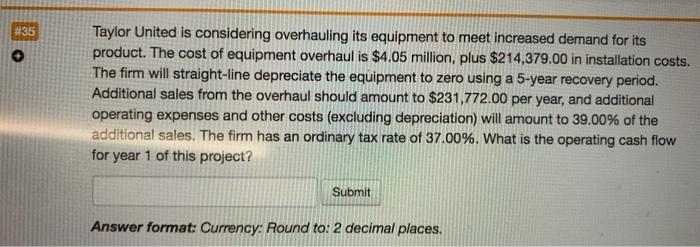

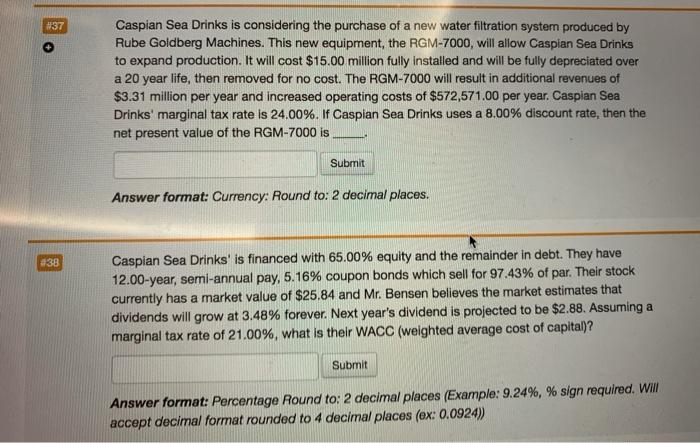

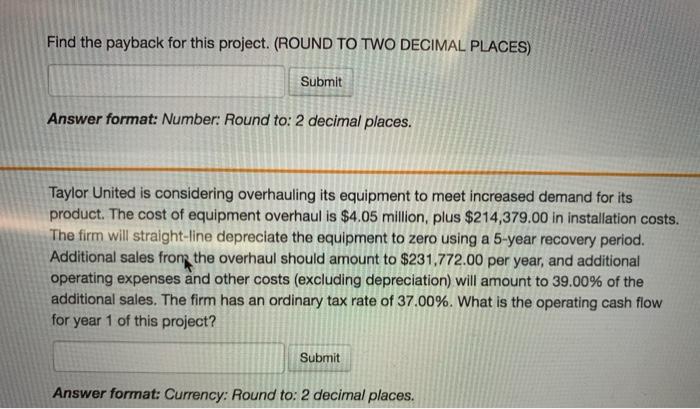

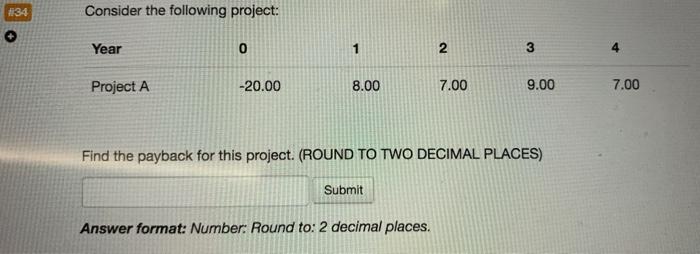

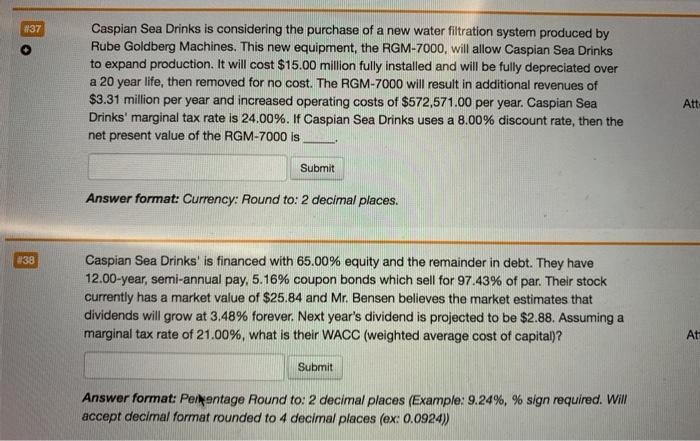

#35 Taylor United is considering overhauling its equipment to meet increased demand for its product. The cost of equipment overhaul is $4.05 million, plus $214,379.00 in installation costs. The firm will straight-line depreciate the equipment to zero using a 5-year recovery period. Additional sales from the overhaul should amount to $231,772.00 per year, and additional operating expenses and other costs (excluding depreciation) will amount to 39.00% of the additional sales. The firm has an ordinary tax rate of 37.00%. What is the operating cash flow for year 1 of this project? Submit Answer format: Currency: Round to: 2 decimal places. #37 Caspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines. This new equipment, the RGM-7000, will allow Caspian Sea Drinks to expand production. It will cost $15.00 million fully installed and will be fully depreciated over a 20 year life, then removed for no cost. The RGM-7000 will result in additional revenues of $3.31 million per year and increased operating costs of $572,571.00 per year. Caspian Sea Drinks' marginal tax rate is 24.00%. If Caspian Sea Drinks uses a 8.00% discount rate, then the net present value of the RGM-7000 is Submit Answer format: Currency: Round to: 2 decimal places. 838 Caspian Sea Drinks' is financed with 65.00% equity and the remainder in debt. They have 12.00-year, semi-annual pay, 5.16% coupon bonds which sell for 97.43% of par. Their stock currently has a market value of $25.84 and Mr. Bensen believes the market estimates that dividends will grow at 3.48% forever. Next year's dividend is projected to be $2.88. Assuming a marginal tax rate of 21.00%, what is their WACC (weighted average cost of capital)? Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) Find the payback for this project. (ROUND TO TWO DECIMAL PLACES) Submit Answer format: Number: Round to: 2 decimal places. Taylor United is considering overhauling its equipment to meet increased demand for its product. The cost of equipment overhaul is $4.05 million, plus $214,379.00 in installation costs. The firm will straight-line depreciate the equipment to zero using a 5-year recovery period. Additional sales from the overhaul should amount to $231,772.00 per year, and additional operating expenses and other costs (excluding depreciation) will amount to 39.00% of the additional sales. The firm has an ordinary tax rate of 37.00%. What is the operating cash flow for year 1 of this project? Submit Answer format: Currency: Round to: 2 decimal places. 4134 Consider the following project: Year 1 N 3 4 Project A -20.00 8.00 7.00 9.00 7.00 Find the payback for this project. (ROUND TO TWO DECIMAL PLACES) Submit Answer format: Number: Round to: 2 decimal places. #37 Caspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines. This new equipment, the RGM-7000, will allow Caspian Sea Drinks to expand production. It will cost $15.00 million fully installed and will be fully depreciated over a 20 year life, then removed for no cost. The RGM-7000 will result in additional revenues of $3.31 million per year and increased operating costs of $572,571.00 per year. Caspian Sea Drinks' marginal tax rate is 24.00%. If Caspian Sea Drinks uses a 8.00% discount rate, then the net present value of the RGM-7000 is Att Submit Answer format: Currency: Round to: 2 decimal places. 138 Caspian Sea Drinks' is financed with 65.00% equity and the remainder in debt. They have 12.00-year, semi-annual pay, 5.16% coupon bonds which sell for 97.43% of par. Their stock currently has a market value of $25.84 and Mr. Bensen believes the market estimates that dividends will grow at 3.48% forever. Next year's dividend is projected to be $2.88. Assuming a marginal tax rate of 21.00%, what is their WACC (weighted average cost of capital)? At Submit Answer format: Permontage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)