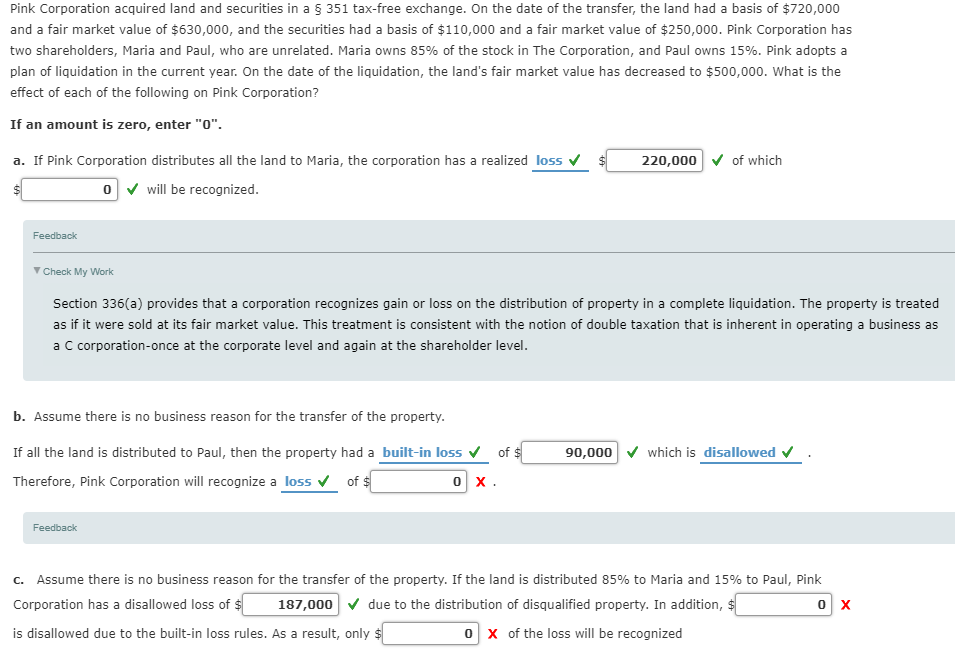

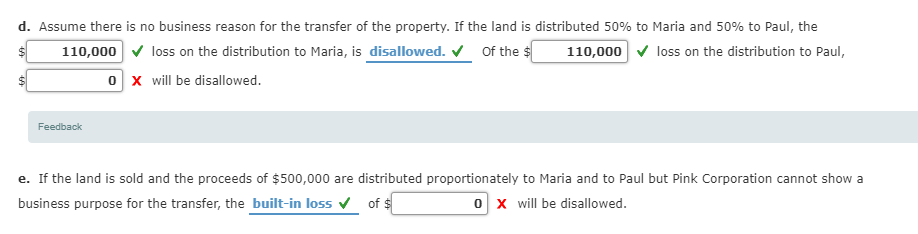

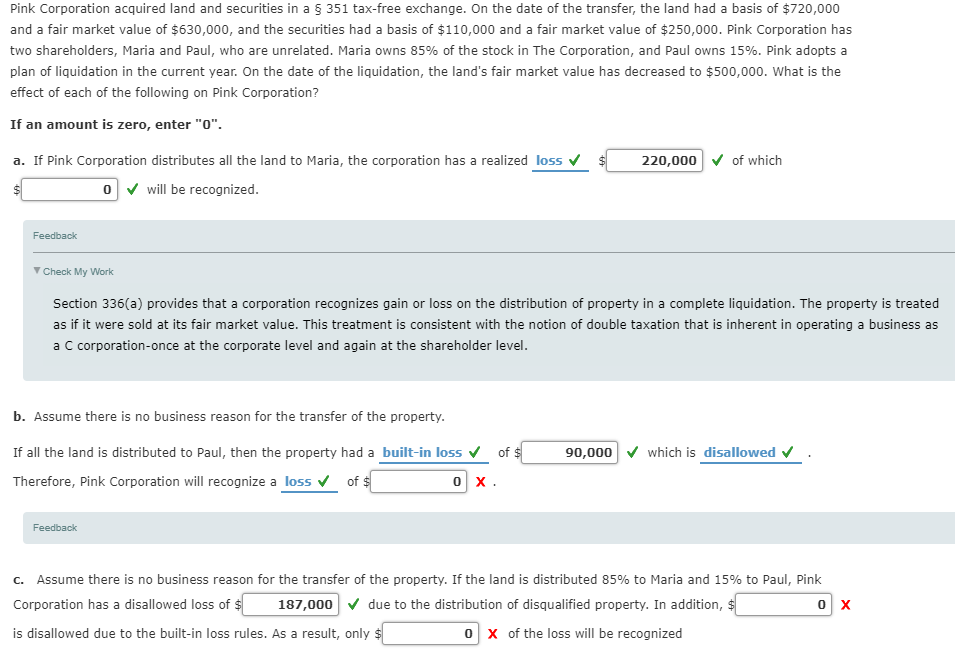

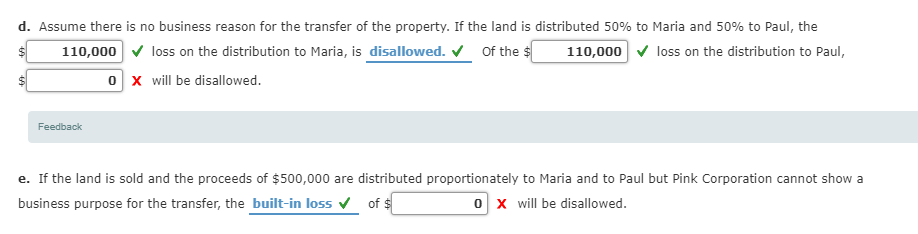

351 tax-free exchange. On the date of the transfer, the land had a basis of $720,000 Pink Corporation acquired land and securities in a and a fair market value of $630,000, and the securities had a basis of $110,000 and a fair market value of $250,00o0. Pink Corporation has two shareholders, Maria and Paul, who are unrelated. Maria owns 85% of the stock in The Corporation, and Paul owns 15%. Pink adopts a plan of liquidation in the current year. On the date of the liquidation, the land's fair market value has decreased to $500,000. What is the effect of each of the following on Pink Corporation? If an amount is zero, enter "O" $ 220,000 of which a. If Pink Corporation distributes all the land to Maria, the corporation has a realized loss will be recognized. Feedback Check My Work Section 336(a) provides that a corporation recognizes gain or loss on the distribution of property in a complete liquidation. The property is treated as if it were sold at its fair market value. This treatment is consistent with the notion of double taxation that is inherent in operating a business as a C corporation-once at the corporate level and again at the shareholder level. b. Assume there is no business reason for the transfer of the property. If all the land is distributed to Paul, then the property had a built-in loss 90,000 which is disallowed of $ of $ Therefore, Pink Corporation will recognize a loss Feedback c. Assume there is no business reason for the transfer of the property. If the land is distributed 85% to Maria and 15% to Paul, Pink Corporation has a disallowed loss of $ due to the distribution of disqualified property. In addition, 0X 187,000 0 x of the loss will be recognized is disallowed due to the built-in loss rules. As a result, only $ d. Assume there is no business reason for the transfer of the property. If the land is distributed 50% to Maria and 50% to Paul, the 110,000loss on the distribution to Maria, is disallowed. Of the $| loss on the distribution to Paul, 110,000 o x will be disallowed. Feedback e. If the land is sold and the proceeds of $500,000 are distributed proportionately to Maria and to Paul but Pink Corporation cannot show a business purpose for the transfer, the built-in loss of $ Ox will be disallowed. 351 tax-free exchange. On the date of the transfer, the land had a basis of $720,000 Pink Corporation acquired land and securities in a and a fair market value of $630,000, and the securities had a basis of $110,000 and a fair market value of $250,00o0. Pink Corporation has two shareholders, Maria and Paul, who are unrelated. Maria owns 85% of the stock in The Corporation, and Paul owns 15%. Pink adopts a plan of liquidation in the current year. On the date of the liquidation, the land's fair market value has decreased to $500,000. What is the effect of each of the following on Pink Corporation? If an amount is zero, enter "O" $ 220,000 of which a. If Pink Corporation distributes all the land to Maria, the corporation has a realized loss will be recognized. Feedback Check My Work Section 336(a) provides that a corporation recognizes gain or loss on the distribution of property in a complete liquidation. The property is treated as if it were sold at its fair market value. This treatment is consistent with the notion of double taxation that is inherent in operating a business as a C corporation-once at the corporate level and again at the shareholder level. b. Assume there is no business reason for the transfer of the property. If all the land is distributed to Paul, then the property had a built-in loss 90,000 which is disallowed of $ of $ Therefore, Pink Corporation will recognize a loss Feedback c. Assume there is no business reason for the transfer of the property. If the land is distributed 85% to Maria and 15% to Paul, Pink Corporation has a disallowed loss of $ due to the distribution of disqualified property. In addition, 0X 187,000 0 x of the loss will be recognized is disallowed due to the built-in loss rules. As a result, only $ d. Assume there is no business reason for the transfer of the property. If the land is distributed 50% to Maria and 50% to Paul, the 110,000loss on the distribution to Maria, is disallowed. Of the $| loss on the distribution to Paul, 110,000 o x will be disallowed. Feedback e. If the land is sold and the proceeds of $500,000 are distributed proportionately to Maria and to Paul but Pink Corporation cannot show a business purpose for the transfer, the built-in loss of $ Ox will be disallowed