook value shown on the Year 2 balance sheet is Multiple Choice $42,500 $30,000 $25,000 $12,500 ammy Company paid cash to purchase a long-term operational asset. The cost of the asset will be expensed (depreciated) Multiple Choice on the day it is purchased. at the end of its useful life. over the useful life of the asset. when the asset is sold Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started