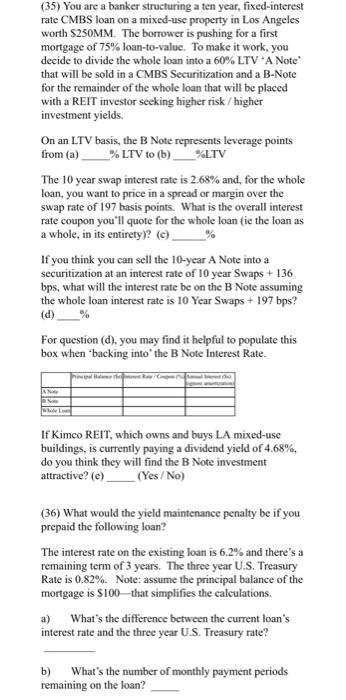

(35) You are a banker structuring a ten year, fixed-interest rate CMBS loan on a mixed-use property in Los Angeles worth $250MM. The borrower is pushing for a first mortgage of 75% loan-to-value. To make it work, you decide to divide the whole loan into a 60% LTV 'A Note' that will be sold in a CMBS Securitization and a B-Note for the remainder of the whole loan that will be placed with a REIT investor seeking higher risk / higher investment yields. On an LTV basis, the B Note represents leverage points from (a) \% LTV to (b) \%LTV The 10 year swap interest rate is 2.68% and, for the whole loan, you want to price in a spread or margin over the swap rate of 197 basis points. What is the overall interest rate coupon you'll quote for the whole loan (ie the loan as a whole, in its entirety)? (c) If you think you can sell the 10-year A Note into a securitization at an interest rate of 10 year Swaps + 136 bps, what will the interest rate be on the B Note assuming the whole loan interest rate is 10 Year Swaps + 197 bps? (d) % For question (d), you may find it helpful to populate this box when 'backing into' the B Note Interest Rate. If Kimco REIT, which owns and buys LA mixed-use buildings, is currently paying a dividend yield of 4.68%, do you think they will find the B Note investment attractive? (c) (Yes/No) (36) What would the yield maintenance penalty be if you prepaid the following loan? The interest rate on the existing loan is 6.2% and there's a remaining term of 3 years. The three year U.S. Treasury Rate is 0.82%. Note: assume the principal balance of the mortgage is $100 - that simplifies the calculations. a) What's the difference between the current loan's interest rate and the three year U.S. Treasury rate? b) What's the number of monthly payment periods remaining on the loan? (36) What would the yield maintenance penalty be if you prepaid the following loan? The interest rate on the existing loan is 6.2% and there's a remaining term of 3 years. The three year U.S. Treasury Rate is 0.82%. Note: assume the principal balance of the mortgage is $100 - that simplifies the calculations. a) What's the difference between the current loan's interest rate and the three year U.S. Treasury rate? b) What's the number of monthly payment periods remaining on the loan? c) What periodic discount rate ( i ) should you use for discounting the monthly yield maintenance cash flows to Present Value? d) What would the present value (PV) of the income stream you set up be? This PV is the prepayment penalty you must pay to refinance the loan at this early date. Hint: use the NPV calculation in excel: (35) You are a banker structuring a ten year, fixed-interest rate CMBS loan on a mixed-use property in Los Angeles worth $250MM. The borrower is pushing for a first mortgage of 75% loan-to-value. To make it work, you decide to divide the whole loan into a 60% LTV 'A Note' that will be sold in a CMBS Securitization and a B-Note for the remainder of the whole loan that will be placed with a REIT investor seeking higher risk / higher investment yields. On an LTV basis, the B Note represents leverage points from (a) \% LTV to (b) \%LTV The 10 year swap interest rate is 2.68% and, for the whole loan, you want to price in a spread or margin over the swap rate of 197 basis points. What is the overall interest rate coupon you'll quote for the whole loan (ie the loan as a whole, in its entirety)? (c) If you think you can sell the 10-year A Note into a securitization at an interest rate of 10 year Swaps + 136 bps, what will the interest rate be on the B Note assuming the whole loan interest rate is 10 Year Swaps + 197 bps? (d) % For question (d), you may find it helpful to populate this box when 'backing into' the B Note Interest Rate. If Kimco REIT, which owns and buys LA mixed-use buildings, is currently paying a dividend yield of 4.68%, do you think they will find the B Note investment attractive? (c) (Yes/No) (36) What would the yield maintenance penalty be if you prepaid the following loan? The interest rate on the existing loan is 6.2% and there's a remaining term of 3 years. The three year U.S. Treasury Rate is 0.82%. Note: assume the principal balance of the mortgage is $100 - that simplifies the calculations. a) What's the difference between the current loan's interest rate and the three year U.S. Treasury rate? b) What's the number of monthly payment periods remaining on the loan? (36) What would the yield maintenance penalty be if you prepaid the following loan? The interest rate on the existing loan is 6.2% and there's a remaining term of 3 years. The three year U.S. Treasury Rate is 0.82%. Note: assume the principal balance of the mortgage is $100 - that simplifies the calculations. a) What's the difference between the current loan's interest rate and the three year U.S. Treasury rate? b) What's the number of monthly payment periods remaining on the loan? c) What periodic discount rate ( i ) should you use for discounting the monthly yield maintenance cash flows to Present Value? d) What would the present value (PV) of the income stream you set up be? This PV is the prepayment penalty you must pay to refinance the loan at this early date. Hint: use the NPV calculation in excel