Question

3.6 Borduria Energy is involved in several commercial activities related to electrical energy: generation, bulk sales to large consumers, retail sales to small consumers, and

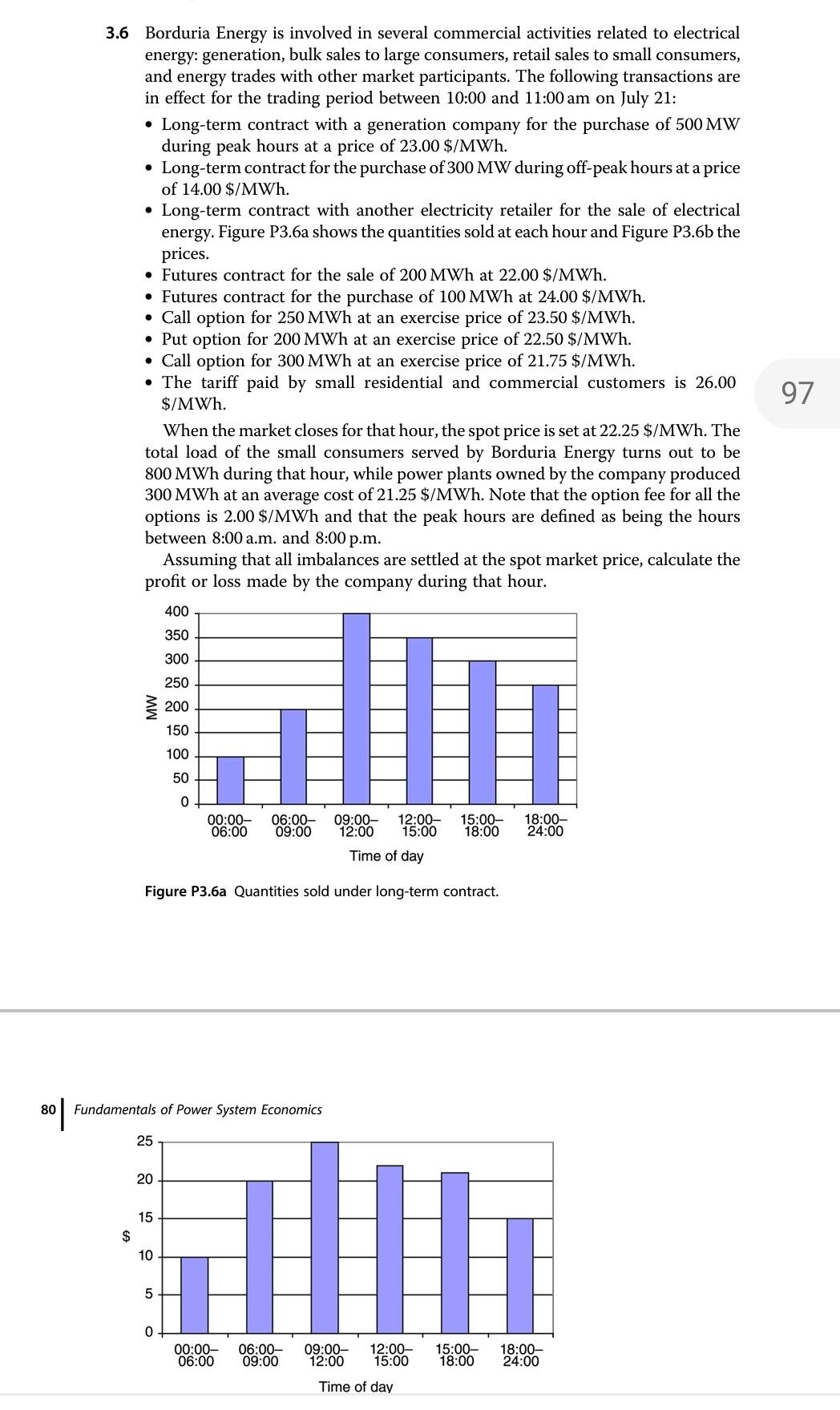

3.6 Borduria Energy is involved in several commercial activities related to electrical energy: generation, bulk sales to large consumers, retail sales to small consumers, and energy trades with other market participants. The following transactions are in effect for the trading period between 10:00 and 11:00 am on July 21: Long-term contract with a generation company for the purchase of 500 MW during peak hours at a price of 23.00 $/MWh. $ Long-term contract for the purchase of 300 MW during off-peak hours at a price of 14.00 $/MWh. Long-term contract with another electricity retailer for the sale of electrical energy. Figure P3.6a shows the quantities sold at each hour and Figure P3.6b the prices. Futures contract for the sale of 200 MWh at 22.00 $/MWh. Futures contract for the purchase of 100 MWh at 24.00 $/MWh. Call option for 250 MWh at an exercise price of 23.50 $/MWh. Put option for 200 MWh at an exercise price of 22.50 $/MWh. Call option for 300 MWh at an exercise price of 21.75 $/MWh. The tariff paid by small residential and commercial customers is 26.00 $/MWh. When the market closes for that hour, the spot price is set at 22.25 $/MWh. The total load of the small consumers served by Borduria Energy turns out to be 800 MWh during that hour, while power plants owned by the company produced 300 MWh at an average cost of 21.25 $/MWh. Note that the option fee for all the options is 2.00 $/MWh and that the peak hours are defined as being the hours between 8:00 a.m. and 8:00 p.m. Assuming that all imbalances are settled at the spot market price, calculate the profit or loss made by the company during that hour. 06:00- 09:00- 12:00- 15:00- 18:00- 12:00 15:00 18:00 24:00 Time of day Figure P3.6a Quantities sold under long-term contract. 25 80 Pl Fundamentals of Power System Economics 20 15 10 400 350 300 5 250 200 150 100 50 0 0 00:00- 06:00 09:00 00:00- 06:00- 09:00- 12:00- 15:00- 18:00- 06:00 09:00 12:00 15:00 18:00 24:00 Time of day

I want solution

3.6 Borduria Energy is involved in several commercial activities related to electrical energy: generation, bulk sales to large consumers, retail sales to small consumers, and energy trades with other market participants. The following transactions are in effect for the trading period between 10:00 and 11:00 am on July 21 : - Long-term contract with a generation company for the purchase of 500MW during peak hours at a price of 23.00$/MWh. - Long-term contract for the purchase of 300MW during off-peak hours at a price of 14.00$/MWh. - Long-term contract with another electricity retailer for the sale of electrical energy. Figure P3.6a shows the quantities sold at each hour and Figure P3.6b the prices. - Futures contract for the sale of 200MWh at 22.00$/MWh. - Futures contract for the purchase of 100MWh at 24.00$/MWh. - Call option for 250MWh at an exercise price of 23.50$/MWh. - Put option for 200MWh at an exercise price of 22.50$/MWh. - Call option for 300MWh at an exercise price of 21.75$/MWh. - The tariff paid by small residential and commercial customers is 26.00 $/MWh. When the market closes for that hour, the spot price is set at 22.25$/MWh. The total load of the small consumers served by Borduria Energy turns out to be 800MWh during that hour, while power plants owned by the company produced 300MWh at an average cost of 21.25$/MWh. Note that the option fee for all the options is 2.00$/MWh and that the peak hours are defined as being the hours between 8:00 a.m. and 8:00 p.m. Assuming that all imbalances are settled at the spot market price, calculate the profit or loss made by the company during that hour. Figure P3.6a Quantities sold under long-term contract. 80 FuStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started