Answered step by step

Verified Expert Solution

Question

1 Approved Answer

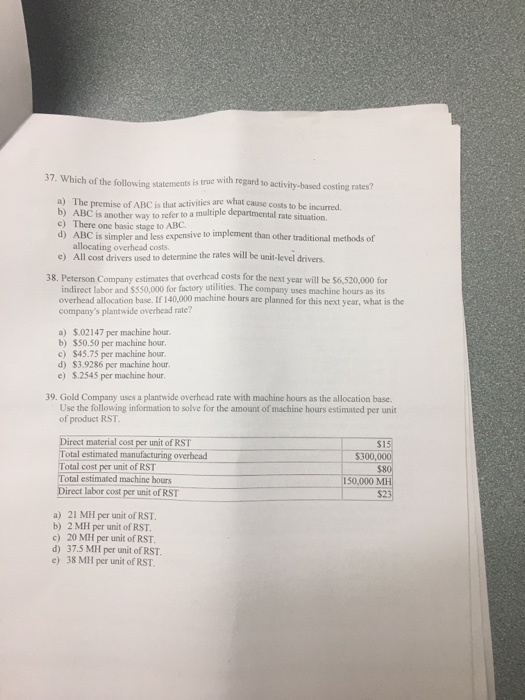

37. Which of the following statements is true with regard to activity-based costing rates? a) The premise of ABC is that activities are what

37. Which of the following statements is true with regard to activity-based costing rates? a) The premise of ABC is that activities are what cause costs to be incurred. b) ABC is another way to refer to a multiple departmental rate situation. e) There one basic stage to ABC. d) ABC is simpler and less expensive to implement than other traditional methods of allocating overhead costs. e) All cost drivers used to determine the rates will be unit-level drivers. 38. Peterson Company estimates that overhead costs for the next year will be $6,520,000 for indirect labor and $550,000 for factory utilities. The company uses machine hours as its overhead allocation base. If 140,000 machine hours are planned for this next year, what is the company's plantwide overhead rate? a) $.02147 per machine hour. b) $50.50 per machine hour. c) $45.75 per machine hour. d) $3.9286 per machine hour. e) $.2545 per machine hour. 39. Gold Company uses a plantwide overhead rate with machine hours as the allocation base. Use the following information to solve for the amount of machine hours estimated per unit of product RST. Direct material cost per unit of RST Total estimated manufacturing overhead Total cost per unit of RST Total estimated machine hours Direct labor cost per unit of RST a) 21 MH per unit of RST. b) 2 MH per unit of RST. c) 20 MH per unit of RST. d) 37.5 MH per unit of RST. e) 38 MH per unit of RST. $15 $300,000 $80 150,000 MH $23

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 37 Option a is the c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started