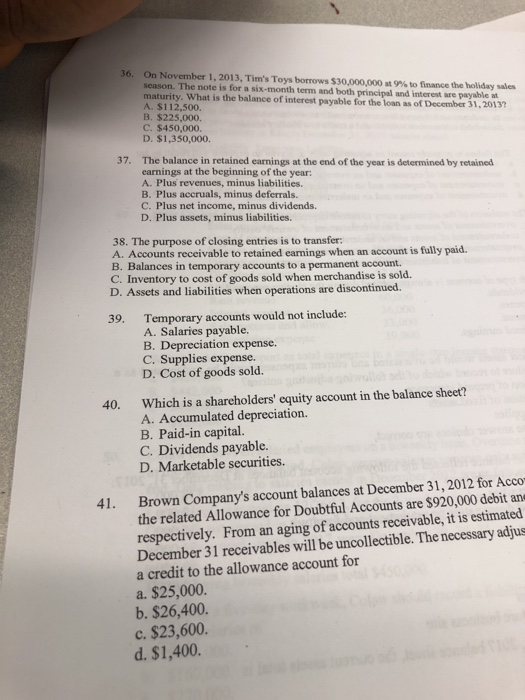

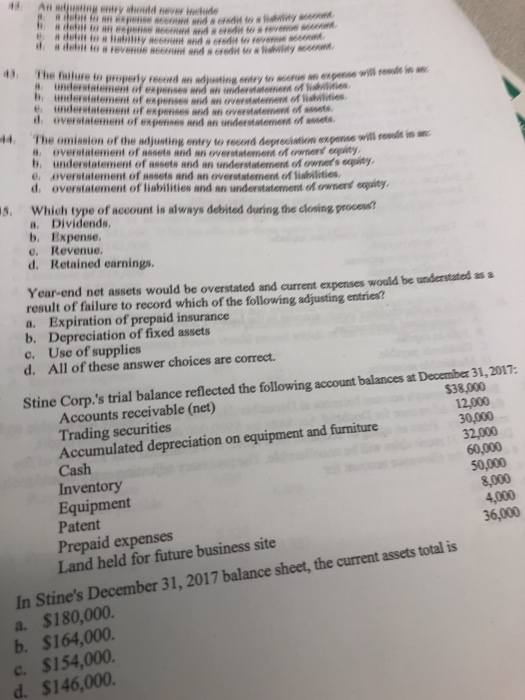

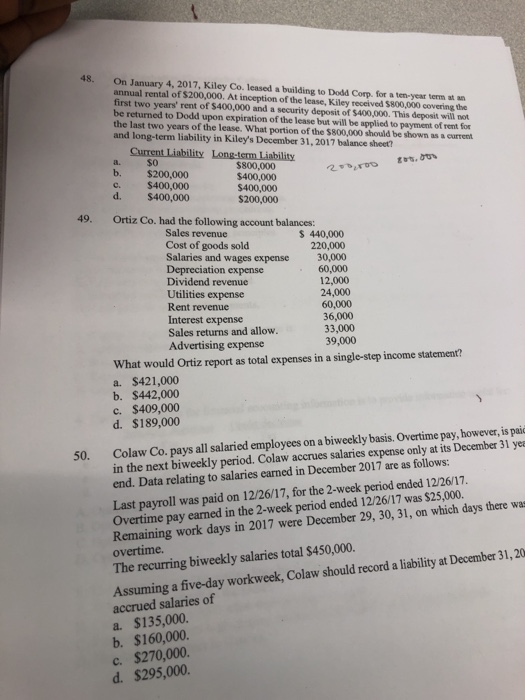

36. On November 1, 2013, Tim's Toys borrows $30,000,000 at 9% to finance the holiday sales season. The note is for a six-month term and both principal and interest are payable at maturity. What is the balance of interest payable for the loan as of December 31,2013 A. $112,500. B. $225,000. C. $450,000 D. $1,350,000. The balance in retained earnings at the end of the year is determined by retained earnings at the beginning of the year A. Plus revenues, minus liabilities. B. Plus accruals, minus deferrals. C. Plus net income, minus dividends. D. Plus assets, minus liabilities. 37. 38. The purpose of closing entries is to transfer A. Accounts receivable to retained earnings when an account is fully paid. B. Balances in temporary accounts to a permanent account. C. Inventory to cost of goods sold when merchandise is sold. D. Assets and liabilities when operations are discontinued 39. Temporary accounts would not include: A. Salaries payable. B. Depreciation expense. C. Supplies expense. D. Cost of goods sold. Which is a shareholders' equity account in the balance sheet? A. Accumulated depreciation. B. Paid-in capital. C. Dividends payable. D. Marketable securities. 40. Brown Company's account balances at December 31, 2012 for Acco the related Allowance for Doubtful Accounts are $920,000 debit an 41. respectively. From an aging of accounts receivable, it is estimated December 31 receivables will be uncollectible. The necessary adjus a credit to the allowance account for a. $25,000 b. $26,400. c. $23,600 d. $1,400. 1. The fulure to properly reond an yusting endry tw s underetatement of expenses and an t ww'eretntement of expenses md sn over.tetement of .wities t ndesiatement of exspenses and n overstatement of senete d. overstatement of expenses and an understatement of es 4. The omission of the adjusting entry to rend depreciation expense will reede ie overetatement of nosets and an overstatement of owserd egty b, understatement of assets and an understatement of ownets epity e, overstatement of aesets and an overstatement of iabilities d. overstatement of liabilities and an understatement o ownerd equity . Which type of account is always debited during the closing proce a. Dividends b. Expense. e, Revenue d. Retained earnings Year-end net assets would be overstated and current expenses would be understated as a result of failure to record which of the following adjusting entries? a. Expiration of prepaid insurance b. Depreciation of fixed assets c. Use of supplies d. All of these answer choices are correct Stine Corp.'s trial balance reflected the following account balances at December 31,2017 $38,000 Accounts receivable (net) Trading securities Accumulated depreciation on equipment and furniture Cash Inventory Equipment Patent 32,000 60,000 50,000 8,000 4,000 36,000 Prepaid expenses Land held for future business site In Stine's December 31, 2017 balance shee, the current ssetstalis In Stine's December 31,2017 bal a. $180,000. b. $164,000. c$154,000 d. $146,000 48. On January 4, 2017, Kiley Co. leased a building to Dodd Corp. for a ten-year term at an annual rental of $200,000. At inception of the lease, Kiley received $800,000 covering the first two years' rent of $400,000 and a security deposit of $400,000. This deposit will not be returned to Dodd upon expiration of the lease but will be applied to payment of rent for the last two years of the lease. What portion of the $800,000 should be shown as a current and long-term liability in Kiley's December 31, 2017 balance sheet? a. $O b. $200,000 c. $400,000 d. $400,000 $800,000 $400,000 $400,000 $200,000 49. Ortiz Co. had the following account balances Sales revenue Cost of goods sold Salaries and wages expense Depreciation expense Dividend revenue Utilities expense Rent revenue Interest expense Sales returns and allow. Advertising expense S 440,000 220,000 30,000 60,000 12,000 24,000 60,000 36,000 33,000 39,000 What would Ortiz report as total expenses in a single-step income statement? a. $421,000 b. $442,000 c. $409,000 d. $189,000 50. Colaw Co. pays all salaried employees on a biweekly basis. Overtime pay, however,is pai in the next biweekly period. Colaw accrues salaries expense only at its December 31 yee end. Data relating to salaries earned in December 2017 are as follows: Last payroll was paid on 12/26/17, for the 2-week period ended 12/26/17. Overtime pay earned in the 2-week period ended 12/26/17 was $25,000. Remaining work days in 2017 were December 29, 30, 31, on which days there wa overtime. Assuming a five-day workweek, Colaw should record a liability at December 31, 20 accrued salaries of a. $135,000. b. $160,000. c. $270,000. d. $295,000. The recurring biweekly salaries total $450,000. b. S 5000 or