Answered step by step

Verified Expert Solution

Question

1 Approved Answer

37.LOKI Corporation, an unlisted entity, has assets of P12,500,000. It can negotiate P5 million gain either by selling the entire assets or the shares

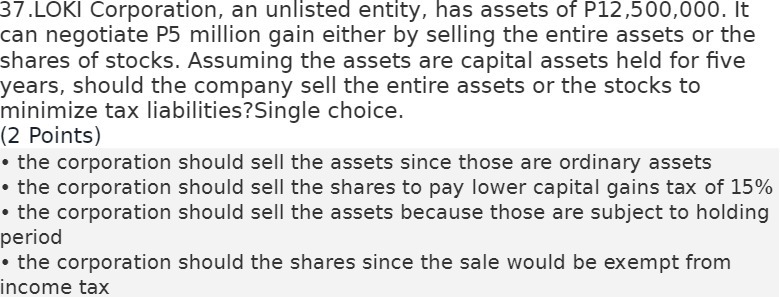

37.LOKI Corporation, an unlisted entity, has assets of P12,500,000. It can negotiate P5 million gain either by selling the entire assets or the shares of stocks. Assuming the assets are capital assets held for five years, should the company sell the entire assets or the stocks to minimize tax liabilities?Single choice. (2 Points) the corporation should sell the assets since those are ordinary assets the corporation should sell the shares to pay lower capital gains tax of 15% the corporation should sell the assets because those are subject to holding period the corporation should the shares since the sale would be exempt from income tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The correct answer is The corporation should sell the shares to pay lower capital gains tax of 15 He...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started