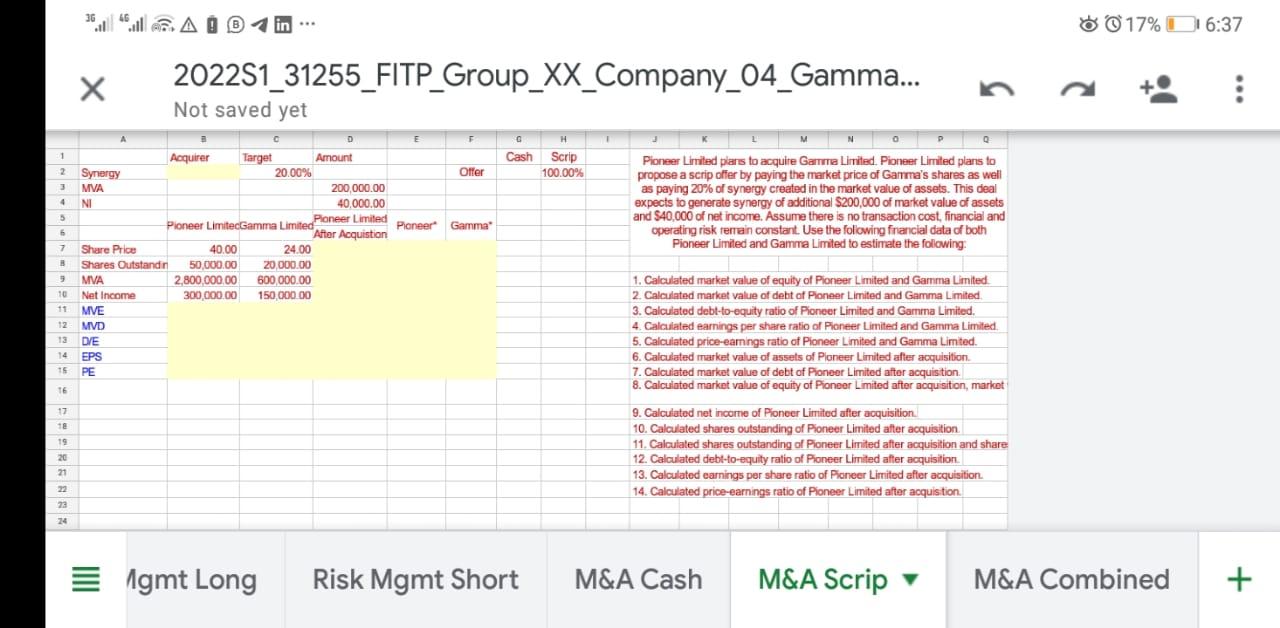

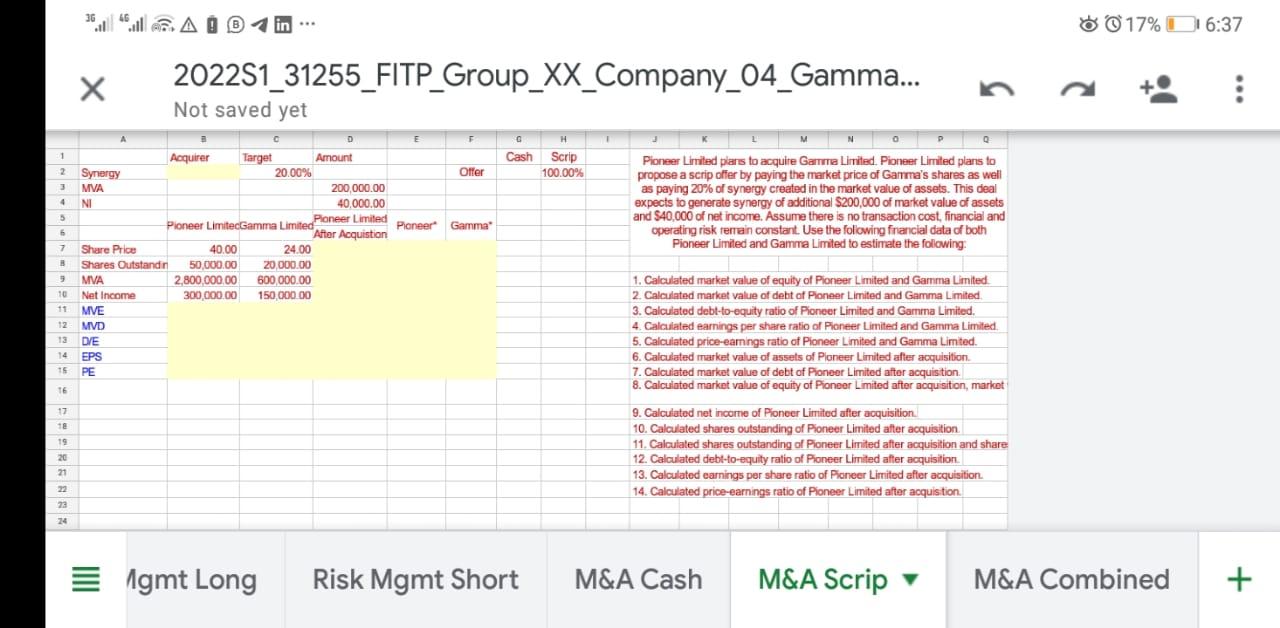

36 X 46 A 1 in 2022S1_31255_FITP_Group_XX_Company_04_Gamma... Not saved yet D E F G H Acquirer Target Amount Cash Scrip 20.00% Offer 100.00% Pioneer LimitedGamma Limited Gamma 24.00 40.00 50,000.00 20,000.00 2,800,000.00 600,000.00 300,000.00 150,000.00 Mgmt Long Risk Mgmt Short A 1 2 3 MVA 4 NI 5 6 M 7 Share Price B Shares Outstandin 9 MVA 10 Net Income 11 MVE 12 MVD 13 DVE 14 EPS 15 PE 16 17 18 19 20 21 22 23 24 Synergy 200,000.00 40,000.00 Pioneer Limited Pioneer After Acquistion Pioneer Limited plans to acquire Gamma Limited. Pioneer Limited plans to propose a scrip offer by paying the market price of Gamma's shares as well as paying 20% of synergy created in the market value of assets. This deal expects to generate synergy of additional $200,000 of market value of assets and $40,000 of net income. Assume there is no transaction cost, financial and operating risk remain constant. Use the following financial data of both Pioneer Limited and Gamma Limited to estimate the following: 1. Calculated market value of equity of Pioneer Limited and Gamma Limited. 2. Calculated market value of debt of Pioneer Limited and Gamma Limited. 3. Calculated debt-to-equity ratio of Pioneer Limited and Gamma Limited. 4. Calculated earnings per share ratio of Pioneer Limited and Gamma Limited. 5. Calculated price-earnings ratio of Pioneer Limited and Gamma Limited. 6. Calculated market value of assets of Pioneer Limited after acquisition. 7. Calculated market value of debt of Pioneer Limited after acquisition. 8. Calculated market value of equity of Pioneer Limited after acquisition, market 9. Calculated net income of Pioneer Limited after acquisition. 10. Calculated shares outstanding of Pioneer Limited after acquisition 11. Calculated shares outstanding of Pioneer Limited after acquisition and share 12. Calculated debt-to-equity ratio of Pioneer Limited after acquisition. 13. Calculated earnings per share ratio of Pioneer Limited after acquisition. 14. Calculated price-earnings ratio of Pioneer Limited after acquisition. M&A Scrip M&A Cash 17% 6:37 M&A Combined + 36 X 46 A 1 in 2022S1_31255_FITP_Group_XX_Company_04_Gamma... Not saved yet D E F G H Acquirer Target Amount Cash Scrip 20.00% Offer 100.00% Pioneer LimitedGamma Limited Gamma 24.00 40.00 50,000.00 20,000.00 2,800,000.00 600,000.00 300,000.00 150,000.00 Mgmt Long Risk Mgmt Short A 1 2 3 MVA 4 NI 5 6 M 7 Share Price B Shares Outstandin 9 MVA 10 Net Income 11 MVE 12 MVD 13 DVE 14 EPS 15 PE 16 17 18 19 20 21 22 23 24 Synergy 200,000.00 40,000.00 Pioneer Limited Pioneer After Acquistion Pioneer Limited plans to acquire Gamma Limited. Pioneer Limited plans to propose a scrip offer by paying the market price of Gamma's shares as well as paying 20% of synergy created in the market value of assets. This deal expects to generate synergy of additional $200,000 of market value of assets and $40,000 of net income. Assume there is no transaction cost, financial and operating risk remain constant. Use the following financial data of both Pioneer Limited and Gamma Limited to estimate the following: 1. Calculated market value of equity of Pioneer Limited and Gamma Limited. 2. Calculated market value of debt of Pioneer Limited and Gamma Limited. 3. Calculated debt-to-equity ratio of Pioneer Limited and Gamma Limited. 4. Calculated earnings per share ratio of Pioneer Limited and Gamma Limited. 5. Calculated price-earnings ratio of Pioneer Limited and Gamma Limited. 6. Calculated market value of assets of Pioneer Limited after acquisition. 7. Calculated market value of debt of Pioneer Limited after acquisition. 8. Calculated market value of equity of Pioneer Limited after acquisition, market 9. Calculated net income of Pioneer Limited after acquisition. 10. Calculated shares outstanding of Pioneer Limited after acquisition 11. Calculated shares outstanding of Pioneer Limited after acquisition and share 12. Calculated debt-to-equity ratio of Pioneer Limited after acquisition. 13. Calculated earnings per share ratio of Pioneer Limited after acquisition. 14. Calculated price-earnings ratio of Pioneer Limited after acquisition. M&A Scrip M&A Cash 17% 6:37 M&A Combined +