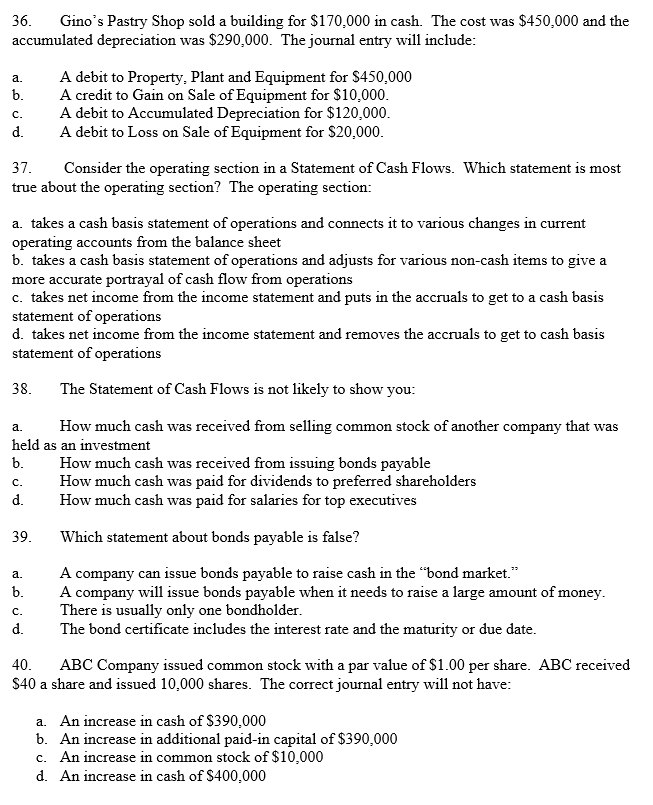

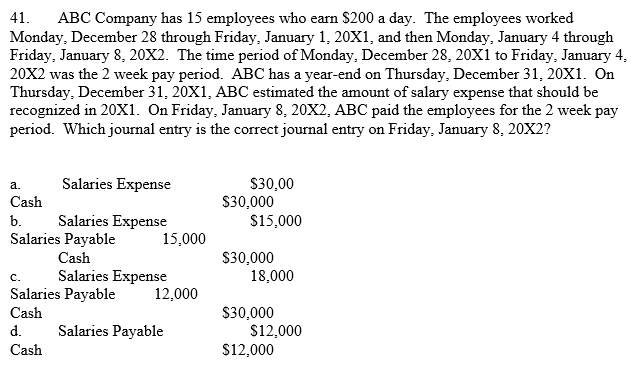

36. Gino's Pastry Shop sold a building for $170,000 in cash. The cost was $450,000 and the accumulated depreciation was $290,000. The journal entry will include: A debit to Property, Plant and Equipment for $450,000 A credit to Gain on Sale of Equipment for $10,000. A debit to Accumulated Depreciation for $120,000. A debit to Loss on Sale of Equipment for $20,000. d. 37. Consider the operating section in a statement of Cash Flows. Which statement is most true about the operating section? The operating section: a. takes a cash basis statement of operations and connects it to various changes in current operating accounts from the balance sheet b. takes a cash basis statement of operations and adjusts for various non-cash items to give a more accurate portrayal of cash flow from operations c. takes net income from the income statement and puts in the accruals to get to a cash basis statement of operations d. takes net income from the income statement and removes the accruals to get to cash basis statement of operations 38. The Statement of Cash Flows is not likely to show you: a. How much cash was received from selling common stock of another company that was held as an investment How much cash was received from issuing bonds payable c. How much cash was paid for dividends to preferred shareholders How much cash was paid for salaries for top executives b. 39. Which statement about bonds payable is false? A company can issue bonds payable to raise cash in the "bond market." A company will issue bonds payable when it needs to raise a large amount of money. There is usually only one bondholder. The bond certificate includes the interest rate and the maturity or due date. 40. ABC Company issued common stock with a par value of $1.00 per share. ABC received $40 a share and issued 10,000 shares. The correct journal entry will not have: a. An increase in cash of $390,000 b. An increase in additional paid-in capital of $390,000 c. An increase in common stock of $10,000 d. An increase in cash of $400,000 41. ABC Company has 15 employees who earn $200 a day. The employees worked Monday, December 28 through Friday, January 1, 20X1, and then Monday, January 4 through Friday, January 8, 20X2. The time period of Monday, December 28, 20X1 to Friday, January 4, 20X2 was the 2 week pay period. ABC has a year-end on Thursday, December 31, 20X1. On Thursday, December 31, 20X1, ABC estimated the amount of salary expense that should be recognized in 20X1. On Friday, January 8, 20X2, ABC paid the employees for the 2 week pay period. Which journal entry is the correct journal entry on Friday, January 8, 20X2? $30,00 $30,000 $15,000 a. Salaries Expense Cash b. Salaries Expense Salaries Payable 15,000 Cash c. Salaries Expense Salaries Payable 12.000 $30,000 18,000 Cash d. Cash Salaries Payable $30,000 $12,000 $12,000