Answered step by step

Verified Expert Solution

Question

1 Approved Answer

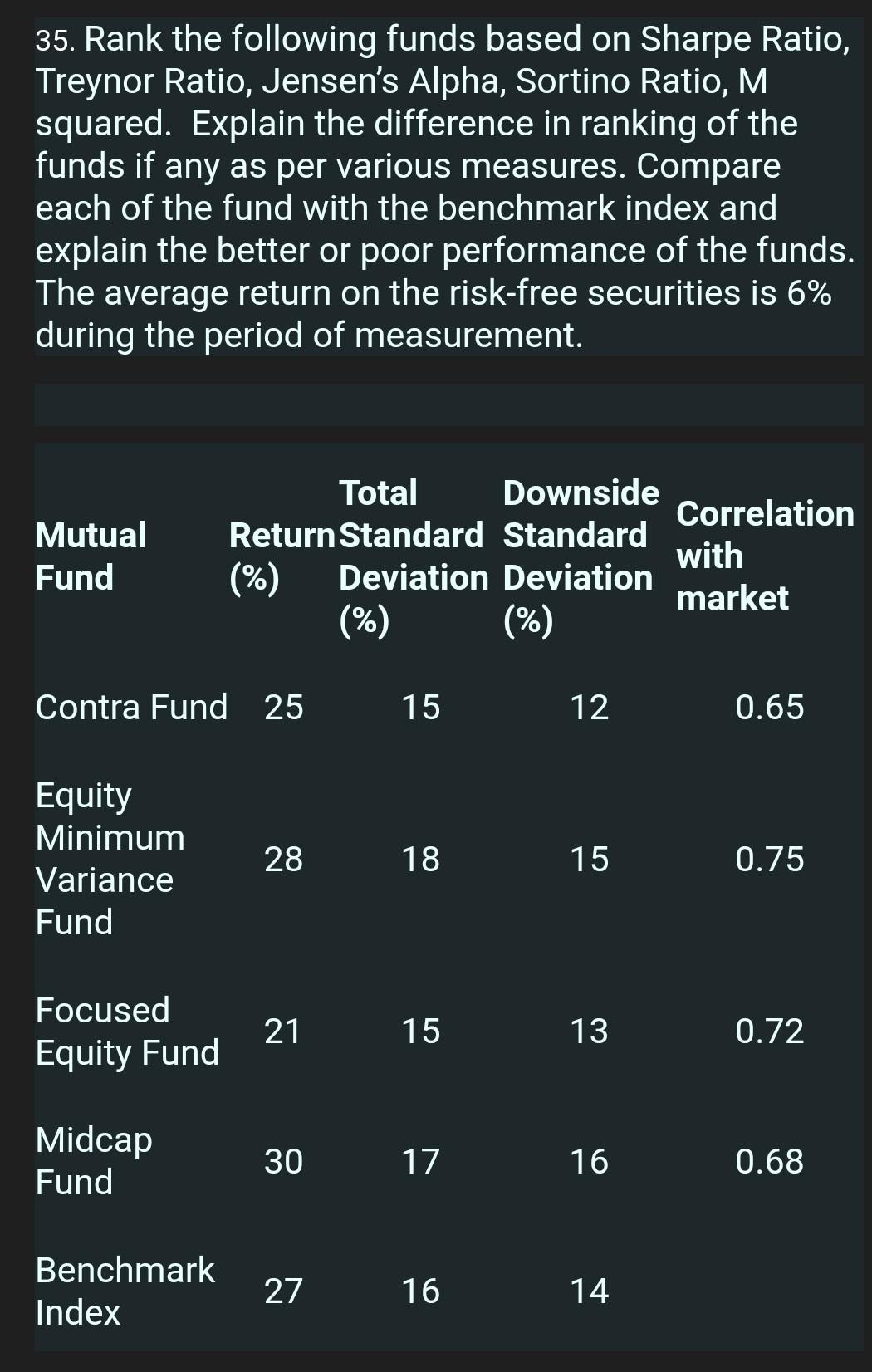

35. Rank the following funds based on Sharpe Ratio, Treynor Ratio, Jensen's Alpha, Sortino Ratio, M squared. Explain the difference in ranking of the funds

35. Rank the following funds based on Sharpe Ratio, Treynor Ratio, Jensen's Alpha, Sortino Ratio, M squared. Explain the difference in ranking of the funds if any as per various measures. Compare each of the fund with the benchmark index and explain the better or poor performance of the funds. The average return on the risk-free securities is 6% during the period of measurement. Mutual Fund Total Downside Correlation Return Standard Standard with (%) Deviation Deviation market (%) (%) Contra Fund 25 15 12 0.65 Equity Minimum Variance Fund 28 18 15 0.75 Focused Equity Fund 21 15 13 0.72 Midcap Fund 30 17 16 0.68 Benchmark Index 27 16 14 35. Rank the following funds based on Sharpe Ratio, Treynor Ratio, Jensen's Alpha, Sortino Ratio, M squared. Explain the difference in ranking of the funds if any as per various measures. Compare each of the fund with the benchmark index and explain the better or poor performance of the funds. The average return on the risk-free securities is 6% during the period of measurement. Mutual Fund Total Downside Correlation Return Standard Standard with (%) Deviation Deviation market (%) (%) Contra Fund 25 15 12 0.65 Equity Minimum Variance Fund 28 18 15 0.75 Focused Equity Fund 21 15 13 0.72 Midcap Fund 30 17 16 0.68 Benchmark Index 27 16 14

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started