Answered step by step

Verified Expert Solution

Question

1 Approved Answer

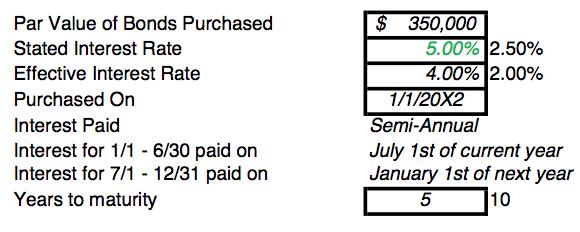

$ 350,000 5.00% 2.50% 4.00% 2.00% 1/1/20X2 Par Value of Bonds Purchased Stated Interest Rate Effective Interest Rate Purchased On Interest Paid Semi-Annual Interest

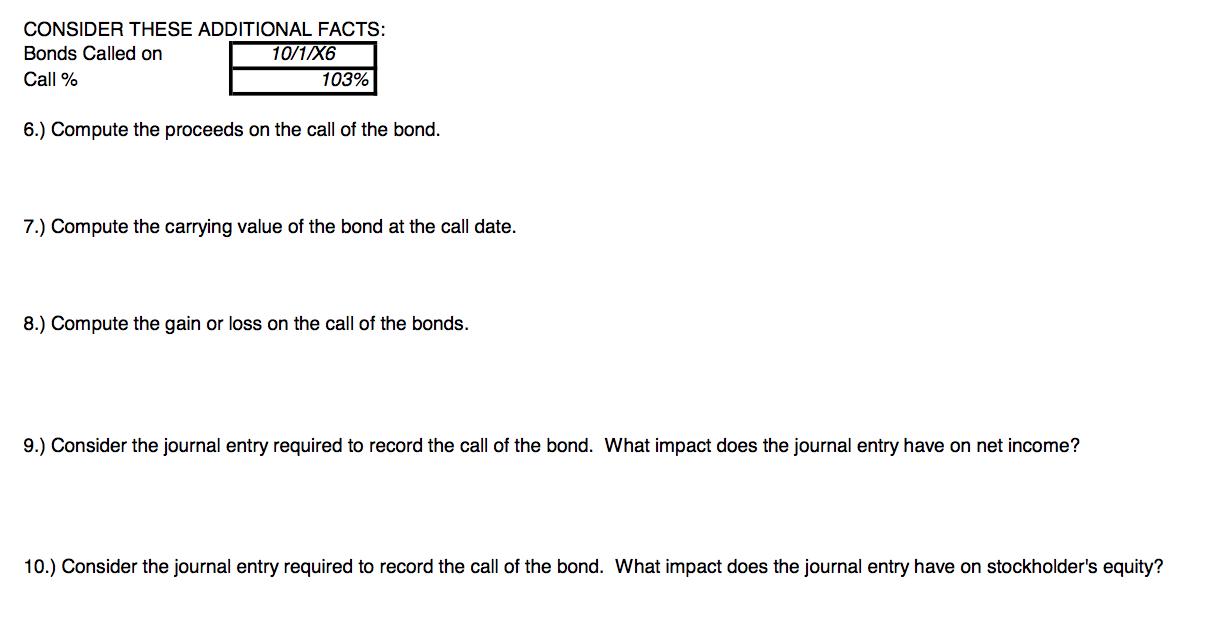

$ 350,000 5.00% 2.50% 4.00% 2.00% 1/1/20X2 Par Value of Bonds Purchased Stated Interest Rate Effective Interest Rate Purchased On Interest Paid Semi-Annual Interest for 1/1 - 6/30 paid on Interest for 7/1 - 12/31 paid on Years to maturity July 1st of current year January 1st of next year 10 CONSIDER THESE ADDITIONAL FACTS: Bonds Called on 10/1/X6 Call % 103% 6.) Compute the proceeds on the call of the bond. 7.) Compute the carrying value of the bond at the call date. 8.) Compute the gain or loss on the call of the bonds. 9.) Consider the journal entry required to record the call of the bond. What impact does the journal entry have on net income? 10.) Consider the journal entry required to record the call of the bond. What impact does the journal entry have on stockholder's equity?

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

6 Proceeds on the call of the bond 350000 103 360500 7 Carrying ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started