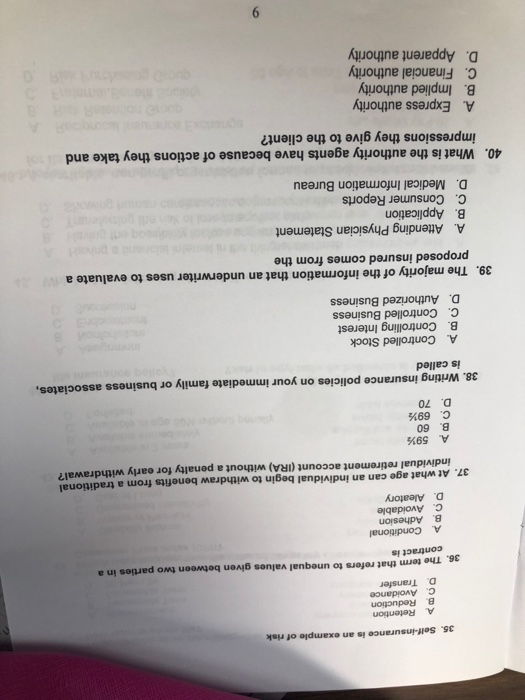

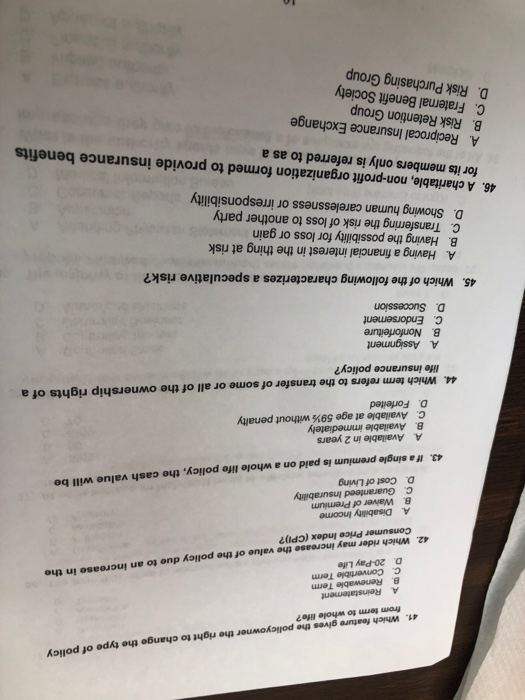

35. Self-insurance is an example of risk A Retention B. Reduction cAvoidance D. Transfer 36. The term that refers to unequal values given between two parties in a contract is Conditional B. Adhesion C. Avoidable D. Aleatory 37. At what age can an individual begin to withdraw benefits from a traditional individual retirement account (IRA) without a penalty for early withdrawal? A. 59% B. 60 C 69% D. 70 38. Writing insurance policies on your immediate family or business associates, is called A. Controlled Stock B. Controlling Interest C. Controlled Business D. Authorized Business 39. The majority of the information that an underwriter uses to evaluate a proposed insured comes from the A. Attending Physician Statement B. Application C. Consumer Reports D. Medical Information Bureau 40. What is the authority agents have because of actions they take and impressions they give to the client? A. Express authority B. Implied authority C. Financial authority D. Apparent authority 41. Which feature gives the policyowner the right to change the type of policy from term to whole life? A Reinstatement B Renewable Term C Convertible Term D. 20-Pay Life 42. Which rider may increase the value of the policy due to an increase in the Consumer Price Index (CPI)? A Disability Income B Waiver of Premium C Guaranteed Insurability D. Cost of Living 43. If a single premium is paid on a whole life policy, the cash value will be A. Available in 2 years B. Available immediately C. Available at age 59% without penalty D. Forfeited 44. Which term refers to the transfer of some or all of the ownership rights of a life insurance policy? A Assignment B. Nonforfeiture C. Endorsement D. Succession 45. Which of the following characterizes a speculative risk? A. Having a financial interest in the thing at risk B. Having the possibility for loss or gain C. Transferring the risk of loss to another party D. Showing human carelessness or irresponsibility 46. A charitable, non-profit organization formed to provide insurance benefits for its members only is referred to as a A Reciprocal Insurance Exchange B. Risk Retention Group C. Fraternal Benefit Society D. Risk Purchasing Group 35. Self-insurance is an example of risk A Retention B. Reduction cAvoidance D. Transfer 36. The term that refers to unequal values given between two parties in a contract is Conditional B. Adhesion C. Avoidable D. Aleatory 37. At what age can an individual begin to withdraw benefits from a traditional individual retirement account (IRA) without a penalty for early withdrawal? A. 59% B. 60 C 69% D. 70 38. Writing insurance policies on your immediate family or business associates, is called A. Controlled Stock B. Controlling Interest C. Controlled Business D. Authorized Business 39. The majority of the information that an underwriter uses to evaluate a proposed insured comes from the A. Attending Physician Statement B. Application C. Consumer Reports D. Medical Information Bureau 40. What is the authority agents have because of actions they take and impressions they give to the client? A. Express authority B. Implied authority C. Financial authority D. Apparent authority 41. Which feature gives the policyowner the right to change the type of policy from term to whole life? A Reinstatement B Renewable Term C Convertible Term D. 20-Pay Life 42. Which rider may increase the value of the policy due to an increase in the Consumer Price Index (CPI)? A Disability Income B Waiver of Premium C Guaranteed Insurability D. Cost of Living 43. If a single premium is paid on a whole life policy, the cash value will be A. Available in 2 years B. Available immediately C. Available at age 59% without penalty D. Forfeited 44. Which term refers to the transfer of some or all of the ownership rights of a life insurance policy? A Assignment B. Nonforfeiture C. Endorsement D. Succession 45. Which of the following characterizes a speculative risk? A. Having a financial interest in the thing at risk B. Having the possibility for loss or gain C. Transferring the risk of loss to another party D. Showing human carelessness or irresponsibility 46. A charitable, non-profit organization formed to provide insurance benefits for its members only is referred to as a A Reciprocal Insurance Exchange B. Risk Retention Group C. Fraternal Benefit Society D. Risk Purchasing Group